Introduction

Automated Futures Trading Systems with PickMyTrade are transforming how modern traders approach the futures markets in 2025. With its no-code automation and lightning-fast execution, PickMyTrade enables anyone to connect TradingView strategies directly to leading brokers and automate trades with millisecond precision.

This comprehensive guide will take you through everything you need to know about automated futures trading systems, from understanding the basics of futures contracts to implementing sophisticated algorithmic trading strategies using PickMyTrade’s powerful automation platform.

Understanding Futures Trading

What Are Futures Contracts?

Futures contracts allow you to lock in a price to buy or sell an asset at a future date, regardless of market price changes. These standardized agreements are traded on regulated exchanges like the CME Group or ICE, and you can trade futures on virtually anything: cryptocurrencies, forex, stock indices, commodities, and even unusual markets like bacon futures.

Key Concepts for Beginners

Leverage and Margin The key feature of futures is leverage – you only need to put up a small percentage of the total contract value, called margin, to control a large position. This can amplify both profits and losses, making proper risk management essential.

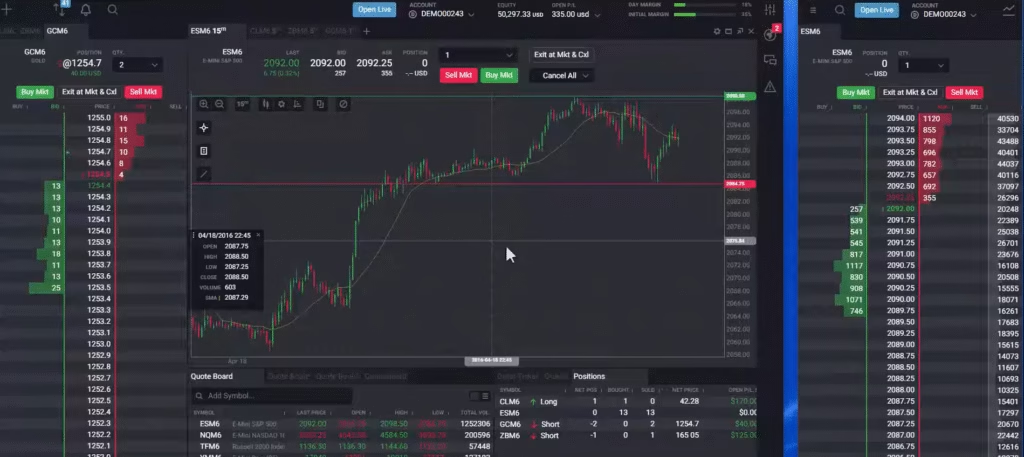

Contract Specifications Each contract is standardized with specific contract size, tick value (the minimum price increment the contract can move), margin requirement and expiration date. For example, the E-mini S&P 500 (ES) contract is one of the most popular futures contracts in the U.S.

Popular Futures Markets for Trading Commodity futures are generally divided into four major categories:

- Energy: Crude oil, Natural Gas, Heating Oil

- Metals: Gold, Silver, Copper

- Agricultural: Corn, Soybeans, Wheat, Coffee

- Livestock: Cattle, Hogs

Micro Contracts for Beginners

Many futures exchanges offer micro contracts, which are smaller versions of standard contracts, perfect for beginners because they reduce risk while learning. Micro E-mini contracts are smaller versions of standard E-mini futures, just 1/10th the size, making them perfect for beginners or traders with limited capital.

What is PickMyTrade?

Platform Overview

PickMyTrade is a bridge between your algorithmic signals (from TradingView) and real execution on futures brokers. The platform uses advanced technology to execute automated trades with precision, perfect for stock trading and futures trading automation.

Key Features

No Coding Required The platform allows traders to automate their TradingView Strategy/Indicator in just 2 minutes without WebAPI requirements. The setup process is designed to be user-friendly, requiring no programming knowledge.

