In 2026, pattern recognition trading has evolved dramatically with AI advancements, delivering higher accuracy, real-time processing, and automated execution. Traditional chart patterns like head-and-shoulders or flags remain relevant, but AI uncovers subtle, non-obvious setups that outperform “perfect” ones—crowded trades often lose their edge as markets price them in early.

Platforms now scan thousands of charts per minute, assigning win probabilities and integrating multi-source data (price, volume, sentiment). Recent data shows AI-driven systems achieving up to 80% win rates in simulated trades, with tools like Tickeron’s Pattern Search Engine highlighting 39 patterns for intraday and swing opportunities.

TrendSpider leads in automated charting, detecting over 220 patterns and 150 candlestick formations across stocks, ETFs, forex, and futures—eliminating bias and enabling multi-timeframe analysis.

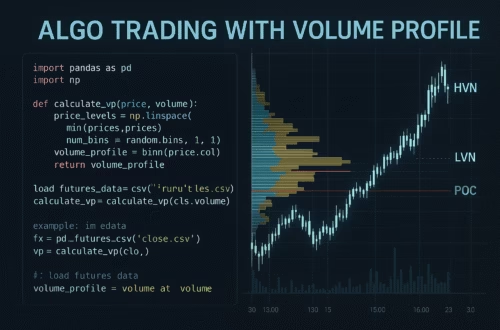

In futures markets, where volatility demands speed, AI enhances pattern recognition trading by processing relational data and time-series models for better liquidity forecasts and execution.

A standout solution for US futures traders is PickMyTrade, a specialized automation platform built for Tradovate, Rithmic, Interactive Brokers, and more. It excels in pattern recognition trading by bridging signals (e.g., from TradingView alerts) to low-latency execution. PickMyTrade supports unlimited strategies, tickers, and 24/7 automation—ideal for E-mini S&P 500 (ES), Nasdaq-100 (NQ), or other high-liquidity contracts. Traders automate SuperTrend flips, scalping, or multi-session setups with precise risk controls, reducing manual effort while capturing opportunities in fast-moving US markets.

Emerging 2026 trends include quantum-assisted models, federated learning for privacy, and agentic AI for adaptive strategies. Small, efficient models outperform giants in domain-specific tasks like futures pattern detection.

Why AI Elevates Pattern Recognition Trading in 2026

AI processes vast datasets instantly, spotting anomalies humans miss. Reinforcement learning adapts strategies live, while sentiment integration adds context.

Studies show “messier” patterns (less textbook) yield better results—AI excels here with mathematical precision.

Click Here To Automate Trading

How to Get Started with Pattern Recognition Trading Using AI

- Choose tools like TrendSpider for analysis and PickMyTrade for futures automation.

- Backtest patterns on historical data.

- Set risk parameters (e.g., 1% stops).

- Automate via webhooks for 24/7 execution.

- Monitor and refine—AI learns from outcomes.

Pattern recognition trading isn’t about replacing judgment; it’s about augmenting it for consistent edges.

Ready to transform your approach? Explore PickMyTrade for seamless US futures automation and stay ahead in 2026.

Most Asked FAQs

It involves identifying repeatable chart formations (e.g., triangles, flags) to predict price moves, now supercharged by AI for accuracy and speed.

Yes—data from 370,000+ detections shows viable 2-3% returns per cycle with AI, though perfect patterns underperform due to crowding.

It automates signals into executions on brokers like Tradovate/Rithmic, supporting unlimited futures strategies for 24/7 US market trading.

All trading carries risk; AI reduces emotional bias but requires proper risk management—backtest thoroughly and use stops.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Zero-Lag Scalping System for ES/NQ Futures