Introduction

In this Goat Funded Trader Review 2025 & TradeLocker Connection Guide, we explore whether GFT is a legit prop firm or a risky bet. Founded in 2022 in Hong Kong, GFT has funded over 98,000 traders and paid out more than $10 million. But is it worth your time and money? Let’s look at its features, challenges, pros/cons, and how to connect your account with TradeLocker. Goat Funded Trader (GFT) is one of the newer proprietary trading firms making waves in the prop trading space. Founded in 2022 and headquartered in Hong Kong, the firm claims to have funded over 98,000 traders and paid out more than $10 million.

But is GFT worth your time and money? In this review, we’ll cover its features, challenges, pros/cons, and how to connect your account with TradeLocker.

Key Points on GFT

- Founded: 2022 (Hong Kong HQ)

- Account Sizes: $2,500 to $200,000 (scaling up to $2M)

- Profit Splits: 80% standard, up to 100% with add-ons

- Funding Models: 1-Step, 2-Step, 3-Step, Goat Blitz (instant), and Instant Funding

- Leverage: Up to 1:100

- Trading Platforms: TradeLocker, MT5, MatchTrader

- Payouts: On-demand or every 30 days (via crypto or Rise Pay)

- Support: 24/7 via Discord and email

While the low entry fees (starting at $17) and multiple evaluation options attract traders, GFT also faces criticism for strict drawdown rules and allegations of payout delays.

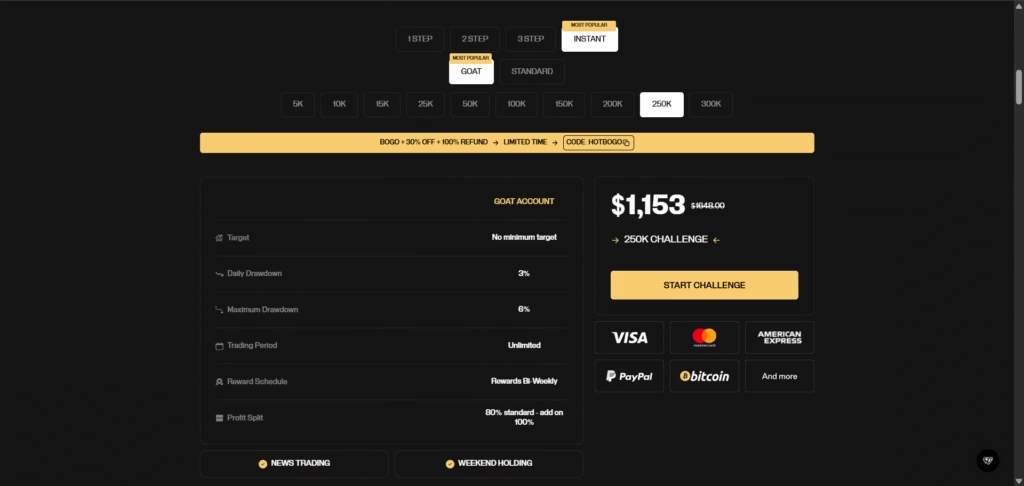

Goat Funded Trader Challenge Types and Rules

Here’s a quick breakdown of GFT’s main account types:

| Challenge Type | Phases | Profit Target(s) | Daily Drawdown | Max Drawdown | Account Sizes | Fee Range (USD) | Profit Split |

|---|---|---|---|---|---|---|---|

| 1-Step | 1 | 10% | 4% | 8% | $5K–$200K | $25–$943 | 80–100% |

| 2-Step | 2 | 8% / 6% | 3–4% | 6–8% | $5K–$200K | $17–$700 | 80–100% |

| 3-Step | 3 | 6% each | 3–4% | 6–8% | $5K–$200K | $20–$800 | 80–100% |

| Goat Blitz (Instant) | N/A | N/A | 3% | 6% | $2.5K–$100K | $50–$500 | 80–95% |

| Instant Funding | N/A | N/A | 4% | 8% | $5K–$200K | $100–$1,000 | 80–100% |

Note: Fees vary depending on discounts and promotions.

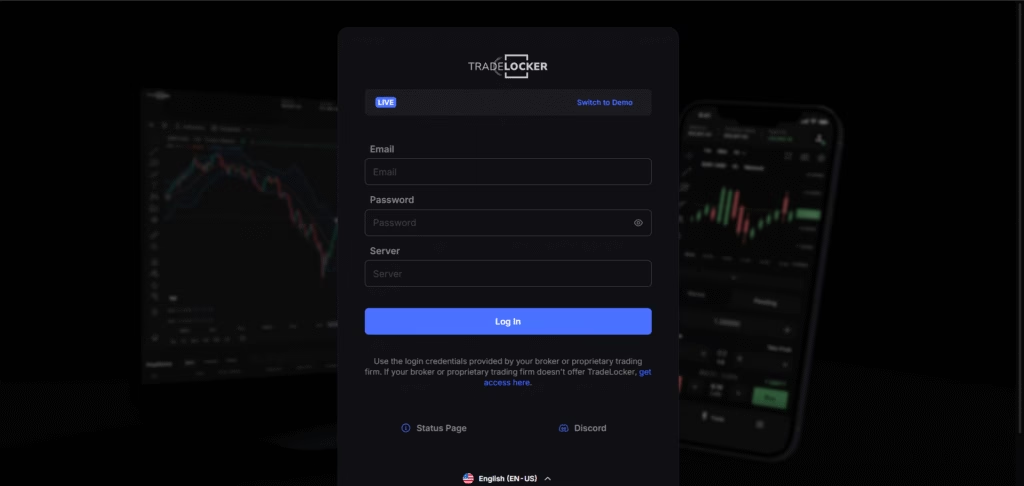

Connecting GFT to TradeLocker

One of GFT’s big selling points is support for TradeLocker, which integrates directly with TradingView charts for intuitive execution.