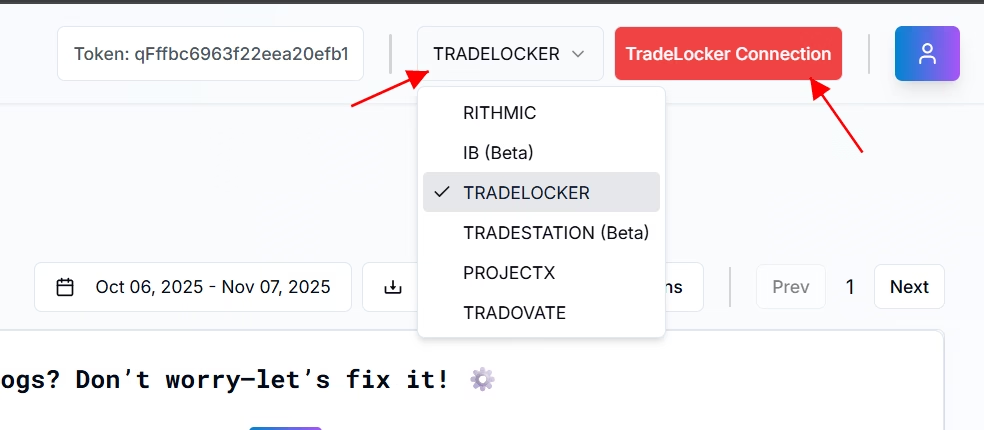

Broker Compatibility PickMyTrade connects with the best brokers for TradingView and algo trading:

- Rithmic – Best futures broker for algo trading with low latency

- Interactive Brokers – Best broker for automated trading across multiple markets

- TradeStation – Best platform for trading stocks and futures

- TradeLocker – Best broker for TradingView automation

- ProjectX – Best futures trading platform for professional traders

- Tradovate – Best futures brokerage for algo trading with competitive pricing

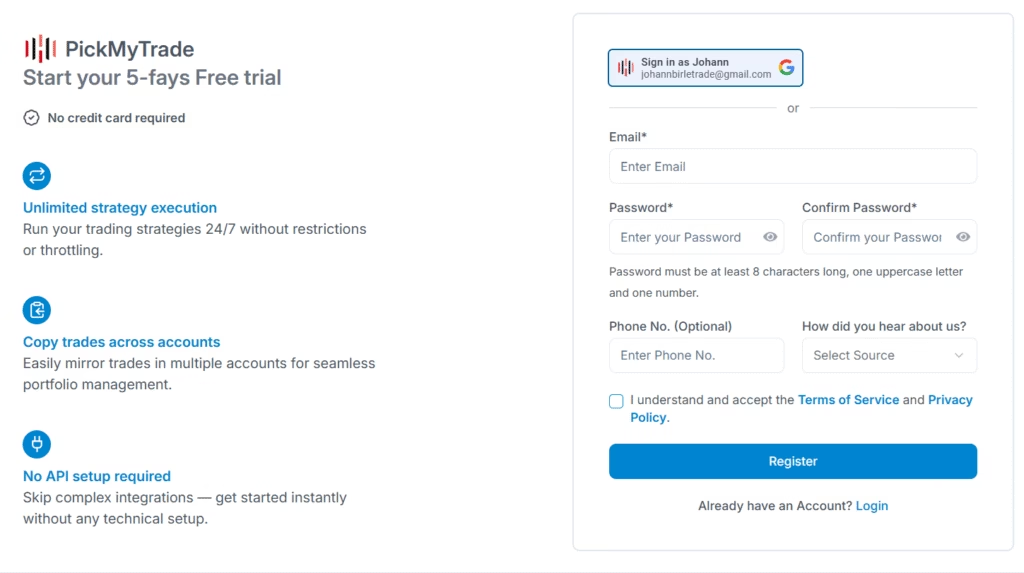

Pricing and Plans The platform offers $50/month for unlimited strategies, with a 5-day free trial available with no credit card required.

Company Background

PickMyTrade is based in Evanston, United States, and operates as a platform that automates trading strategies for futures markets. The platform emphasizes ease of use, requiring minimal technical expertise to set up and manage automated trades.

Getting Started with Automated Futures Trading

Step 1: Choose Your Trading Platform

Before implementing automation, you need to understand the basics. Getting started with futures isn’t rocket science, but consistently making profits is a whole different ballgame.

