Introduction

The Trading Pit Rithmic Connection Guide 2025 provides traders with a clear step-by-step process to connect Rithmic with The Trading Pit for futures challenges. This guide explains setup, trading rules, and tips to make the most of Rithmic while trading funded accounts in 2025.

The Trading Pit, a Liechtenstein-based proprietary (prop) trading firm, has emerged as a strong choice for traders seeking funded accounts in CFDs (forex, commodities, indices, crypto, stocks) and futures markets. Known for its transparent evaluation process, robust platform support, and trader-centric resources, it offers funding up to $250,000, scalable to €5 million as a signal partner, with profit splits up to 80%. In 2025, The Trading Pit earns high praise, boasting a 4.8/5 Trustpilot rating (650+ reviews) and a 9.31/10 score from Traders Union for its reliability, quick payouts, and educational tools. However, some traders note stricter drawdown rules and occasional platform glitches during volatile markets, with one review scoring it 55/100 for these limitations. This blog provides a detailed review of The Trading Pit, its challenge structures, and a step-by-step guide to using the Rithmic platform for futures trading in 2025.

Review of The Trading Pit in 2025

The Trading Pit stands out for its multi-asset offerings, user-friendly challenges, and integration with high-performance platforms like Rithmic, ATAS, and NinjaTrader. Founded by professional traders, it emphasizes skill development, transparency, and scalability. Traders can access funded accounts after passing evaluation challenges, with leverage up to 1:50 (FX) and no strict time limits (except 90 days for CFDs and 30/60 days for futures). The firm provides free market analysis tools, webinars, and responsive support, making it accessible for both beginners and experienced traders.

Pros

- Funding and Payouts: Up to $250,000 funding, scalable to €5 million; 50%-80% profit splits; biweekly or weekly payouts.

- Platform Support: Rithmic, ATAS, NinjaTrader, and TradingView; low-latency for futures trading.

- Support and Education: 24/7 live chat, email support, and free resources like “From Zero to Hero” webinars.

- User Ratings: 4.8/5 on Trustpilot; 9.31/10 on Traders Union for reliability and low spreads.

Cons

- Drawdown Rules: 5% daily and 10% max drawdown (trailing or static) can feel restrictive for aggressive traders.

- Challenge Fees: Range from €49 to €1,139, higher than some competitors, though refundable upon first payout.

- Platform Stability: Rare glitches reported during high volatility, per user forums.

Who It’s For

The Trading Pit suits disciplined traders, particularly those focused on futures using platforms like Rithmic. It’s less ideal for high-frequency or high-risk scalpers due to strict rules (e.g., no HFT, news trading restrictions).

| Aspect | Pros | Cons |

|---|---|---|

| Funding | Up to $250K; 80% profit split | Profit targets tied to risk rules |

| Platforms | Rithmic, ATAS, NinjaTrader; multi-asset | Instrument-specific fees apply |

