New to trading and struggling to read charts? Learning candlestick patterns can give you an edge in spotting reversals, timing entries, and improving your overall trading strategy. Even better? You can now automate the entire process—from pattern recognition to trade execution—using tools like TradingView and Tradestation automation via PickMyTrade.

Candlestick Patterns for New Traders

Candlestick charts are a trader’s best friend. Each candle represents price action during a specific time period and tells a story about market sentiment. For beginners, learning a few essential candlestick patterns can help you quickly understand market behavior.

Read the Market Like a Pro

Experienced traders use candlestick patterns to read market psychology at a glance. Instead of guessing, you can rely on these visual clues to understand whether buyers or sellers are in control—and what might happen next.

Hammer Pattern: Bullish Reversal Signal

The Hammer candlestick typically forms after a downtrend and signals a potential bullish reversal. It has a small body and a long lower wick, showing that sellers pushed the price down but buyers came back strong.

✅ When you see a Hammer after a decline, it might be time to look for long trade setups.

Doji Pattern: Market Indecision

The Doji represents indecision in the market. It forms when the open and close prices are nearly equal. After a strong trend, a Doji often hints at a potential reversal or pause.

✅ Watch for Dojis near key support/resistance zones—they can signal upcoming turning points.

Spot Patterns to Time Your Trades

Recognizing these patterns can help you:

- Time entries and exits more accurately

- Avoid emotional trades

- Improve your overall strategy

But manually identifying them can be time-consuming. That’s where automation comes in.

Automate Pattern Detection with TradingView

Instead of staring at charts all day, let technology work for you. Use TradingView indicators or scripts that automatically detect candlestick patterns and set alerts.

- Hammer? ✅ Alert triggered

- Doji near support? ✅ Get notified

- Trendline + pattern? ✅ Entry opportunity

Automation removes guesswork and speeds up decision-making.

Trade Smarter with Tradestation Automation

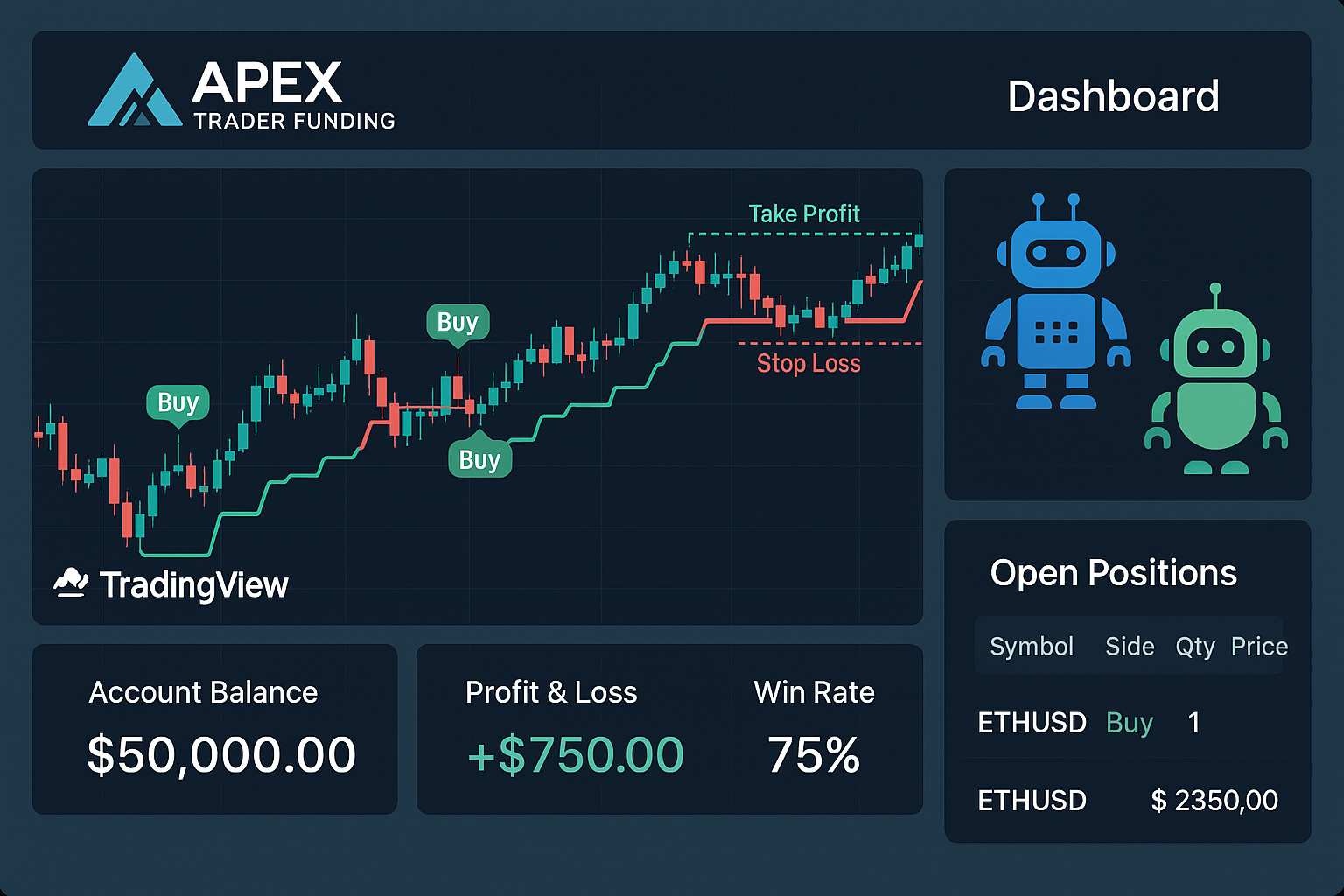

Once you have pattern alerts in place, connect them to PickMyTrade for Tradestation automation. You can automatically execute trades based on your TradingView alerts using:

- Tradestation

- Rithmic

- Interactive Brokers

- TradeLocker

- ProjectX

How it works:

- Create alerts on TradingView (e.g., Hammer pattern detected)

- PickMyTrade listens to the alert

- Trade gets executed automatically on your connected Tradestation account

No more missed entries. No more overtrading. Just precision execution.

Final Thoughts: Combine Candlesticks with Automation

Mastering candlestick patterns like the Hammer and Doji gives you a clear edge in the markets. But combining this knowledge with Tradestation automation tool turns your edge into a repeatable, scalable strategy.

Whether you’re a beginner or a seasoned trader, using automation tools to act on proven patterns can drastically improve your consistency and reduce emotional errors.

Ready to take your trading to the next level?

Start using candlestick patterns—and let automation handle the rest

Also Checkout: Automated Options Trading: ITM vs OTM Options Explained