Step 2: Understand Risk Capital Requirements

For futures trading with automated trading strategies, we recommend at least $10,000 to properly diversify across multiple strategies while maintaining appropriate position sizes. This allows for proper risk management and the ability to withstand drawdowns.

Step 3: Select Your Markets

Some contracts are better suited for day trading due to their volume, volatility, and liquidity:

- E-mini S&P 500 (ES): Most liquid and widely traded

- Crude Oil (CL): High volatility with major price swings

- Gold (GC): Safe-haven asset with clean trends

- Nasdaq (NQ): Technology-focused with strong directional moves

Step 4: Start with Paper Trading

Beginners should start with paper trading and micro contracts to minimize risk while learning. PickMyTrade offers access to a paper trading platform for testing strategies risk-free.

Algorithmic Trading Strategies

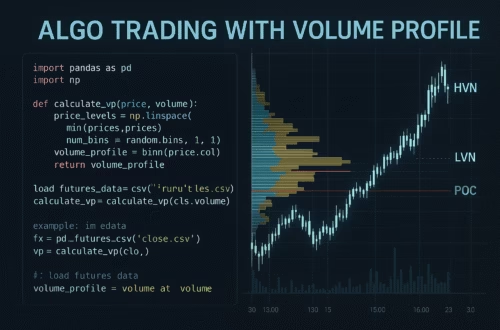

Understanding Algorithmic Trading Systems

Automated futures trading systems use software to execute futures trades based on rules and market signals, without human intervention. These systems are especially powerful in futures markets due to speed, precision, and discipline.

Popular Strategy Types

1. Trend Following

Trend-following strategies identify directional moves in futures prices and jump aboard, like surfing – you don’t create momentum, just ride it intelligently. A simple example is the moving average crossover on E-mini S&P futures: when 20-day crosses above 50-day, buy one contract; cross below, sell.

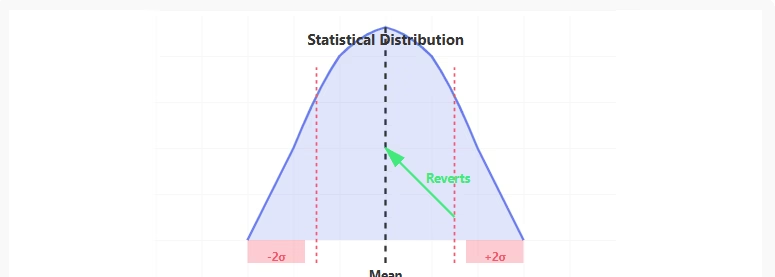

2. Mean Reversion

Statistical analysis might show that when prices stray more than two standard deviations from the 20-day moving average, they typically return to the mean within five days about 75% of the time. This strategy works well in range-bound markets.

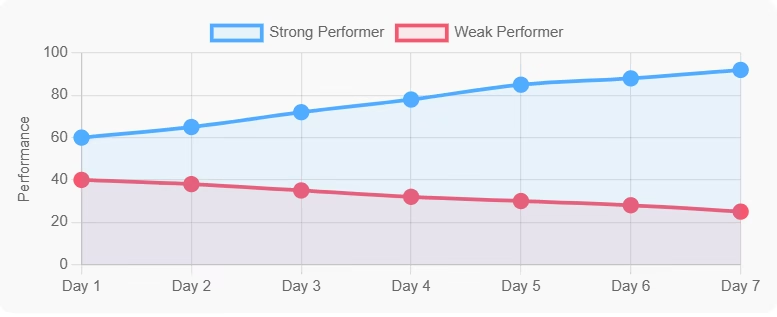

3. Momentum Trading

Momentum trading capitalizes on the continuation of existing market trends, operating under the premise that assets demonstrating strong recent performance will likely continue to outperform in the near future.