| Support | Responsive; free tools | Challenge-based model only |

| Ratings | 4.8/5 Trustpilot; 9.31/10 TU | 55/100 in one review for drawdowns |

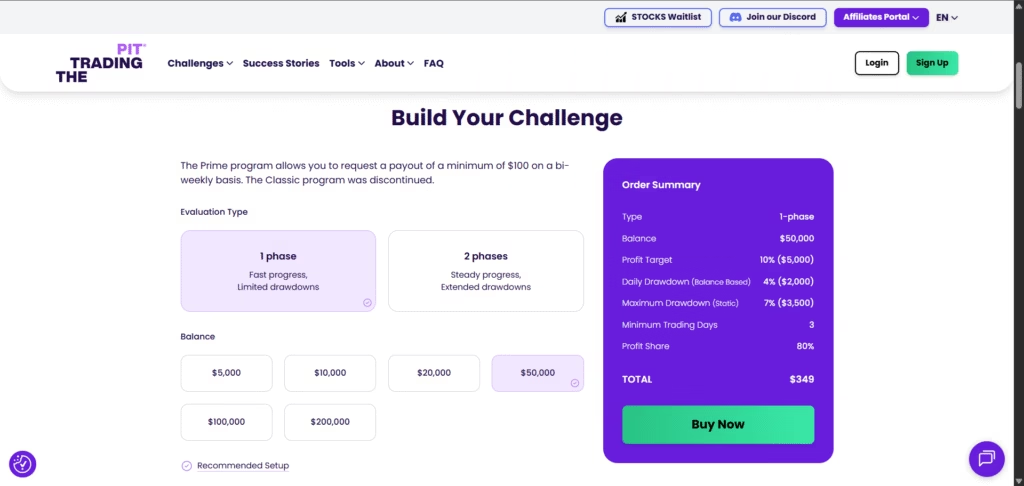

The Trading Pit Challenge Details in 2025

The Trading Pit offers two challenge types: CFD Challenges (forex, indices, commodities, crypto, stocks) and Futures Challenges (CME, EUREX, CBOT, COMEX, NYMEX). Both are demo-based evaluations to test trading skills, leading to funded accounts upon success. Below are the 2025 details.

CFD Challenges

These one- or two-step challenges cover account sizes from €5,000 to €200,000, suitable for traders preferring flexible asset classes.

- Account Options and Fees:

- Lite: €5,000-€10,000, €49-€99

- Standard: €20,000, €169

- Executive: €50,000, €349

- VIP: €100,000-€200,000, €599-€1,139

- Note: Fees are one-time, refundable upon first payout; discounts (e.g., 10% with code FOREXPROPREVIEWS) may apply.

- Rules and Targets:

- Profit Target: 8% (€100,000+ accounts); 10% (others).

- Daily Drawdown: 5% (Prime: balance-based; Classic: equity-based).

- Max Drawdown: 10% (trailing for €10,000-€20,000; static for €50,000-€200,000).

- Duration: 90 days, extendable; minimum 3 trading days.

- Trading Restrictions:

- No news trading ±2 minutes of high-impact events (except pending orders).

- Scalping allowed in CFD Prime (not Classic under 1 minute).

- No high-frequency trading (HFT); copy trading limited across accounts.

- Consistency Rule: 40% of profit target based on best day’s profit.

- Leverage: Up to 1:50 (FX), 1:10 (indices/commodities).

- Payouts and Scaling:

- Profit Split: 50%-80% (80% for Prime).

- Payouts: Weekly (Prime, above $100); Classic requires hitting targets.

- Scaling: Up to €5 million; 25% account balance increase after 10% profit.

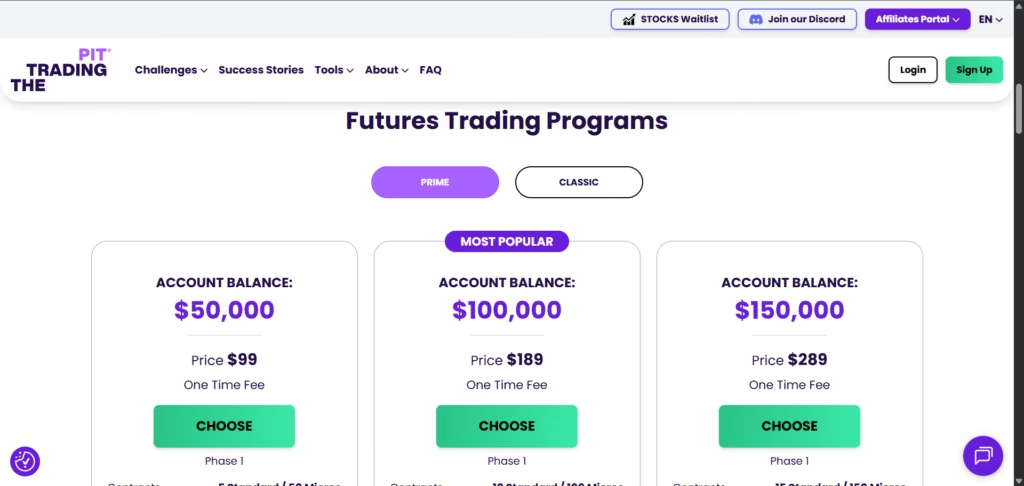

Futures Challenges

These one-step challenges (VIP: extended duration) focus on futures markets, with account sizes from $20,000 to $250,000, ideal for Rithmic users.

