Crypto Market Update

Key Prices

- Bitcoin (BTC): $108,450 (+0.66%)

- Ethereum (ETH): $2,562.10 (+1.05%)

- Solana (SOL): $161.85 (+1.53%)

- Cardano (ADA): $0.78 (+0.93%)

- Binance Coin (BNB): $632.70 (+1.10%)

- Total Crypto Market Cap: $3.41T (+0.89%)

Notable Developments

Bitcoin crossed the $108K level early Tuesday, lifted by persistent ETF inflows and anticipation ahead of tomorrow’s U.S. CPI release. Institutional demand continues to dominate the trend.

Ethereum climbed above $2,560, bolstered by renewed interest in Layer 2 protocols and strong development metrics.

Solana and Cardano gained on-chain traction, with DEX volumes and active addresses rising steadily.

India’s awaited crypto regulatory framework, now expected by Friday, is adding to speculative flows in regional markets.

Market Sentiment

Crypto sentiment remains bullish. Bitcoin leads momentum, Ethereum holds strength on scalability optimism, and altcoins benefit from ecosystem activity and macro positioning.

Forex Market Update

Key Currency Pairs

- EUR/USD: 1.1442 (+0.24%)

- USD/JPY: 143.85 (-0.40%)

- GBP/USD: 1.3591 (+0.26%)

- USD/CAD: 1.3465 (-0.11%)

- AUD/USD: 0.6520 (+0.12%)

Economic Indicators

The dollar edged lower ahead of key CPI data, with markets positioning for potential confirmation of disinflation trends.

The yen gained further as Japanese GDP revisions beat expectations, adding to safe-haven interest.

The euro climbed higher after ECB officials reaffirmed the need for data-dependent tightening.

The pound extended gains with stronger-than-expected wage growth data.

The Aussie rebounded modestly as iron ore prices found support and China’s PBOC hinted at fresh stimulus.

Market Sentiment

FX markets are cautiously optimistic. Dollar weakness continues as CPI looms, while regional currencies gain on positive economic data and central bank divergence narratives.

Futures Market Update

Key Contracts

- S&P 500 Futures: 6,021.30 (+0.21%)

- Nasdaq 100 Futures: 19,725.50 (+0.28%)

- Gold Futures: $3,358.10 (+0.37%)

- WTI Crude Oil: $61.45 (-0.72%)

- Natural Gas Futures: $3.52 (+2.3%)

- Silver Futures: $44.18 (+0.59%)

Key Insights

Equity futures edge higher, with tech continuing to lead gains ahead of major economic data. Nvidia and other AI-heavy names keep the Nasdaq on solid footing.

Gold and silver rise as investors hedge inflation risk ahead of CPI.

Oil slips again amid signs of diplomatic progress in U.S.-China trade talks and expectations of stable supply.

Natural gas extends gains, driven by unseasonably warm weather and reduced European inventories.

Market Sentiment

U.S. futures reflect cautious optimism, tech-driven rallies persist, and commodities remain reactive to macro data and weather-driven demand patterns.

Broader Market Outlook

- Crypto: Bitcoin stabilizes above $108K amid ETF support. Ethereum and altcoins rally ahead of U.S. inflation data and India’s policy rollout.

- Forex: Dollar under pressure as global traders await June CPI. Cross-currency momentum builds on regional economic surprises.

- Futures: Tech remains the growth engine, but markets remain in wait-and-watch mode until inflation prints are released.

Disclaimer

This content is for informational purposes only and should not be considered financial advice. Markets are volatile and conditions may change rapidly. Always perform your own due diligence or consult with a financial advisor before making any trading or investment decisions.