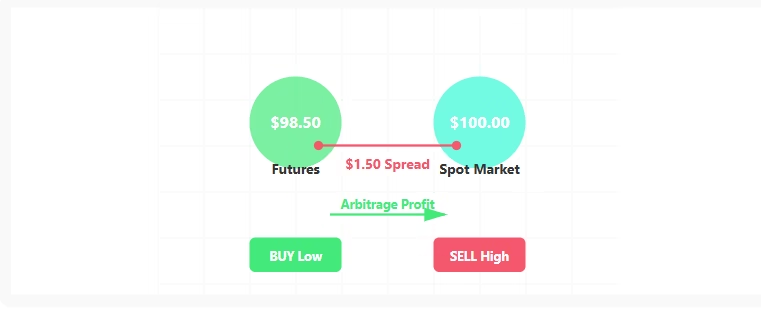

4. Arbitrage Strategies

Arbitrage strategies take advantage of price discrepancies among related markets or assets, such as seeing a difference between a futures contract and its underlying asset.

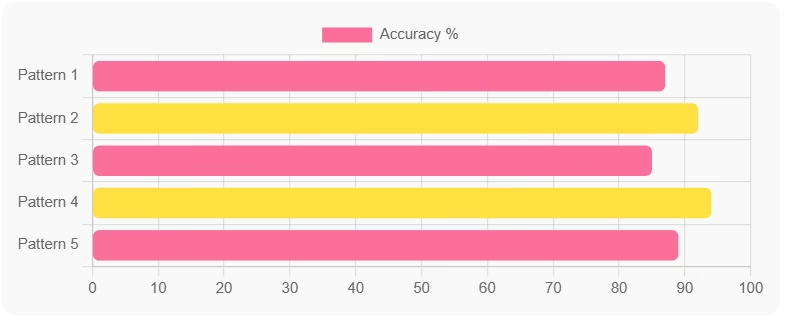

5. Machine Learning-Based Strategies

AI and ML algorithms analyze vast datasets, identifying trading patterns and market anomalies that human traders might overlook, enabling trading algorithms to adapt and optimize their strategies in real-time.

Setting Up PickMyTrade

Initial Setup Process

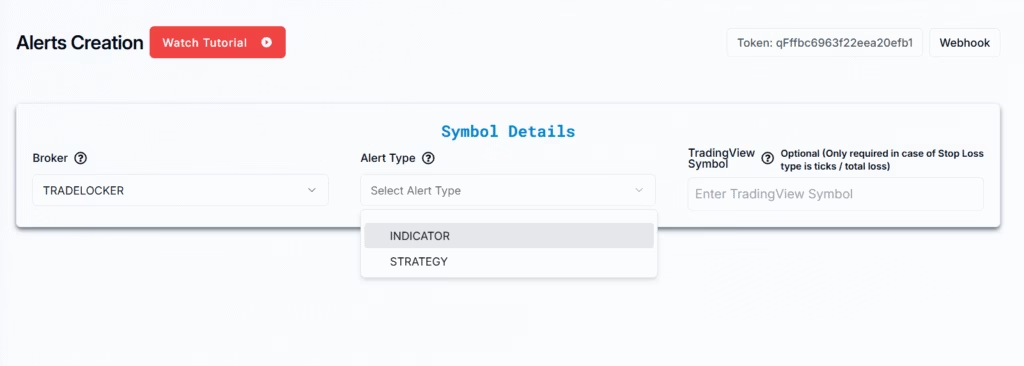

The setup process with PickMyTrade is designed to be straightforward:

- Sign Up and Verify Click the Sign Up button, receive a verification email, verify your account and log in to get started1

- Connect Your Broker Instantly link your Demo, Prop Firm, or Live account in one click

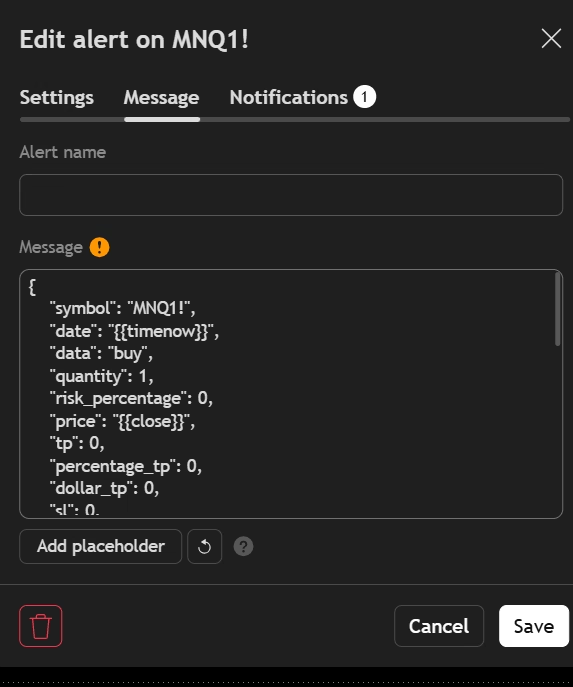

- Generate Alerts Click “Generate Alert” – the system automatically creates alerts based on your TradingView Indicator or Strategy

