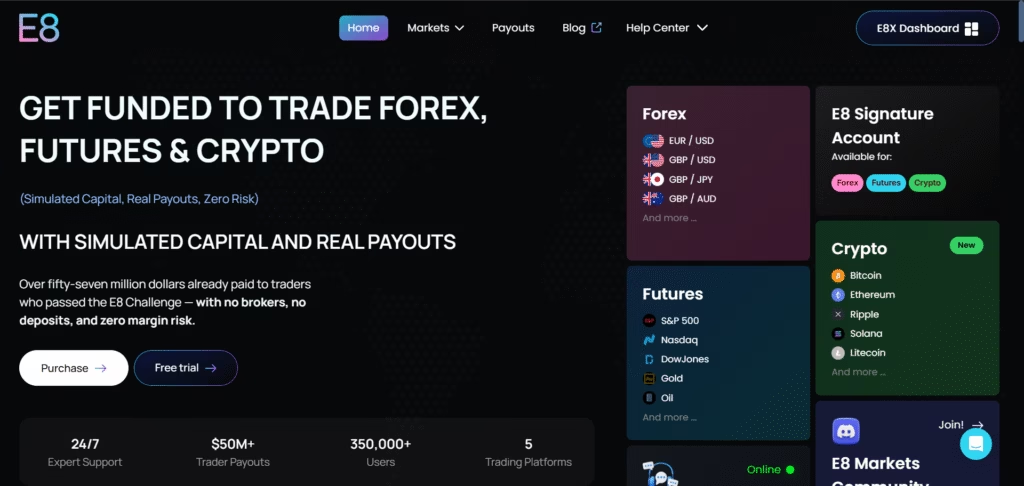

If you’ve been researching the best forex prop firms in 2025, chances are you’ve come across E8 Markets (formerly E8 Funding). This U.S. and Saint Lucia–based proprietary trading firm has become one of the most popular choices for traders looking to access funded trading accounts without risking personal capital.

But is E8 really worth your time and money? Let’s dive into a detailed E8 Markets review to help you decide.

What is E8 Markets?

E8 Markets is a proprietary trading firm that provides traders with simulated funded accounts for educational and evaluation purposes. Instead of trading with your own money, you pay a challenge fee and, if you pass the evaluation, you get access to a funded account where you can earn a share of profits.

The firm focuses on forex, indices, commodities, and cryptocurrencies, offering a wide range of account sizes and evaluation programs.

In simple terms: E8 gives traders a chance to prove their skills, earn payouts, and grow account sizes—all without risking personal funds.

Key Features of E8 Markets

- Multiple Challenge Types – 1-step, 2-step, and 3-step evaluations.

- No Minimum Trading Days – Pass as quickly or slowly as you like.

- Profit Split up to 100% – Higher than many competitors.

- Large Account Sizes – Up to $500,000 available.

- Fast & Automated Payouts – Rise Pay or wire transfer.

- Strategy Friendly – Supports EAs, discretionary trading, copy trading (with rules), and limited news trading.

- 24/7 Support – Chat and email assistance.

