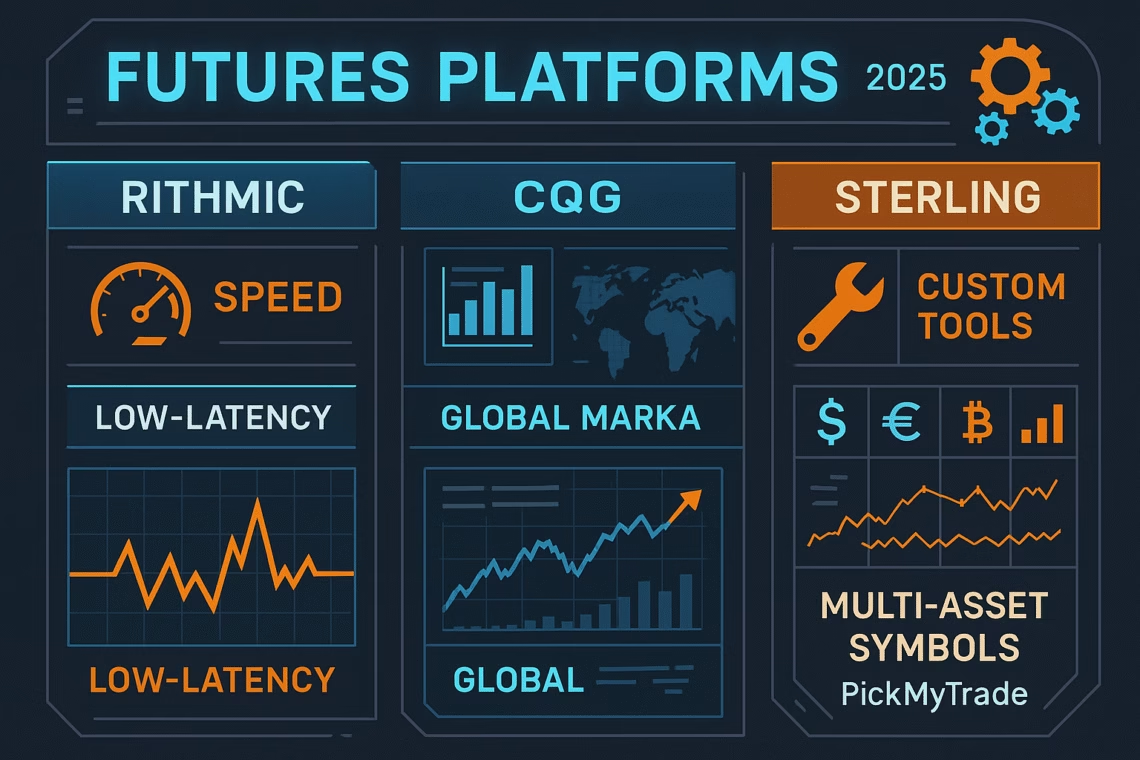

In the high-stakes arena of futures trading, selecting the best futures platform can define your edge amid 2025’s surging volumes—up 18% on CME Group exchanges alone. If you’re weighing Rithmic R|Trader Pro vs CQG vs Sterling, or scouting rithmic alternatives, this guide cuts through the noise. Rithmic excels in low-latency execution for scalpers, CQG dominates with analytics for strategists, and Sterling shines in customizable multi-asset workflows. Recent updates like Rithmic’s server-side copy trading and CQG’s 10.5 enhancements underscore why these options platforms remain staples.

We’ll break down CQG vs Rithmic head-to-head, spotlight Sterling’s versatility, explore rithmic alternatives, and integrate PickMyTrade for seamless automation. Whether you’re a prop trader or day scalper, discover the best futures platform for 2025’s volatile markets—where AI-driven tools and micro-contracts like CME’s 1-Ounce Gold are reshaping plays.

Why Compare Rithmic R|Trader Pro vs CQG vs Sterling in 2025?

Futures platforms aren’t one-size-fits-all. Rithmic’s DMA focus suits HFT pros, CQG’s data depth aids analysts, and Sterling’s Level II tools empower custom strategies. With 2025 trends like 24/5 trading expansions and API integrations booming, switching could slash latency by 40% or unlock automation via PickMyTrade.

Key drivers for upgrades:

- Latency leaps: Rithmic’s co-location edges out CQG’s compression in tick-by-tick feeds.

- Cost efficiencies: Zero platform fees on many brokers, but data routing varies ($0.10–$0.25/contract).

- Automation surge: 60% of pros now use bots—PickMyTrade bridges TradingView to these platforms effortlessly.

Ready for the best futures platform? Let’s dive into the showdown.