- Configure TradingView Copy the generated alert to TradingView and you’re done – your automated trading is now live and ready to execute

Detailed Configuration Steps

Working with Tradovate

Easily connect your Tradovate account through the PickMyTrade dashboard to enable automated trade execution from your TradingView alerts.

Working with Rithmic

Set up Rithmic integration directly in PickMyTrade to automate buy, sell, and close actions based on your predefined TradingView strategies.

Advanced Features Configuration

Multi-Account Trading Execute the same trade across multiple accounts simultaneously with a single alert—perfect for managing client accounts, prop firms, or personal accounts

Risk Management Settings PickMyTrade automatically sets Take Profit (TP) and Stop Loss (SL) levels the moment your algorithm enters a position, improving risk control

Symbol Mapping You can trade a different symbol than the one your alert is on – map symbols freely (e.g., alert on NQ, trade MNQ) or stick to one-to-one mapping for precision

Risk Management

Essential Risk Management Principles

Risk management is paramount in automated futures trading. Protecting your capital should always be your top priority.

Position Sizing Strategies

Key position sizing approaches include:

- Fixed fractional: risk the same percentage of account value on every trade (typically 1-2%)

- Volatility-adjusted: adjust position size based on recent market volatility

- Correlation-adjusted: reduce position sizes when running multiple strategies that might trade similar setups

Stop-Loss Implementation

A stop-loss is an order to close your position if the market moves against you by a specified amount – never trade futures without a clear stop-loss strategy. PickMyTrade handles this automatically through its bracket order system.

Maximum Drawdown Limits

Set a maximum account drawdown threshold (typically 10-20%) where all automated trading stops until manual review. This prevents catastrophic losses during unusual market conditions.

Risk Per Trade Guidelines

- Never risk more than 1-2% of your account per trade

- Use micro contracts when starting out

- Scale position sizes gradually as you gain experience

- Monitor correlation between strategies to avoid concentration risk

Advanced Features

Prop Firm Integration

PickMyTrade has specific support for various prop trading firms:

Take Profit Trader (TPT)

Take Profit Trader offers one-step evaluation for faster funding, PRO and PRO+ accounts with up to 90% profit splits, and access to Tradovate or Rithmic platforms for execution

My Funded Futures

My Funded Futures has quickly become one of the top proprietary futures trading firms with over 72,000 active traders, offering generous profit splits where traders keep 100% of the first $10,000 in profits, then 90% thereafter

AquaFutures

AquaFutures offers funding up to $450,000 with 100% profit on the first $15K, then 90% thereafter, with flexible evaluations and exclusive platform access to ProjectX

Smart Order Types

Bracket Orders Tradovate supports bracket orders with stop losses and take profit as OCO (One-Cancels-Other) orders, ensuring proper risk management on every trade.

ATM Strategies Advanced Trade Management strategies allow for complex order types including:

- Trailing stops

- Auto break-even orders

- Scaled entries and exits

Performance Monitoring

PickMyTrade provides comprehensive performance tracking:

- Real-time position monitoring

- Trade execution logs

- Performance analytics

- Multi-account overview

- Profit/loss tracking

Best Practices

Strategy Development

- Start Simple Manually trade your strategy for at least 30 trades before automation – if you wouldn’t trade it manually, don’t automate it

- Avoid Over-Optimization Over-optimization creates systems that look amazing historically but bomb in live markets – that temptation to perfect your backtests often produces systems optimized for past conditions rather than future realities

- Use Multiple Timeframes Advanced multi-timeframe momentum systems analyze hourly, daily, weekly trends simultaneously, waiting for perfect alignment before using volatility-adjusted sizing

