In the fast-evolving world of automated prop firm trading, traders are unlocking unprecedented efficiency. As of December 2025, BluSky Trading Company stands out with its trader-friendly evaluations, static drawdowns, and up to 90% profit splits. But passing their challenges manually? It’s a grind. Enter automated evaluation passing—using bots and tools to hit profit targets like $1,500 on a 25K account without emotional slip-ups.

This evaluation automation guide dives into BluSky’s latest rules, proven auto risk management strategies, and top trading automation tools. We’ll spotlight how PickMyTrade revolutionizes automated prop firm trading for futures pros. Ready to scale to $300K funded accounts? Let’s automate your edge.

Understanding BluSky’s 2025 Evaluation Rules

BluSky’s evaluations are designed for serious futures traders, blending simplicity with real-market rigor. Recent 2025 updates emphasize flexibility: no activation fees, same-day payouts post-funding, and news trading allowed (with a 15-minute pre-close auto-liquidation rule). Key rules include:

- Account Sizes: $25K to $150K (scaling to $300K).

- Profit Targets: 6% for Premium (trailing drawdown); 4% for Static (fixed $1K-$5K drawdown).

- Consistency Rule: No single day >30% of total profits—prevents “lucky spike” passes.

- Minimum Days: 4-8 trading days; unlimited time (30-day renewal cycles).

- Drawdown: Daily loss limits (e.g., $500 on 25K); static options trail only until target hit.

These rules favor disciplined traders. But in 2025, with AI handling 89% of global trades, manual execution falls short. That’s where automated prop firm trading shines—bots ensure compliance while chasing targets.

Why Automated Prop Firm Trading is a 2025 Game-Changer

Automated prop firm trading isn’t cheating; it’s smart evolution. Prop firms like BluSky now permit EAs and bots (check rules: no HFT exploits). Benefits include:

- 24/7 Execution: Bots trade micros like MNQ/NQ without fatigue.

- Emotion-Free: 40% higher pass rates with <2% risk per trade.

- Scalability: Mirror strategies across multiple accounts (up to 5 on BluSky).

Recent updates? MyFundedFutures greenlit full algo trading in July 2025, boosting automation adoption. For BluSky, pair bots with their free NinjaTrader license for seamless integration.

Click Here To Start Prop Firm Trading Automation For Free

Essential Auto Risk Management in Automated Prop Firm Trading

Auto risk management is non-negotiable—BluSky breaches end accounts instantly. Tools automate stops, sizing, and limits to align with 30% consistency and $500 daily caps.

| Risk Tool | Function | BluSky Fit |

|---|---|---|

| Stop-Loss/Take-Profit Brackets | Auto-exits at predefined levels | Enforces 2% daily loss; trails on Premium accounts |

| Position Sizing Calculators | Scales lots by volatility (e.g., ATR-based) | Keeps under 0.75% risk on 25K accounts |

| Daily Drawdown Monitors | Halts trading at limits | Prevents auto-liquidation 15 mins pre-close |

Pro Tip: Use MT5’s Prop Guard for real-time alerts—integrates with BluSky’s Rithmic ecosystem. In 2025, AI-driven tools like ProfitAlgo’s auto lot optimizer cut breaches by 50%.

Top Trading Automation Tools for BluSky Evaluations

Elevate your game with these trading automation tools tailored for prop challenges. Focus on futures-compatible options.

