If you’re a forex prop firm trader, clean charts might seem like a sign of a solid strategy. But what if those perfect-looking visuals are lying to you?

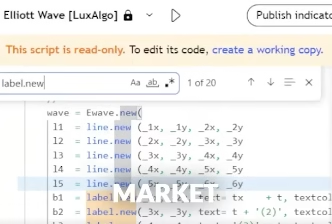

Tools in Pine Script like label.new() and line.new() draw arrows, trendlines, and waves—but many of them appear after price movements, not before. That makes a script look more accurate than it really is.

Why It’s Dangerous

Imagine watching a chart in real time—no signal shows up. Then after a big move, a buy arrow suddenly appears. This makes the strategy look great… in hindsight. But during the actual move, there was no clue. You couldn’t have traded it live.

How These Visuals Work

It’s not a bug. These visuals often wait for confirmation—a pivot high or low—before showing anything. That means the price has already moved by the time the arrow shows up.

So, when you see perfect trendlines and waves in backtesting, you’re seeing after-the-fact signals. These visuals weren’t there when it counted.

Repainting Ruins Backtesting

This is especially dangerous during backtests. Many traders think their strategy has a high win rate—when in reality, the signals were late. In live markets, these signals wouldn’t help. They only make results look better than they are.

Clean Charts Can Be Misleading

A tidy chart doesn’t always mean a smart strategy. Sometimes, it hides the fact that the visuals only show up once it’s too late to act.

What to Do as a Forex Prop Firm Trader

- Be skeptical of visuals that appear only after price moves.

- During backtests, ask yourself: “Would I have seen this signal live?”

- Test your strategy in forward/live mode, not just with historical data.

- Focus on non-repainting indicators for real-time reliability.

Final Tip

As a forex prop firm Automation trader, your edge depends on real-time decisions—not perfect hindsight. Don’t let repainting visuals trick you into overconfidence. Trade with tools that reflect the true live market.

Also Checkout: FTMO Review in 2025

FundedFirm empowers traders by combining skill and funding—helping committed professionals reach new heights in the global forex market!