Here’s how to connect:

- Sign up on the GFT website.

- During setup, select TradeLocker as your trading platform.

- After purchase, you’ll receive login credentials via email.

- Log in at:

- live.tradelocker.com (for live accounts)

- demo.tradelocker.com (for evaluations/demo)

- Enter your email and password, then start trading.

For third-party tools like copy trading, you’ll need to:

- Add your account in the dashboard.

- Select TradeLocker as the platform.

- Choose GFT as broker, enter server (e.g., OSP-DEMO), then confirm.

Connection usually takes 2 minutes, and support is available if credentials don’t arrive.

Goat Funded Trader Review: Key Points

| Source | Rating | Reviews | Key Pros | Key Cons |

|---|---|---|---|---|

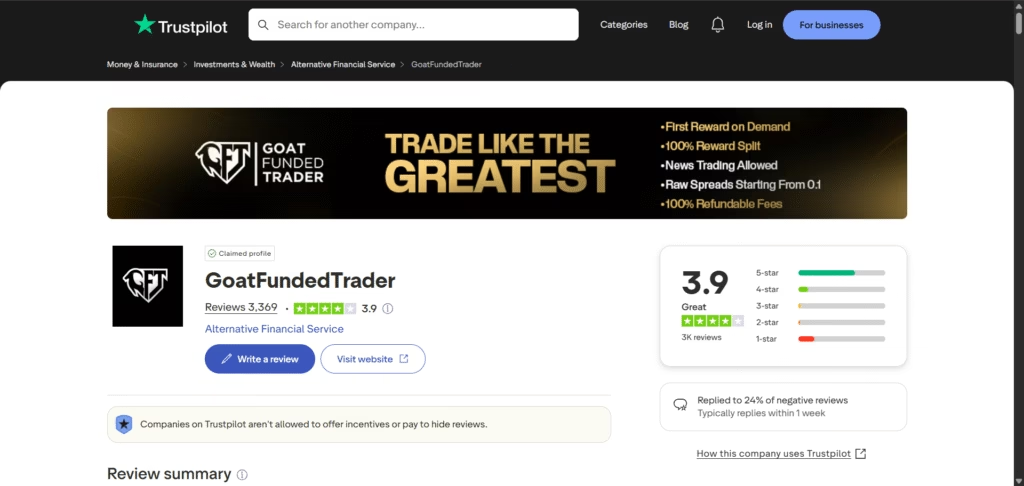

| Trustpilot | 3.9/5 | 3,000+ | Responsive support, low fees, clear rules | Payout delays, scam claims, glitches |

| DailyForex | 4.5/5 | N/A | Scaling, monthly salary, crypto payouts | Strict rules, no education |

| PropFirmMatch | N/A | User-based | Affordable, immediate support | Some reports of hidden rules |

| Reddit (r/Forex) | Mixed | Discussion | Flexible trading | Equity-based drawdown unfairness |

| YouTube/X | Varied | Video/blogs | Unbiased breakdowns, promo reviews | Accusations of manipulation |

Pros and Cons of GFT

Pros

- Low entry fees (starting at $17)

- Profit splits up to 100%

- No minimum trading days

- Supports EAs and copy trading

- Scaling up to $2M

- 24/7 customer support

Cons

- Strict drawdown rules (3–4% daily, 6–8% max)

- Allegations of hidden rules and payout delays

- No educational resources for beginners

- Limited country availability (e.g., Russia, Iran, North Korea banned)

Final Verdict: Is GFT Worth It?

Goat Funded Trader offers affordable challenges, instant funding options, and strong TradeLocker integration, making it attractive for disciplined traders.

However, mixed reviews around payout delays and strict equity-based rules mean you should approach with caution. If you’re experienced and can manage risk effectively, GFT could be a rewarding prop firm. Beginners may want to look elsewhere for firms with looser rules and more educational support.

Key Takeaway

GFT is a legit but strict prop firm. Its TradeLocker integration is excellent, fees are low, and payouts are real but only if you can stick to the tight drawdown rules.

You may also like:

The Trading Pit Rithmic Connection Guide 2025

FTMO Review in 2025

Alpha Trader Firm: Your 2025 Trading Adventure Awaits!

Take Profit Trader Rithmic Connection Guide (2025)

How to Connect Rithmic RTrader Pro to Bulenox Prop Futures Trading in 2025

Ready to Trade Smarter?

Take your trades to the next level with sniper entries and automated stock trading tools. Pair technical setups with the best futures trading platforms and make your execution precise and automatic.

Disclaimer: Trading involves risk. Only invest what you can afford to lose. No strategy guarantees future performance.