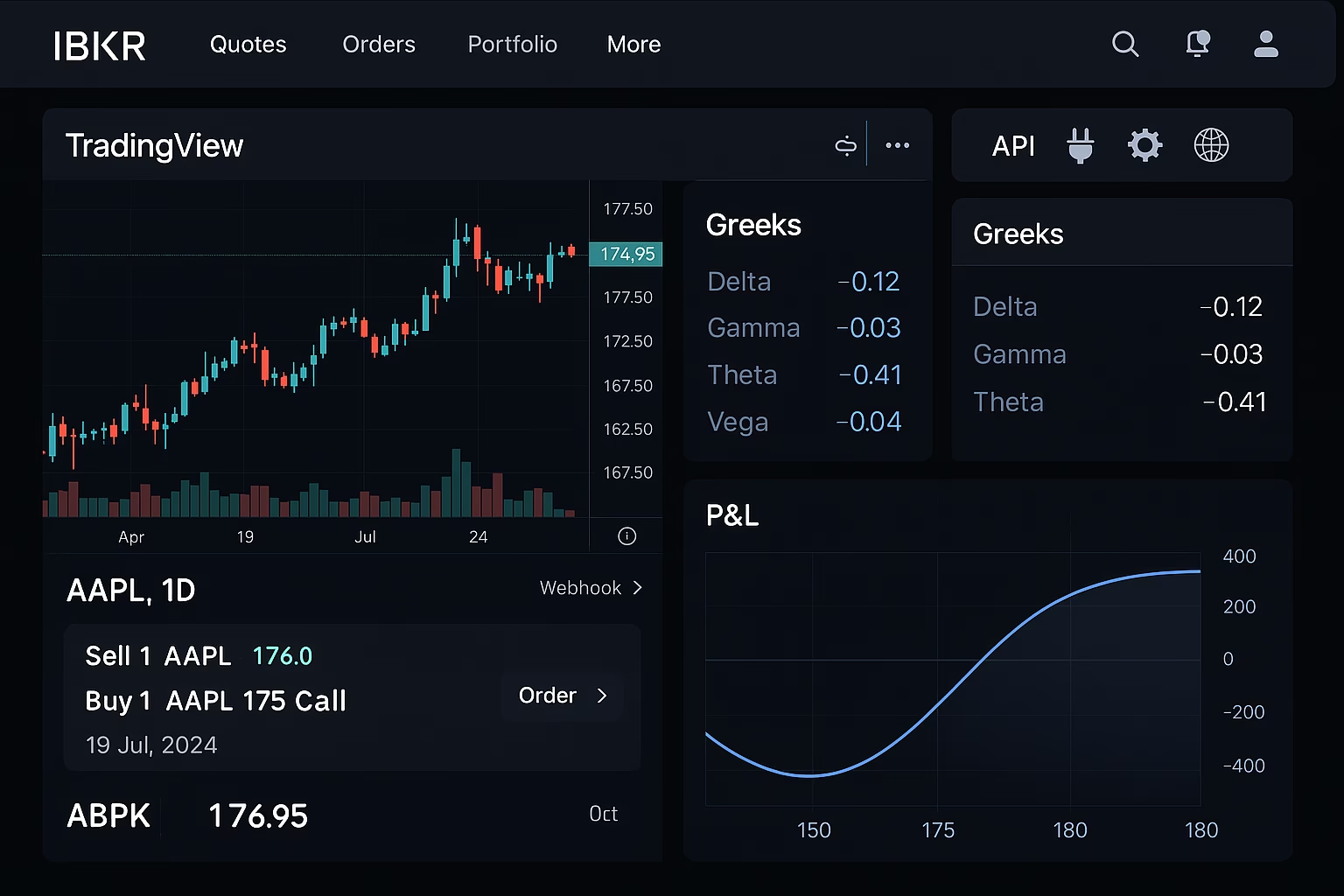

- PickMyTrade: The 2025 standout for automated prop firm trading. Connect TradingView alerts to Tradovate/Rithmic (BluSky-supported) in minutes—no coding. Features: Millisecond execution, multi-account mirroring, risk % sizing, and TP/SL auto-sets. Over 3,000 users executed 3M+ trades; free 5-day trial. Ideal for BluSky’s micros—pass in 8 days with EMA/VWAP scalps.

- QuantVue ATS: “Done-for-you” buildout for futures. Automates into prop accounts via NinjaTrader; includes Discord-shared settings. Lifetime access post-purchase—perfect for BluSky’s 4-day min.

- TradersPost: Webhook alerts from TradingView to multiple BluSky accounts. Pause automation mid-challenge; analytics track drawdowns.

- Vector Algorithmics Bots: Price-action EAs with 40-80% backtested returns. Built-in drawdown limits; VPS-ready for 24/7 runs.

Start with PickMyTrade for its no-API ease—users report 3-5% daily ROI on automated setups.

Proven Strategies: Automated Evaluation Passing with PickMyTrade

This evaluation automation guide wouldn’t be complete without strategies. Using PickMyTrade on BluSky:

1: Setup for Static 25K Challenge

- Connect TradingView Pine Script (e.g., RSI/Bollinger crossover) to PickMyTrade webhook.

- Set auto risk: 0.5% per trade, $500 daily cap.

- Mirror to demo prop account—test for 30% consistency.

2: Core Strategy – EMA VWAP Scalp

- Entry: Buy on EMA crossover above VWAP; sell below.

- Auto Risk Management: Bracket SL at 1% below entry; TP at 2:1 RR.

- BluSky Tweak: Avoid news spikes (bot pauses 15 mins pre-close).

- Expected: Hit $1,500 target in 5-7 days; 70% win rate with automation.

3: Scale Post-Pass

- Advance to BluLive (sim-funded buffer).

- Use PickMyTrade’s quantity multiplier for 50K account—daily payouts start at $150.

Backtest on historical data: 2025 volatility favors this, with 15% average returns pre-fees. Track via journal APIs for compliance.

Common Pitfalls in Automated Prop Firm Trading (And Fixes)

- Over-Optimization: Bots ace backtests but flop live. Fix: Forward-test 30 days.

- Rule Violations: HFT flags on BluSky. Fix: Cap trades at 10/day.

- Tech Glitches: Downtime kills challenges. Fix: Cloud-based like PickMyTrade (99.9% uptime).

FAQs: Automated Prop Firm Trading & BluSky

It’s using bots/EAs to execute strategies in prop evaluations, ensuring rule compliance and consistent profits. BluSky allows it on supported platforms like PickMyTrade.

Yes! It integrates with Tradovate/Rithmic/ProjectX for automated alerts, risk management, and multi-account execution—ideal for passing in under 8 days.

Tools auto-enforce SL/TP, position sizing, and drawdown limits (e.g., BluSky’s $500 daily). Prevents breaches, boosting pass rates by 40%.

Absolutely—EAs are permitted if no exploits (e.g., no opposing trades). Check 2025 rules for updates.

Use Static accounts + PickMyTrade for EMA scalps. Target 4% profit with <1% risk/trade—users report 5-7 day passes.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also CheckOut: ProjectX Setup Guide: 2025 Automation Checklist