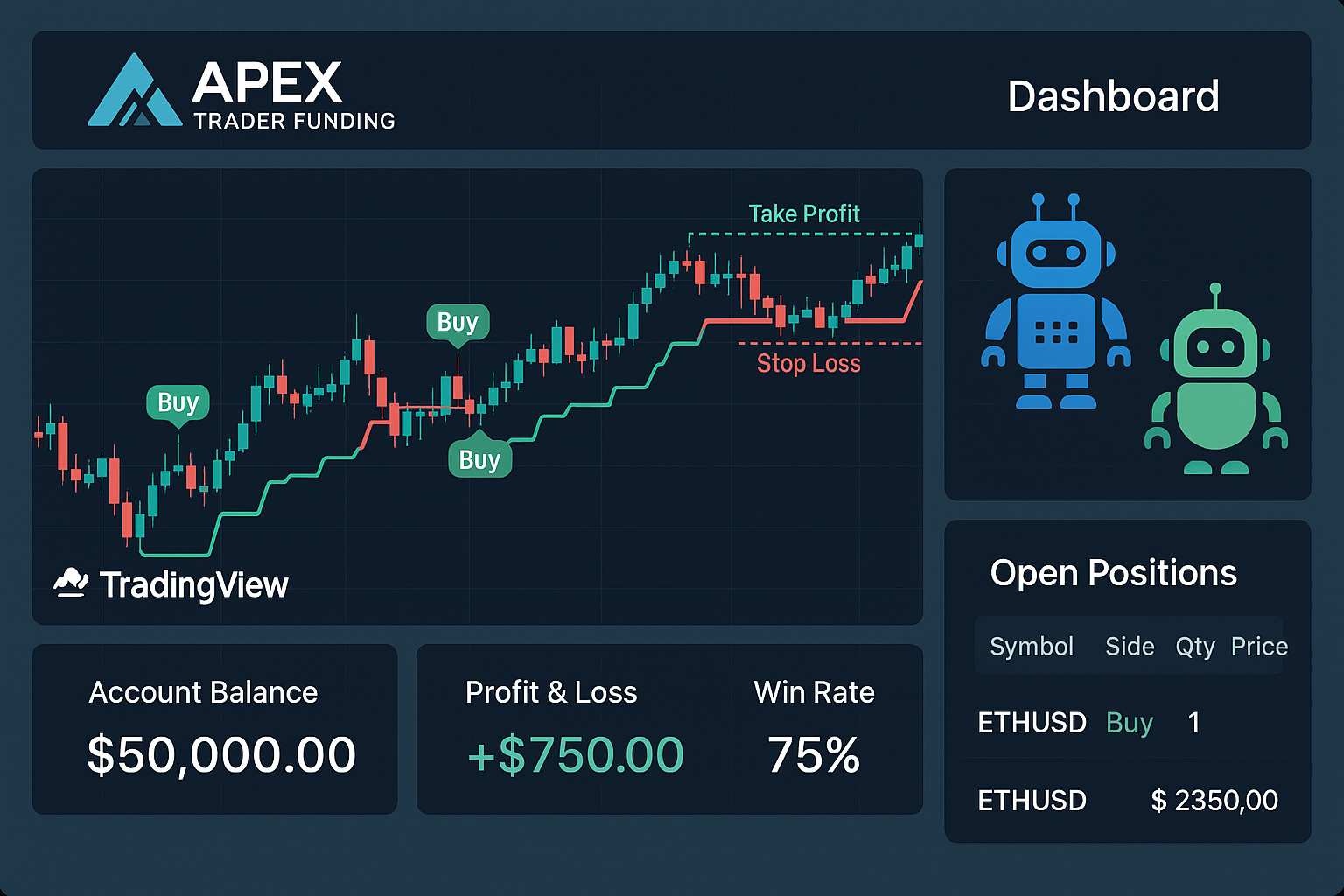

If you’re serious about getting funded by Apex Trader or already using Apex Trader Funding automation, then building a strong trading plan is a must. Success in prop firm trading doesn’t come from luck—it comes from having clear, rule-based strategies that you can automate and trust.

Use Clear Buy and Sell Signals

In automated trading, timing is everything. That’s why indicators like Supertrend are popular—they simplify your entry and exit decisions.

- Buy Signal: Supertrend turns green → your bot places a buy.

- Sell Signal: Supertrend turns red → your bot exits the trade.

When paired with Apex Trader Funding automation, these signals help you meet profit targets while respecting drawdown limits.

Stop-Loss Orders: Risk Control in Automation

Stop-loss orders are critical, especially for Apex evaluations.

- Automatically cut losing trades.

- Avoid breaching daily or max drawdowns.

- Stay within Apex risk rules.

In an automated system, your stop-loss is predefined—no emotion, no second-guessing.

Take-Profit Orders: Secure Your Gains

Profit targets matter just as much as losses. Use take-profit orders to:

- Lock in profits before the market reverses.

- Pass Apex profit targets faster.