Testing Protocol

- Paper Trading First Always test strategies in demo mode for at least 30 days

- Forward Testing Forward test everything 30+ days before risking real money – this reveals execution issues backtests miss

- Gradual Scaling Start with micro contracts and scale up gradually

Daily Management

Once properly set up, automated trading strategies require 15-30 minutes daily for monitoring and review:

- Check positions and P&L

- Review execution logs for errors

- Monitor for unusual market conditions

- Verify strategy parameters remain appropriate

Common Pitfalls to Avoid

- Ignoring Slippage Expect 1-3 ticks of slippage on futures during normal market conditions – this increases during high-volatility periods

- Poor Timing Knowing when futures markets open prevents orders during low-liquidity periods when spreads widen

- Lack of Supervision Never let bots trade unsupervised – check positions daily, ensure bots aren’t stuck in loops or responding to bad data

Troubleshooting and FAQs

Common Issues and Solutions

Q: What latency should I expect? Execution delay should be under 2 seconds from signal generation to order placement – longer delays reduce strategy effectiveness

Q: Can I trade different symbols than my alerts? Yes, when you set up the alert in PickMyTrade, you can enter a specific trading symbol that is different from the symbol on your TradingView chart

Q: Can I connect multiple accounts? Yes, you can connect multiple accounts, however each additional connection costs $50 per month

Q: Do I need coding skills? No, with PickMyTrade, you can fully automate your TradingView strategy with no coding required

Technical Requirements

Internet Connection Your home internet is a critical weakness – power outages, disruptions, crashes kill bots when you need them most, as futures trading bots require 24/7 uptime

Platform Compatibility PickMyTrade works with:

- TradingView for strategy creation

- Multiple broker platforms for execution

- Both Windows and Mac operating systems

- Cloud-based infrastructure for reliability

Getting Support

PickMyTrade offers:

- Comprehensive documentation

- Email support

- Tutorial videos

- Community forums

- Demo account for testing

Conclusion

Automated futures trading with PickMyTrade represents a powerful convergence of technology and trading expertise. In 2025, futures algorithms have become a cornerstone of professional trading strategies, reshaping how institutions and savvy retail traders approach derivatives markets.

The platform’s ability to bridge TradingView strategies with professional-grade execution on multiple brokers, combined with its no-code approach and comprehensive risk management features, makes it accessible to traders at all levels. Whether you’re a beginner starting with micro contracts or an experienced trader managing multiple prop firm accounts, PickMyTrade provides the tools needed for successful automated futures trading.

Remember that automated futures trading systems really do work, but they’re only as good as the instructions we give them. Success requires:

- Thorough strategy development and testing

- Proper risk management

- Continuous monitoring and adjustment

- Realistic expectations

- Commitment to learning and improvement

As advancements in technology that were once out of reach now allow traders to harness AI-powered tools to level the playing field with major institutions, platforms like PickMyTrade democratize access to sophisticated trading automation that was once reserved for institutional traders.

Start your automated futures trading journey today with PickMyTrade’s 5-day free trial, and join the thousands of traders already executing millions of trades with millisecond precision.

Disclaimer: Trading futures involves substantial risk and is not suitable for all investors. Past performance is not indicative of future results. Always conduct your own research and consider your risk tolerance before trading. The information provided here is for educational purposes only.

For traders looking to automate trading strategies, PickMyTrade offers seamless integrations with multiple platforms. You can connect Rithmic, Interactive Brokers, TradeStation, TradeLocker, or ProjectX through pickmytrade.io.

If your focus is Tradovate automation, use pickmytrade.trade for a dedicated, fully integrated experience. These integrations allow traders to execute strategies automatically, manage risk efficiently, and monitor trades with minimal manual intervention.

You May also like:

GPT-4o vs GPT-4.5 vs o3 – How to Find the Right ChatGPT Model in 2025 for TradingView Strategy Development

Best Trading Bot 2025

Claude 4.1 AI for Trading: 2025 Guide to Building an Algo-Trading Copilot

Goat Funded Trader (GFT) TradeLocker Connection Guide

The Trading Pit Rithmic Connection Guide 2025