Hey there, trading crew! Picture this: you’re sipping coffee, plotting your next futures trade, and suddenly realize you could be trading with someone else’s money—keeping up to 90% of the profits. Sounds like a dream, right? That’s where Take Profit Trader (TPT) comes in. Based in Orlando, Florida, and founded in 2021 by James Sixsmith, TPT is making waves in the futures prop trading world with its no-nonsense approach and one-step evaluation. I’ve been digging into what TPT offers, and I’m stoked to break it down for you—pricing, Rithmic setup, trader vibes, and more. Let’s dive in and see if TPT’s your ticket to trading glory! If you’re evaluating Take Profit Trader in 2025 and looking to connect directly with Rithmic, this guide is for you. We’ll walk through the full Take Profit Trader Rithmic connection process and cover everything from setup to supported platforms, pricing, and common issues.

Why Take Profit Trader Stands Out

TPT is all about keeping things simple and trader-friendly. Here’s what’s got me excited:

- One-Step Evaluation: Unlike other firms with multi-step challenges, TPT gets you to a funded account with just one test—hit a 6% profit target while sticking to risk rules.

- Juicy Profit Splits: Retain 80% of your profits with a PRO account — or level up to PRO+ and enjoy an impressive 90% profit share.

- Platform Paradise: Choose from over 15 platforms, including NinjaTrader, TradingView, Quantower, and MotiveWave, with Rithmic or CQG data feeds.

- Trade Your Way: Manage up to five PRO or PRO+ accounts, trading futures on major exchanges like CME, NYMEX, COMEX, and CBOT—think crude oil, gold, or Micro E-mini S&P 500.

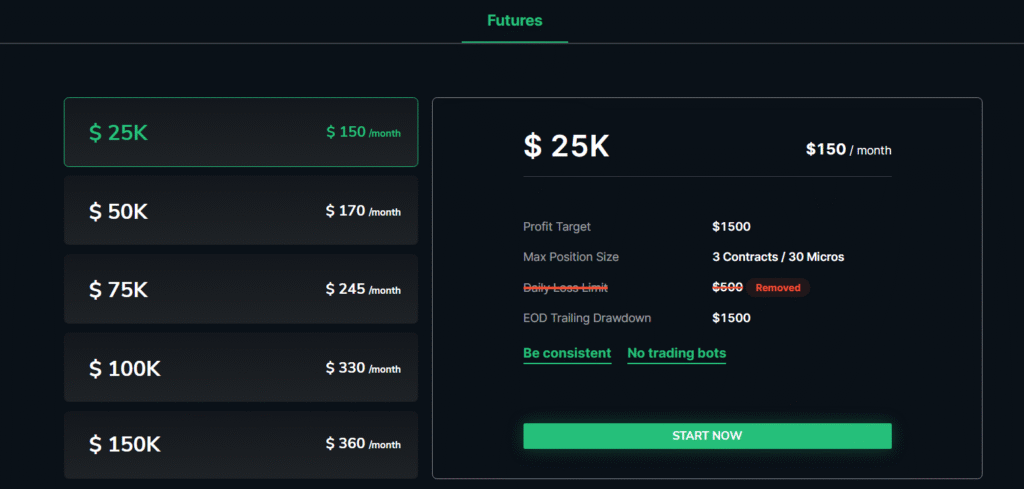

- No Daily Loss Limits in PRO+: Recent updates mean PRO+ accounts have end-of-day drawdowns, giving you more room to trade your style.

The catch? You can’t use trading bots (they want discretionary traders), and no trading’s allowed during high-impact news like FOMC or NFP. But with perks like these, TPT’s definitely worth a look.

How to Connect Rithmic to TPT

Don’t want to use NinjaTrader? No problem—you can connect directly to Rithmic using other supported platforms like Quantower, MotiveWave, or Bookmap. Here’s how:

Step-by-Step: Direct Rithmic Login for TPT

- Get Your Rithmic Credentials

- Log in to your TakeProfitTrader.com dashboard.

