In the world of automation of prop firm, many traders chase high win rates believing it’s the key to consistent profits. But is it really? While win rate is important, it’s only one part of a complete trading system. This post will help you understand why relying on win rate alone—especially in automated stock prop firm trading—can lead to failure.

The Win Rate Deception in Automated Trading

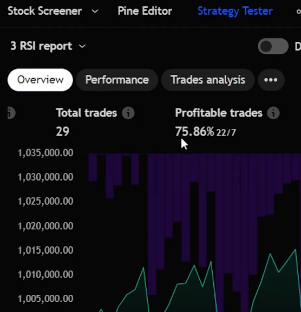

A win rate measures how many of your trades are profitable. For example, if 75 out of 100 trades win, that’s a 75% win rate. Sounds great, right?

But in automated stock trading for prop firms, a high win rate might still result in net losses if those wins are small and the occasional losses are big.

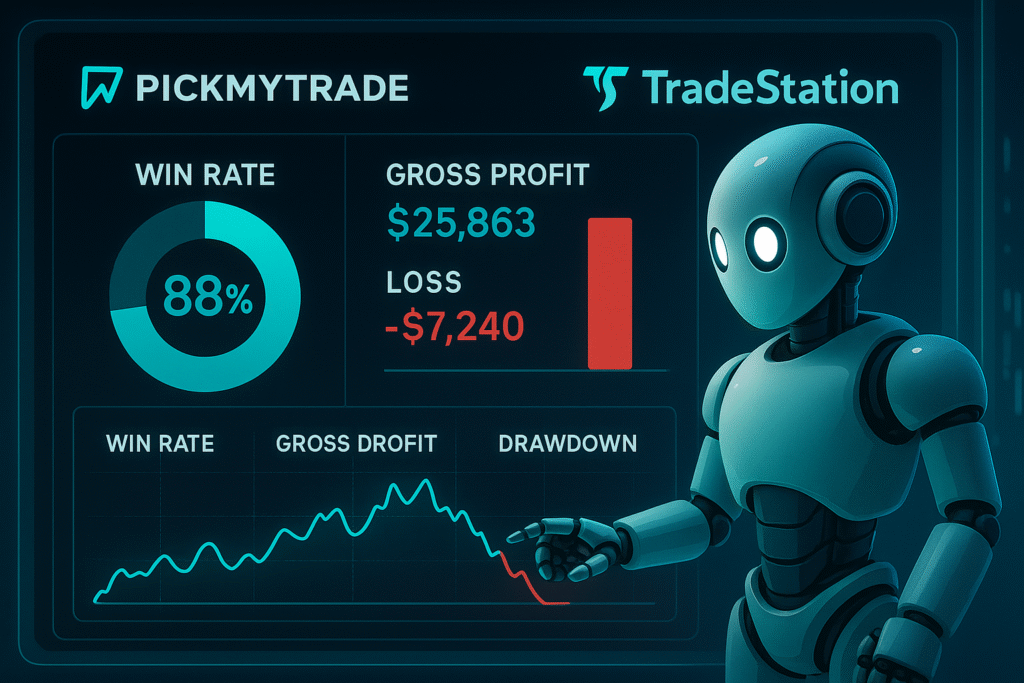

How Big Losses Crush Your Automated Gains

Let’s say your trading bot wins 75% of the time. But if the gross losses from the 25% losing trades are massive, they could erase all your small gains.

Real Example:

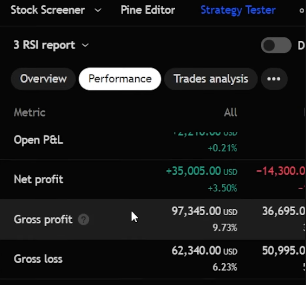

- Gross Profit: $97,000

- Gross Loss: $62,000

- Net Profit: Only $35,000

This proves that a high win rate can still lead to low or negative profits if your risk isn’t controlled—especially in fast-paced stock prop firm automation environments.

One Big Loss Can Kill 10 Wins

Imagine risking $1,000 per trade with a target of $200. You win 9 trades and lose 1.

- Win: 9 × $200 = $1,800

- Loss: 1 × $1,000 = -$1,000

- Net: $800 profit

Now increase the loss to $2,000 or more, and you’re instantly in the red, even with a 90% win rate. That’s the trap traders fall into when focusing only on win rate in prop firm strategies.

What Matters More Than Just Win Rate

If you want to succeed with stock prop firm automation, focus on:

- Risk-Reward Ratio: Aim for trades where you risk $1 to gain $2 or more

- Drawdown: Know how much your account can fall before recovering

- Gross Profit vs Gross Loss: The final profit depends on this balance

- Position Sizing: Proper lot sizing is key in automated strategies

Improve Your Stock Prop Firm Strategy

Use these tips to refine your strategy:

- Set strict stop-losses in your automation tools

- Backtest your strategies on platforms like TradingView

- Use tools like PickMyTrade to automate trade execution for stocks across brokers like Tradovate, TradeStation, and Interactive Brokers

- Review trades weekly to adjust risk or profit targets

Automate with Confidence

When working with stock prop firms, automation saves time and removes emotion. Platforms like PickMyTrade help you connect strategies directly from TradingView to your prop firm broker.

But no matter how smart the bot is—bad risk management will lead to bad results.

Final Thoughts

A high win rate doesn’t guarantee success—especially in stock prop firm automation. Understand the full picture: risk, reward, drawdown, and trade sizing. Only then can you develop a sustainable and scalable trading system.

Also Checkout: Alpha Trader Firm: Your 2025 Trading Adventure Awaits!