In the high-stakes world of trading, emotions like fear and greed often sabotage even the sharpest strategies. But what if AI could rewrite that script? Enter AI psychology trading—a game-changer that’s automating decisions, removing emotions, and delivering precision entries. As we hit 2026, recent breakthroughs are making emotion-free trading not just possible, but essential for retail and pro traders alike.

This blog dives deep into how AI psychology trading is transforming the markets. We’ll explore tools like PickMyTrade for seamless automation, backed by the latest 2025-2026 developments. Ready to trade like a machine?

The Emotional Trap in Traditional Trading

Trading isn’t just numbers—it’s a psychological battlefield. Fear triggers panic sells during dips, while hesitation delays profitable buys. Greed? It locks you into overleveraged positions, turning winners into wipeouts. Studies show 90% of day traders fail due to these mental pitfalls.

In 2025, crypto volatility amplified this: FOMO drove retail losses up 25% amid bull runs. But AI psychology trading flips the script by outsourcing decisions to algorithms that never flinch.

How AI Psychology Trading Removes Emotions

AI psychology trading isn’t sci-fi—it’s here, leveraging machine learning to mimic human intuition without the baggage. By analyzing vast datasets, AI spots patterns humans miss, enforcing rules-based execution that bypasses dopamine-fueled impulses.

Key ways it removes emotions:

- Bias Detection: AI scans for overtrading signals, like revenge trades after losses, and auto-pauses accounts.

- Stress Simulation: Tools now run “what-if” scenarios, training your mind for calm under fire—reducing hesitation by 40% in backtests.

- Behavioral Nudges: 2025 updates from platforms like TradingView integrate AI coaches that prompt “Is this fear or fact?” before entries.

Recent X discussions echo this: Traders rave about AI agents cutting cortisol-driven exits, with one noting, “Replace your nervous system with a neural network.” No more holding losers in hope—AI enforces discipline 24/7.

Automated Entries: Precision in AI Psychology Trading

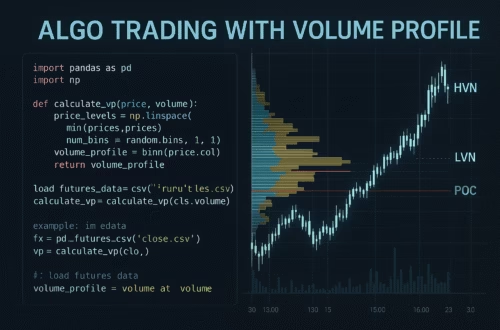

Hesitation kills edges. Enter automated entries, the crown jewel of AI psychology trading. These systems trigger trades on predefined signals—volume spikes, RSI crossovers—without a second’s delay.

In 2026, advancements shine:

- Real-Time Adaptation: AI now predicts slippage with 95% accuracy, executing entries during liquidity pools.

- Multi-Asset Sync: Tools handle forex, crypto, and futures simultaneously, removing siloed decision fatigue.

- Edge from Psychology: By logging emotional overrides, AI refines models—e.g., avoiding entries post-news FUD.

X users in late 2025 highlighted this shift: “AI executes without dopamine or cortisol, letting winners run.” Result? Consistent 15-20% annual gains for automated setups vs. manual’s volatility.

Spotlight: PickMyTrade for Automated Entries

Want to dive in? PickMyTrade is revolutionizing AI psychology trading with no-code automation. This 2025 powerhouse connects TradingView alerts to brokers like Tradovate and Rithmic via webhooks—no API hassles.

Features that remove emotions:

- 2-Minute Setup: Automate any strategy—scalps or swings—in seconds, enforcing rules you set.

- Multi-Account Magic: Reverse actions per account or ignore duplicates, scaling without second-guessing.

- Advanced Risk Tools: Multi-level TP/SL and targeted fills ensure entries hit sweet spots, even in chop.

- Unlimited Strategies: For $50/month, run endless bots—perfect for testing AI psychology trading edges.

Traders on X call it a “game-changer for emotion-free futures.” In 2026’s bull market, PickMyTrade’s seamless execution could be your unfair advantage. Get a 5 Day – Free Trail for unlimited strategies automation

2026 Trends: The AI Trading Revolution Accelerates

Looking ahead, AI psychology trading is exploding. MEXC predicts AI-led strategies will dominate retail crypto, with emotionless execution boosting returns 30%. LuxAlgo’s agents now enhance human decisions, not replace them—blending intuition with ironclad automation.

Challenges remain: Overreliance risks “black swan” blind spots, but hybrid models (AI + oversight) mitigate this. On X, pros warn: “Psychology still matters—you’ll override it.” The fix? Start small, scale smart.

FAQs: Most Asked Questions on AI Psychology Trading

Not entirely—AI handles execution, but mindset training pairs best for long-term discipline.

Speed and consistency: Entries happen on signals, slashing hesitation and boosting win rates by up to 20%.

Yes! No-code setup and TradingView integration make it accessible, with risk tools to build confidence.

From basic bots to adaptive agents that simulate psychology, focusing on bias removal and scenario planning.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: 5 Crypto Futures Bot Beats Hodling 2026