- Find your Rithmic credentials under “Evaluation Details.”

- Make sure to sign all required non-pro agreements for data access.

- Download Your Preferred Platform

- Choose a Rithmic-compatible platform like:

- Install the platform and choose Rithmic as your data feed during the setup.

- Login with Rithmic Paper Trading

- Use the system “Rithmic Paper Trading (Chicago)” or the server TPT recommends.

- Username and password come from your TPT dashboard.

- If asked for plug-in modes or gateway options, leave them at default unless otherwise stated.

- Start Trading!

- Once connected, your platform should display live simulation data.

- You can now trade the TPT evaluation account with ultra-low latency—no NinjaTrader required.

Pro Tip: Still confused? Platforms like Quantower and MotiveWave have detailed help docs or tutorials specifically for Rithmic login. You can also reach out to TPT support or visit third-party setup sites like canadianfuturestrader.ca.

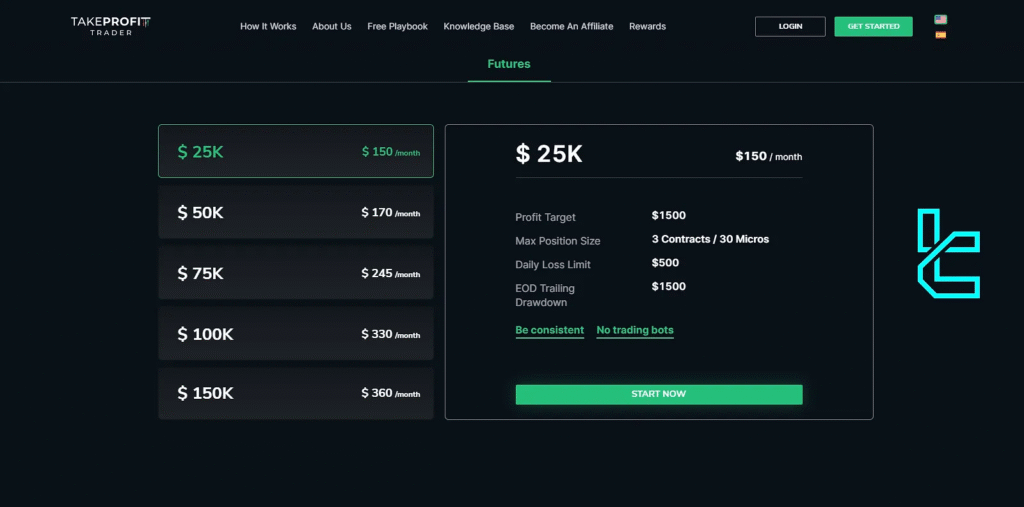

Pricing: What’s It Gonna Cost?

TPT offers transparent pricing, with both evaluation and funded accounts designed to fit various budgets. Here’s the breakdown as of July 2025:

- Evaluation Accounts (monthly fees):

- $25,000 account: $150

- $50,000 account: $170

- $100,000 account: $275

- $150,000 account: $360

- Funded Accounts (PRO): One-time activation fee of $130, no monthly costs.

- Funded Accounts (PRO+): No activation fee with promotions like “NOFEE40” (40% off evaluations + free PRO+ upgrade).

Promotions Alert: TPT’s known for sweet deals. The “NOFEE40” code slashes 40% off evaluations for life, and “50AND100” offers 50% off plus a fee refund after withdrawal. Check takeprofittrader.com or their X (@TakeProfitTrade) for the latest offers, but verify before signing up as promos can change.

Here’s a quick table to sum it up:

| Account Size | Evaluation Fee (Monthly) | PRO Activation Fee | PRO+ Activation Fee | Profit Split |

|---|---|---|---|---|

| $25,000 | $150 | $130 | $0 (with promo) | 80% (PRO), 90% (PRO+) |

| $50,000 | $170 | $130 | $0 (with promo) | 80% (PRO), 90% (PRO+) |

| $100,000 | $275 | $130 | $0 (with promo) | 80% (PRO), 90% (PRO+) |

| $150,000 | $360 | $130 | $0 (with promo) | 80% (PRO), 90% (PRO+) |

Micro-contract traders will love TPT’s low commissions (up to 50% cheaper than competitors), though e-mini commissions are a tad higher.

