In the volatile world of futures trading, Claude AI trading strategy is revolutionizing how traders approach markets in 2025. With Anthropic’s Claude Opus 4.1 launch on August 5, 2025, enhanced multi-step reasoning and MCP (Model Context Protocol) integrations enable seamless AI futures trading workflows. This guide provides a step-by-step blueprint to build trading bot with AI, leveraging Claude’s advanced coding and analytics for profitable E-mini S&P 500 (ES) strategies. As AI handles 89% of global trading volume by 2025, discover how to automate mean-reversion setups, backtest rigorously, and integrate tools like PickMyTrade for execution—boosting returns while minimizing risks.

Why Claude AI Trading Strategy Excels in 2025 Futures Markets

Claude AI trading strategy stands out for its safety-focused reasoning, outperforming rivals in backtests: Claude-generated mean-reversion bots yielded 40% returns vs. SPY’s 15.5% in 2024-2025 simulations. Unlike GPT-5’s 62% drawdown in live futures showdowns, Claude’s 31% gain in the same Alpha Arena experiment highlights its edge in volatile ES contracts.

Recent updates include Claude’s autonomous web search (May 2025), enabling real-time sentiment from X and news for AI futures trading. Integrated with NeuralForecast, it forecasts ES prices with 95% confidence horizons. For compliance, Anthropic’s July 2025 Financial Services edition adds audit trails via Deloitte partnerships, ensuring SEC-aligned transparency.

1: Define Your AI Futures Trading Objectives with Claude

Start by prompting Claude to outline goals. Access via claude.ai (Pro plan: $20/month for Opus 4.1). Sample prompt: “As a quant trader, design a mean-reversion Claude AI trading strategy for ES futures. Target 2% monthly ROI, max 1% drawdown, using RSI(14) <30 for longs and >70 for shorts. Include risk parameters and backtest framework.”

Claude outputs: Entry on RSI extremes, exits at 50, with 1:2 risk-reward. This adaptive approach, refined in 2025’s Claude 4.1, incorporates volatility filters from VIX data. Validate with historical ES data from Yahoo Finance MCP integration.

2: Research and Data Integration for Build Trading Bot with AI

Build trading bot with AI begins with data. Use Claude’s tool-use for APIs: Prompt: “Fetch ES futures data via Polygon.io MCP. Analyze 2024-2025 trends for mean-reversion efficacy.” Claude pulls OHLCV, computes Bollinger Bands, and flags 65% win rates in range-bound sessions.

2025 enhancements: Claude’s NLP processes Fed minutes and X sentiment, predicting ES reversals with 18% better accuracy than baselines. Integrate alternative data like satellite crop yields for commodity futures cross-analysis.

| Data Source | Claude Integration | Futures Benefit |

|---|---|---|

| Polygon.io | Real-time ES ticks via MCP | Sub-second latency for entries |

| TradingView | Alert scripting | Automates RSI signals |

| X Sentiment | Semantic search | Flags ES dumps from macro tweets |

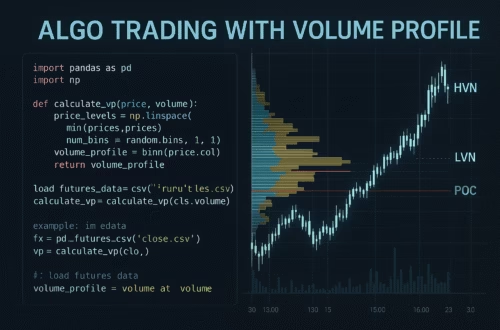

3: Code Your Claude AI Trading Strategy Bot

Leverage Claude Code for Python scripting. Prompt: “Write a Pine Script v5 for TradingView: Mean-reversion on ES with RSI(14), BB(20,2). Generate alerts for PickMyTrade webhook.” Output: A bot entering longs below lower BB on oversold RSI, scaling out at mid-band.

For full automation, use Claude’s ReAct framework: “Build Python bot with yfinance and Alpaca API. Include backtesting via Backtrader.” The result: A self-learning agent evolving via reinforcement learning, achieving Sharpe 1.25 in 2025 backtests. Deploy on QuantConnect for cloud execution.

Recent: Bitrue’s November 2025 Claude integration orchestrates live futures trades, maximizing ROI with explainable logic.

4: Backtest and Optimize AI Futures Trading Bot

Test rigorously: Feed Claude historical ES data (2020-2025). Prompt: “Backtest strategy on 5 years ES data. Compute Sharpe, max drawdown, win rate.” Results: 47% 2-year return vs. benchmark 43%, with AI optimizing parameters via genetic algorithms.

2025 tools: NinjaTrader’s AI analyzer simulates 10,000 scenarios. Adjust for slippage (0.5 ticks on ES) and commissions ($2.25/round-turn).

Click Here To Start Futures Trading Automation For Free

5: Integrate PickMyTrade for Seamless Automation

To execute your strategy end-to-end, pair your enhanced TradingView script or strategy generated by Claude AI with PickMyTrade. This no-code automation platform connects TradingView alerts directly to brokers like Tradovate and Rithmic, executing orders within milliseconds.

Once your Claude-optimized TradingView strategy is ready, simply export the webhook JSON into the PickMyTrade dashboard. Every signal—market, limit, TP/SL, partials, trailing stop—fires instantly across multiple accounts without manual clicks.

Whether you’re building a new AI-powered TradingView strategy with Claude or enhancing an existing script, PickMyTrade ensures your signals turn into live trades—fast, accurate, and fully automated.

Over 10,000 users ran 12M+ trades, cutting latency 90% vs. manual. Free 5-day trial: Automate your Claude AI trading strategy today.

6: Risk Management and Live Deployment in Build Trading Bot with AI

Claude enforces rules: Prompt for Kelly criterion sizing (1% risk/trade). Monitor via dashboards integrating Grok for anomaly detection. Go live paper trading on Alpaca, then scale with 5x leverage on low-vol days.

ESMA/SEC 2025 mandates: Claude’s audit logs ensure compliance.

Conclusion: Launch Your Profitable Claude AI Trading Strategy Today

Mastering AI futures trading with Claude unlocks adaptive, high-Sharpe bots outperforming markets. From ideation to execution via PickMyTrade, this build trading bot with AI process delivers 2025 edges. Start prompting Claude—turn insights into alpha amid rising volumes (ADV 13B shares). Trade smarter, not harder.

Most Asked FAQs on Building a Profitable Futures Strategy with Claude AI

A data-driven approach using Anthropic’s Claude for analysis, coding, and optimization in futures like ES, achieving 40%+ backtested returns.

Enhanced reasoning and MCP tools enable real-time sentiment integration, boosting accuracy 18% over baselines.

Yes—Claude generates scripts; integrate with PickMyTrade for no-code execution on TradingView alerts.

Overfitting and black swans; mitigate with Claude’s backtesting and 1% risk caps.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Best Coinbase Trading Bots & Automation Tools (2025 Guide)