- Avoid overtrading or giving gains back.

Your automation logic should always include a take-profit condition.

Why Automation Needs Rules

With Apex Trader Funding automation, emotional trading isn’t an option—you’re either following a system or failing evaluations.

That’s why rule-based logic like:

- Wait for signal

- Set stop-loss

- Set take-profit

- Exit on reversal

…is non-negotiable for passing and scaling Apex accounts.

How to Automate It

Want to automate your trades directly from TradingView?

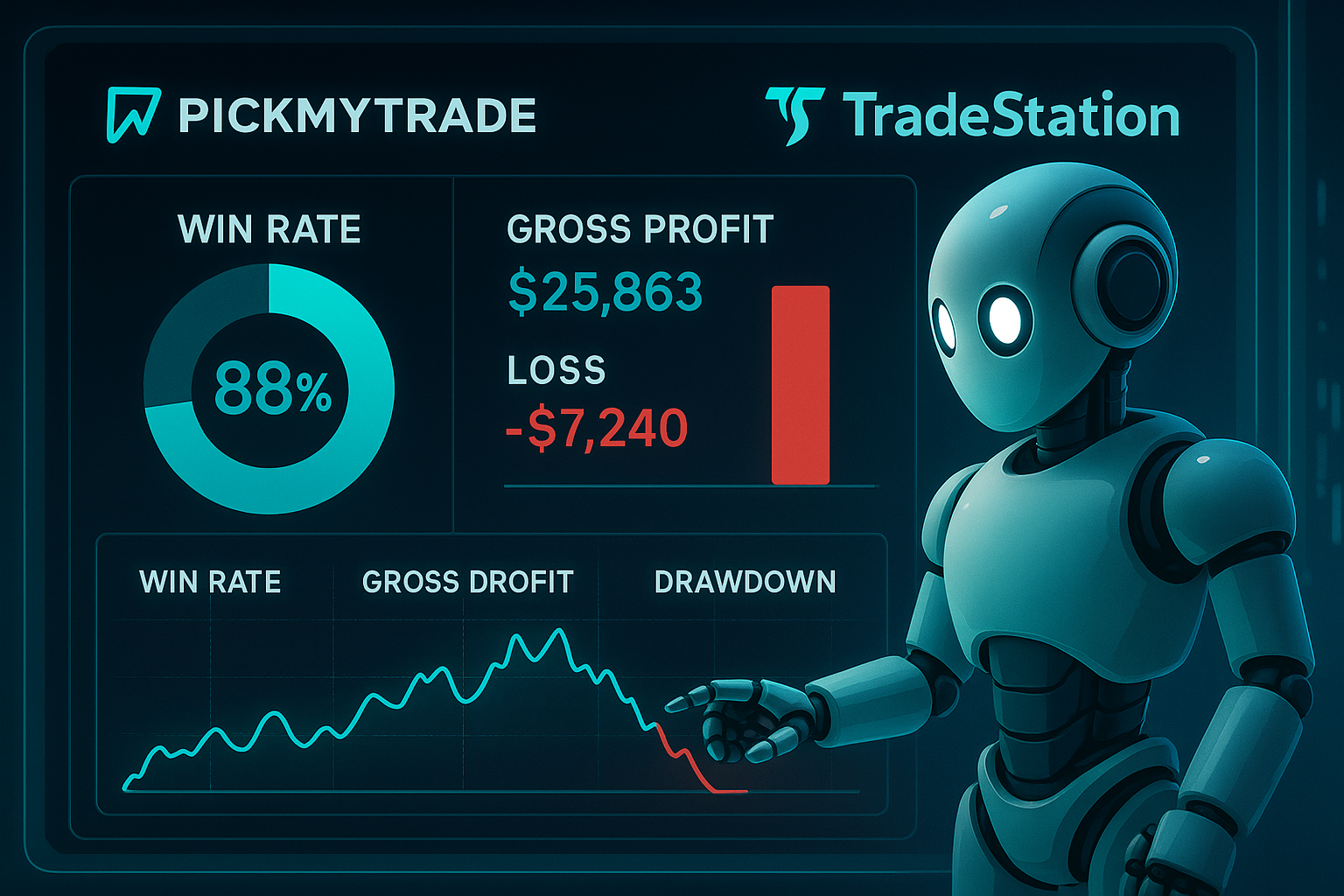

Use platforms like PickMyTrade:

- Tradovate: https://pickmytrade.trade

- IBKR, Rithmic, TradeLocker, TradeStation, ProjectX: https://pickmytrade.io

These tools allow you to turn TradingView alerts into live trades automatically.

Final Thoughts: Trade with Structure

A high win rate isn’t enough. For Apex Trader Funding automation to work, your trading strategy must:

- Use clear entry/exit signals

- Always include stop-loss and take-profit logic

- Follow strict, automated rules

By sticking to these principles, you can trade confidently, pass prop firm evaluations, and scale up faster.

Also Checkout: Master the TradingView Strategy Tester in TradeLocker Automation