- Account Options and Fees:

- Lite: $20,000, €99 (CME only).

- Standard: $150,000, €169 (multiple exchanges).

- Executive: $150,000, €349 (higher contract limits).

- VIP: $250,000, €599 (60-day duration).

- Note: Fees refundable upon first payout; $25/month for live futures data post-challenge.

- Rules and Targets:

- Profit Target: $1,000 (Lite) to $5,000 (VIP).

- Daily Drawdown: 5% (Prime: balance-based; Classic: equity-based).

- Max Drawdown: Up to $3,500 (trailing for Classic; static for Prime).

- Duration: 30 days (60 for VIP); minimum 3 trading days (5 for Executive/VIP).

- Trading Restrictions:

- Prime: News trading allowed; positions auto-close at 15:55 CT.

- Classic: No news trading ±2 minutes; positions close by 16:00 CT Friday (no weekend holds).

- No HFT; copy trading allowed across up to 5 accounts.

- Inactivity (21 days no trades) leads to account closure.

- Consistency Rule: 40% of profit target based on best day’s profit (automated post-March 6, 2025).

- Payouts and Scaling:

- Profit Split: 50%-80% (80% for Prime).

- Payouts: Biweekly (Prime); Classic upon profit target.

- Scaling: Up to €5 million; 25% account balance increase after 10% profit.

How to Use The Trading Pit with Rithmic in 2025

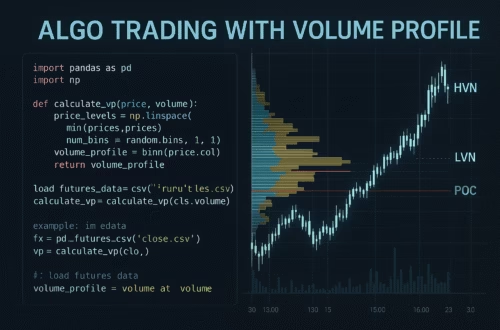

Rithmic (R|Trader or R|Trader Pro) is a low-latency platform optimized for futures trading, offering real-time data, API support for custom indicators, and robust risk management tools. It’s a top choice for The Trading Pit’s Futures Challenges. Here’s how to set it up and trade in 2025:

Step 1: Register and Purchase a Challenge

- Visit https://client-area.thetradingpit.com/signup and create an account with ID-verified details.

- Select a Futures Challenge (Lite, Standard, Executive, or VIP) and pay the fee (€99-€599).

- Receive login credentials via email.

Step 2: Download and Install R|Trader

- Log into https://www.thetradingpit.com/.

- Go to “Download Platforms” and select R|Trader or R|Trader Pro (Windows-compatible).

- Run setup.exe, accept the license agreement, choose the installation directory (default: C drive), and complete installation.

- Launch via the desktop shortcut.