E8 Forex Challenges Explained

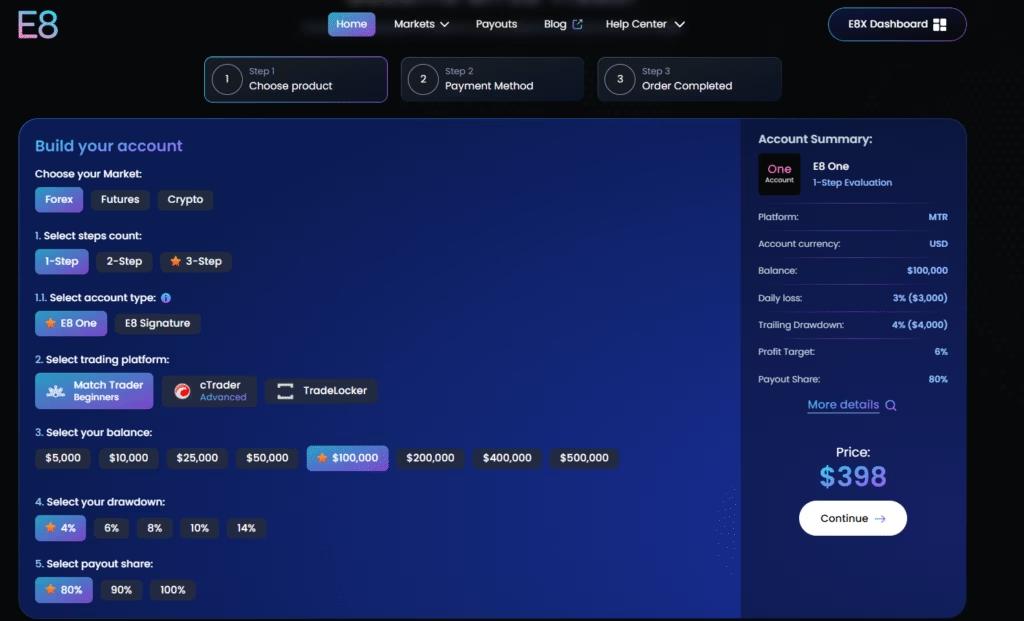

E8 offers three different challenge models to fit different trading styles:

1. E8 One (1-Step Challenge)

- Simplest and fastest evaluation.

- Requires passing only one phase before funding.

- Ideal for traders looking for a quick route to a funded account.

- Higher pass rate compared to industry norms.

2. Standard 2-Step Challenge

- The most common evaluation format.

- Two phases:

- Phase 1: Reach the profit target.

- Phase 2: Prove consistency with a reduced target.

- Balances flexibility and safety.

3. E8 Track (3-Step Challenge)

- Slower, more gradual process with lower targets.

- Suited for cautious and longer-term traders.

Pass Rate: On average, 17.7% of active traders succeed in E8’s evaluations—slightly above the industry average.

Account Sizes and Scaling

E8 offers account balances of $5,000, $25,000, $50,000, $100,000, $200,000, $400,000, and $500,000.

With consistent performance, traders can scale accounts upward after successful payouts, gaining access to even larger simulated capital.

Risk Rules: Drawdowns & Profit Targets

E8 enforces standard prop firm risk management rules:

- Profit Targets – Typically 8–10% in Phase 1.

- Maximum Drawdown – Around 10% of the initial balance.

- Trailing/Relative Drawdown – Between 6–14%, depending on account type.

- Daily Loss Limit – Prevents excessive single-day losses.

These are strict but fair compared to industry peers.

Profit Splits & Payouts

E8’s payout model is one of the strongest in the industry:

- 80% to 100% profit splits, depending on the account.

- Payout Frequency – Every 14 days.

- Methods – Rise Pay (fastest) or wire transfer.

- Automation – Payouts are automatic, minimizing errors and delays.

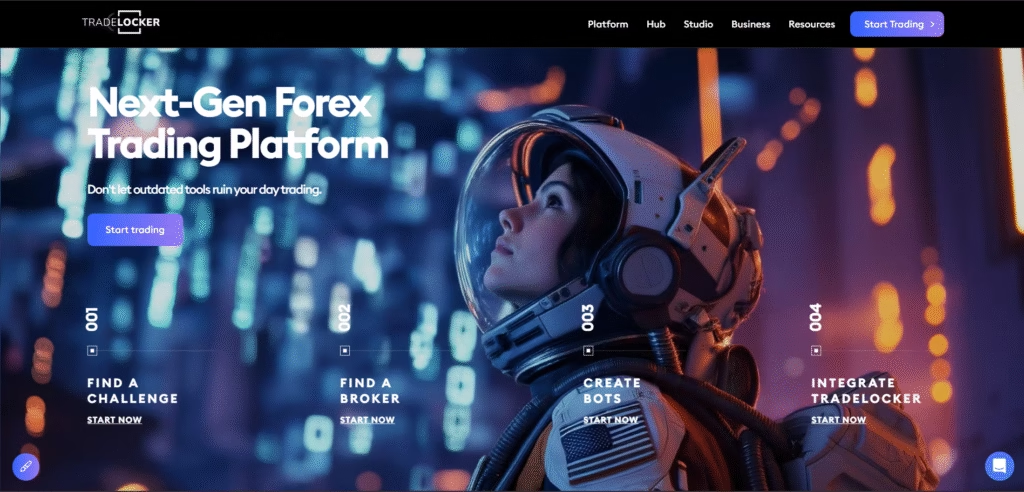

Trading Platforms: TradeLocker & More

E8 supports multiple trading platforms, with TradeLocker being the highlight.

