Choosing a trading strategy is one of the most important steps for success—especially when trading prop firm futures. Two commonly used indicators are the Relative Strength Index (RSI) and the Supertrend. Both have different strengths, risks, and styles. Let’s break down which one might suit you best based on your trading personality and risk appetite.

Supertrend Strategy in Prop Firm Futures: High Risk, High Reward

The Supertrend indicator works well in strong trending markets. It’s popular among aggressive futures traders who seek higher returns.

What to Know:

- Potential Return: High

- Risk Level: High

- Max Drawdown: Can exceed 40%

- Win Rate: Lower compared to RSI

- Profit Factor: Around 1.39

In prop firm trading, where capital preservation is key, the large drawdowns of Supertrend could be a red flag for beginners. But if you’re experienced and can manage volatility, it could deliver impressive profits.

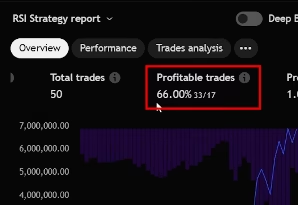

RSI Strategy in Prop Firm Futures: Low Risk, Consistent Returns

The RSI strategy focuses on identifying overbought and oversold conditions. It appeals to conservative traders aiming for a higher win rate with lower risk.

Key Metrics:

- Potential Return: Moderate

- Risk Level: Low

- Max Drawdown: Around 22%

- Win Rate: Higher than Supertrend

- Profit Factor: Around 1.92

For prop firm traders focused on consistent profits and account safety, RSI may be the better option. It’s designed to offer steady returns without huge swings.

Supertrend vs. RSI: At a Glance

| Feature | Supertrend | RSI |

|---|---|---|

| Potential Return | High | Moderate |

| Risk | High | Low |

| Win Rate | Lower | Higher |

| Drawdown | ~43% | ~22% |

Which Prop Firm Strategy Should You Use?

Ask yourself these important questions:

- How much risk can I handle?

If large drawdowns stress you out, RSI might be the better fit. - Do I want fast gains or steady growth?

Supertrend may bring bigger wins—if you can manage the risk. - What’s my trading personality?

Are you a calm, methodical trader (RSI), or more aggressive and trend-focused (Supertrend)?

Pro Tip: In the world of prop firm, consistency and risk control often matter more than wild profits.

Final Thoughts for Prop Firm Traders

Whether you’re using RSI or Supertrend, the key is matching the strategy to your goals and risk tolerance. Both can work inside prop firm accounts, but only if you’re disciplined and fully understand their behavior.

Before You Trade:

- Past performance ≠ future results

- Always set stop-loss levels

- Automate your strategies for better execution

Automate Your Strategy for Prop Firm

Take your strategy from TradingView straight to your broker:

- Tradovate: PickMyTrade.trade

- Rithmic, Interactive Brokers, TradeLocker, TradeStation, ProjectX: PickMyTrade.io

Ready to Level Up Your Prop Firm Trading?

Start by testing RSI and Supertrend side-by-side. Monitor drawdowns, consistency, and risk-adjusted returns. Choosing the right approach could be the difference between passing or failing your next prop firm challenge.

Also Checkout: Titan Capital Markets Review