CQG vs Rithmic: Head-to-Head for the Best Futures Platform

In CQG vs Rithmic, the debate rages on data fidelity vs speed. Rithmic’s MBO (Market By Order) granularity crushes CQG’s MBP (Market By Price) for order flow, but CQG’s 75+ global feeds offer broader coverage. 2025 benchmarks show Rithmic at 1ms latency vs CQG’s 5ms—critical for scalpers.

| Feature | Rithmic R|Trader Pro | CQG QTrader | |———|———————–|————-| | Latency | Ultra-low (1ms, co-located) | Low (5ms, reliable) | | Data Type | MBO tick-by-tick | MBP compressed | | Fees (per contract) | $0.25 (min $20/mo) | $0.10 (min $10/mo) | | Best For | HFT, algo traders | Analysts, global access | | 2025 Update | Server-side copy trading | Version 10.5: Range bars, OTC support |

Winner? Rithmic for precision; CQG for affordability and tools.

Rithmic R|Trader Pro: Speed Demon for Scalpers

Rithmic’s flagship dominates rithmic alternatives with direct exchange access, handling 20% of daily futures volume. Excel integration and trailing stops shine for algos. 2025’s mobile beta and break-even brackets add mobility. Drawback: Windows-heavy, no native Mac support.

CQG QTrader: Analytics Powerhouse

CQG edges CQG vs Rithmic in polish, with TFlow charts and UDS strategies updated for CME/Eurex in 2025. Ideal for multi-asset pros, but compression may skew delta calcs. Fees: Lower entry, but pro data hikes costs 5-10x.

Click Here To Start Futures Trading Automation For Free

Sterling Trader Pro: Versatile Rithmic Alternative in 2025

As a top rithmic alternative, Sterling Trader Pro blends equities, options, and futures in a Level II beast—perfect for hybrid traders. Version 10.4 (2025) amps options chains and risk metrics. Custom hotkeys and mobile apps rival Rithmic’s speed without the silos.

Why switch? Broader asset support than CQG, with 4.8/5 UX ratings. Fees: Broker-dependent ($0.50–$1/contract). Best for: Prop firms needing OMS integration.

| Platform | Strengths vs Rithmic | 2025 Edge |

|---|---|---|

| Sterling | Multi-asset, customizable DOM | v10.4: Real-time margin |

| CQG | Global data, charts | 10.5: HMS futures |

Top Rithmic Alternatives: Best Futures Platforms Beyond the Big Three

Exploring rithmic alternatives? 2025’s best futures platforms include NinjaTrader for order flow and Interactive Brokers for globals.

- NinjaTrader: Free sim, $0.09/contract—top for beginners with ATM strategies.

- Interactive Brokers (TWS): $0.25–$0.85 fees, 100+ products—pro-grade algos.

- Optimus Flow: No-cost order flow via Rithmic/CQG—2025 Fintech winner.

- TradingView: Cloud charts + broker links—automation-ready.

- Sierra Chart: Customizable, low-latency—pairs with any feed.

These outpace Rithmic in accessibility, per StockBrokers.com rankings.

PickMyTrade: Automation Boost for Rithmic, CQG, and Sterling

Elevate any best futures platform with PickMyTrade’s no-code automation—integrating TradingView alerts to Rithmic, CQG (via Tradovate), and Sterling in seconds. 2025’s webhook execution cuts drift to zero, supporting 5M+ trades with TP/SL scaling.

Seamless setup:

- Rithmic: Direct API for prop/live—link accounts, automate scalps.

- CQG: Via Tradovate bridge—ideal for delta strategies.

- Sterling: OMS hooks for multi-asset bots.

4.9/5 on Trustpilot; free trial. It’s the 2025 must-have for hands-off edges.

2025 Trends: What Makes the Best Futures Platform?

- Micros boom: CME’s 1OZ Gold live—platforms like CQG now support OTC.

- API evolution: Rithmic’s copy modules + PickMyTrade = 40% faster replication.

- Mobile mandates: Sterling’s iOS updates rival Rithmic’s beta.

Choose based on style: Speed (Rithmic), depth (CQG), flexibility (Sterling).

FAQs: Most Asked Questions on Rithmic vs CQG vs Sterling

NinjaTrader—free sim, intuitive charts, low $0.09 fees. Easier than Rithmic’s pro curve.

Rithmic (1ms vs 5ms)—ideal for HFT, but CQG’s cheaper for casuals.

Yes—for multi-asset with Level II; v10.4 adds margin tools, but fees vary by broker.

Yes—Rithmic beta app, CQG web, Sterling iOS. All support on-the-go execution.

Rithmic $0.25/contract; CQG $0.10; Sterling broker-dependent ($0.50+). Add data ~$10–20/mo.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Evaluating Strategy Viability with Sharpe Ratio & Performance Metrics