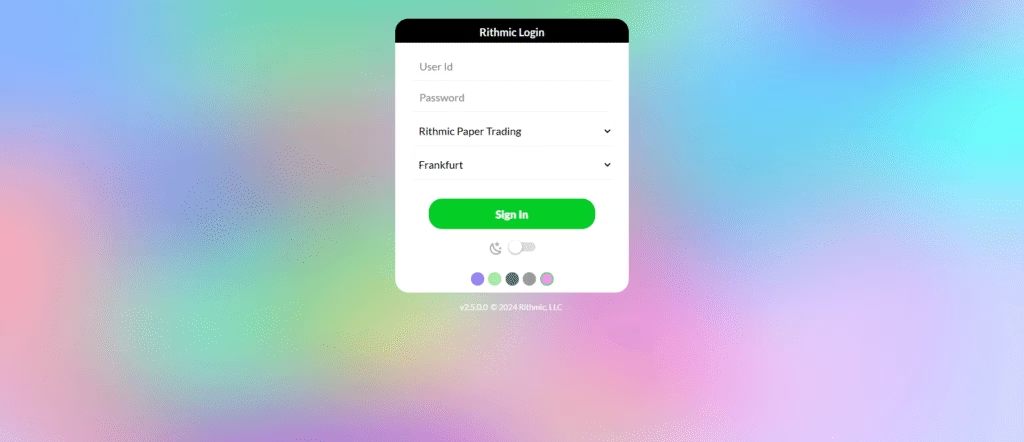

Step 3: Login and Activate

- Open R|Trader and enter your Platform User ID and Password (from email).

- Select “TheTradingPit” as the System and “Frankfurt” as the Gateway.

- Check “Remember” for future logins and click “Connect.”

- Accept Rithmic’s Terms and Conditions to activate trading (required before placing trades).

Step 4: Execute and Manage Trades

- Open the Order Book in R|Trader.

- Select your futures instrument (e.g., CME, EUREX; check fees via site PDFs).

- Choose your demo/challenge account and specify contract size.

- Click “Buy” or “Sell” to execute.

- Use Rithmic’s risk tools to monitor positions, ensuring compliance with drawdown limits (5% daily, up to $3,500 max).

Step 5: Monitor and Scale

- Track progress in the dashboard; meet profit targets ($1,000-$5,000) within 30/60 days.

- Adhere to consistency rules (40% of profit from best day) and avoid restricted practices (e.g., HFT).

- Upon passing, transition to a funded account with biweekly payouts and scaling opportunities.

Tips for Success

- Platform Integration: Use Rithmic’s Plugin Mode for third-party apps (e.g., ATAS, Sierra Chart); run R|Trader Pro first.

- Risk Management: Leverage Rithmic’s tools to stay within drawdown limits; review instrument-specific rules.

- Support: Contact [email protected] or call +4232379000 for setup or trading issues (users report fast responses).

- Practice: Start with a demo to master Rithmic’s interface; explore API for custom indicators or data streaming.

- Costs: No extra fees for Rithmic access, but check instrument commissions and $25/month data fees post-challenge.

Why Choose The Trading Pit with Rithmic?

- Low Latency: Rithmic’s high-performance platform suits futures traders needing fast execution.

- Flexibility: Multiple challenge tiers (Lite to VIP) cater to different skill levels and budgets.

- Resources: Free tools, webinars, and market analysis enhance trading decisions.

- Scalability: Achieve 10% profit milestones to scale accounts up to €5 million.

Potential Challenges

- Learning Curve: Rithmic’s interface may be complex for beginners; practice in demo mode first.

- Rules Compliance: Strict drawdown and consistency rules require disciplined strategies.

- Fees: Challenge costs (€99-€599) and data fees ($25/month post-challenge) add up, though refundable upon payout.

Final Thoughts

The Trading Pit in 2025 is a reliable prop firm for traders aiming to access funded accounts through structured challenges. Its integration with Rithmic makes it particularly appealing for futures traders, offering low-latency trading and robust tools. While drawdown rules and fees may challenge some, the high profit splits, scaling potential, and educational support make it a compelling option. For the latest rules, fees, or platform updates, visit https://www.thetradingpit.com/ or check the dashboard at https://dashboard.thetradingpit.com/. New traders can benefit from the “From Zero to Hero” resources to build skills before diving in.

Start with a demo, master Rithmic, and trade strategically to unlock The Trading Pit’s funding opportunities in 2025!

You may also like:

Goat Funded Trader Review

FTMO Review in 2025

Alpha Trader Firm: Your 2025 Trading Adventure Awaits!

Take Profit Trader Rithmic Connection Guide (2025)

How to Connect Rithmic RTrader Pro to Bulenox Prop Futures Trading in 2025

Ready to Trade Smarter?

Take your trades to the next level with sniper entries and automated stock trading tools. Pair technical setups with the best futures trading platforms and make your execution precise and automatic.

Disclaimer: Trading involves risk. Only invest what you can afford to lose. No strategy guarantees future performance.