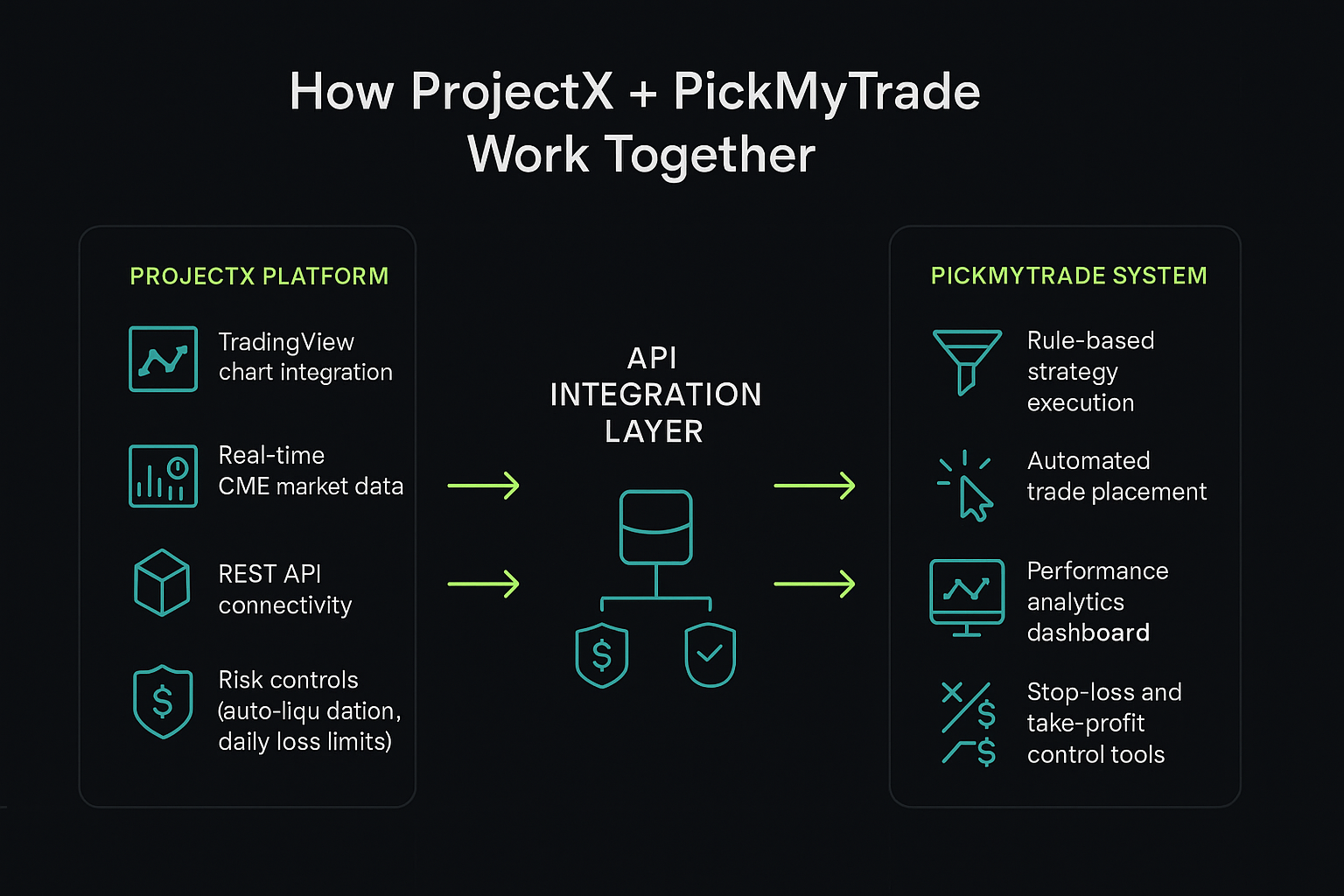

Automate Your Strategy with PickMyTrade

Manual trading during evaluations or across multiple accounts can be frustrating and error-prone. PickMyTrade connects your TradingView alerts directly to your broker, ensuring fast, reliable, and automated execution.

Compatible with Rithmic, Interactive Brokers, TradeStation, TradeLocker, and more.

Visit PickMyTrade.io to start automating today.

Tradovate users, go to PickMyTrade.trade