Why TradeLocker?

- Clean, modern interface.

- Lightning-fast execution.

- Rich set of indicators and customizable charts.

- Risk management tools built in.

- Supports both discretionary and automated strategies.

- Works seamlessly with automation tools like PickMyTrade (for compliant copy trading).

Other platforms include cTrader, Match Trader, and MetaTrader 5 (MT5)—though MT5 is limited for U.S. traders.

For U.S. traders especially, TradeLocker is the key advantage.

Fees & Refund Policy

- Challenge Fees – Competitive, vary by account size.

- Refund Policy – Fees are non-refundable, unlike some firms that refund after funding.

- Value for Money – Still strong, given account sizes and payout structure.

Customer Support & Tools

E8 offers solid support and trader resources:

- 24/7 Live Chat & Email Support.

- E8 Anovo Tool – Proprietary risk and strategy management solution.

- Trader Dashboard – Monitor account status, rules, and request payouts easily.

Pros and Cons of E8 Markets

Pros

- Multiple challenge formats (1, 2, or 3-step).

- Profit splits up to 100%.

- Fast, automated withdrawals.

- No minimum trading days.

- Platforms like TradeLocker for U.S. traders.

- Large account sizes up to $500K.

Cons

- Challenge fees are non-refundable.

- News trading restricted during high-impact events.

- Limited MT5 availability for U.S. traders.

Final Verdict: Should You Choose E8 Markets?

E8 Markets is a modern, flexible, and trader-friendly prop firm. With multiple evaluation programs, high payout percentages, and innovative platforms like TradeLocker, it stands out as one of the best forex prop firms of 2025, especially for U.S. traders.

While the non-refundable fees and limited MT5 support are drawbacks, the overall package is highly competitive and worth considering for serious traders.

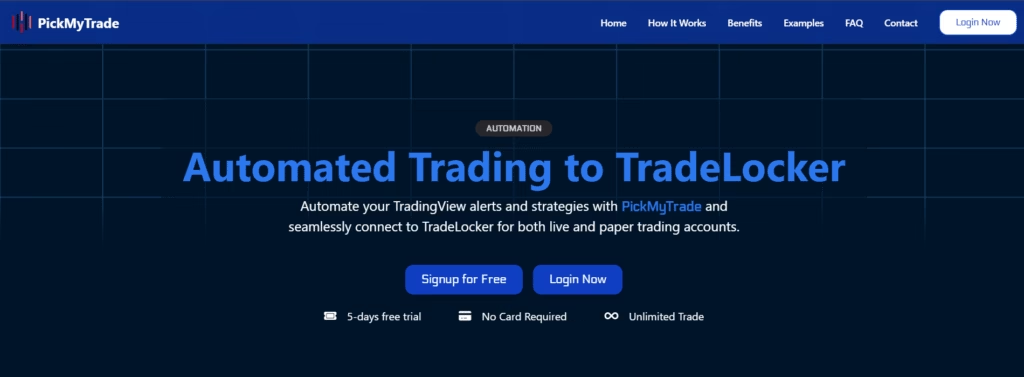

Bonus Tip: Automate Your Trades with PickMyTrade

If your goal is to pass challenges more efficiently or manage multiple funded accounts without manual execution, automation can make a big difference.

This is where PickMyTrade comes in. PickMyTrade fully supports TradeLocker, allowing you to:

- Connect TradingView alerts and strategies directly to TradeLocker.

- Automate order placement with pre-set risk management (lot size, stop-loss, take-profit).

- Run automation across multiple TradeLocker accounts simultaneously.

- Minimize human error and improve consistency during prop firm challenges.

You can watch a full walkthrough here: PickMyTrade + TradeLocker Automation.

If you’re serious about scaling with E8 Markets or any prop firm that uses TradeLocker, PickMyTrade is one of the easiest ways to automate and stay compliant.

You may also Like:

DNA Funded Review 2025: Tradelocker Connection Guide

Goat Funded Trader (GFT) TradeLocker Connection Guide

The Trading Pit Rithmic Connection Guide 2025

Automate Your Interactive Brokers for Options and Futures

Best AI Tools for Trading: Signal Generation, Strategy Building, and Automation