What Traders Are Saying

TPT’s got a solid rep, with a 4-star rating from 4,386 Trustpilot reviews as of July 2025. Here’s the vibe:

- The Good: Traders rave about fast payouts—“I requested a withdrawal, and it hit my account the same day!” said one Trustpilot reviewer. The 24/5 live support gets props for quick fixes, like resolving a Rithmic login issue in minutes. The one-step evaluation and day-one withdrawals are big hits.

- The Not-So-Good: Some traders grumble about high evaluation fees compared to firms like Apex, and the no-trading-during-news rule (e.g., FOMC, NFP) can feel restrictive. A few mentioned support being swamped during peak times, but TPT’s working on it.

Join their Discord or follow @TakeProfitTrade on X to get the real scoop from other traders. What’s your take on TPT’s rep? Share below!

Decision-Making Checklist

Thinking of testing TPT’s evaluation? Here’s what I’d check before diving in:

- Evaluation Rules: Hit a 6% profit target, stay under a 2.2% daily loss limit (removed for PRO+ in January 2025), and a 6% max drawdown. No trading during high-impact news like FOMC or NFP. Full rules at takeprofittrader.com.

- Platform Fit: Make sure you’re comfy with Rithmic or CQG feeds and platforms like NinjaTrader or TradingView. Test the setup in demo mode first.

- Community Buzz: Hop into TPT’s Discord or check X (@TakeProfitTrade) for trader tips and promo updates. It’s a goldmine for real-time insights.

- Payout Power: Day-one withdrawals are awesome, but you need to stay above the buffer zone (e.g., $52,000 for a $50,000 account with a $2,000 drawdown). Withdrawals over $250 are free; under that, it’s a $50 fee.

- Risk Tools: TPT’s risk management system enforces discipline, which is great for staying on track but might feel strict if you’re a free-spirit trader.

How TPT Stacks Up

Compared to Apex Trader Funding and Topstep, TPT holds its own:

- Vs. Apex: Apex provides larger account sizes (up to $300,000) and a 100% profit split on the first $25,000. However, it comes with a stricter evaluation process and higher commissions — $1.99 per side for Rithmic, compared to TPT’s lower rates.

- Vs. Topstep: Topstep’s Trading Combine is a two-step process with a $135/exchange data fee, pricier than TPT’s $130 one-time fee. Topstep’s 100% split on the first $12,500 is tempting, but TPT’s day-one payouts and no daily loss limits in PRO+ give it an edge.

Which firm’s your pick for 2025? Let’s hear it in the comments!

Why TPT Could Be Your 2025 Move

TPT’s one-step evaluation, killer profit splits, and platform flexibility make it a standout for futures traders. The ability to withdraw profits from day one and trade up to five accounts is a game-changer, especially with Rithmic’s lightning-fast execution. Sure, the evaluation fees aren’t the cheapest, and news trading restrictions might bug some, but the fast payouts and supportive community make it worth a shot. Head to takeprofittrader.com to snag deals like “NOFEE40” and start your journey. Have you tried TPT’s evaluation? What’s the toughest part of passing a prop firm challenge for you? Drop a comment and let’s swap stories!

You May Also Like:

Apex Trader Funding Rithmic Setup Guide in 2025

Connecting Topstep with Rithmic in 2025: Your Ultimate Guide

How to Connect Rithmic RTrader Pro to Bulenox Prop Futures Trading in 2025

Ready to Trade Smarter?

Take your trades to the next level with sniper entries and automated stock trading tools. Pair technical setups with the best futures trading platforms and make your execution precise and automatic.

Disclaimer: Trading involves risk. Only invest what you can afford to lose. No strategy guarantees future performance.