Trading is full of risk—but with the right tools, you can make smarter decisions. One powerful tool every trader should use is the TradingView Strategy Tester. And when combined with Tradelocker automation bot, you can test, refine, and automatically execute your strategies—all in one seamless workflow.

What Is the TradingView Strategy Tester?

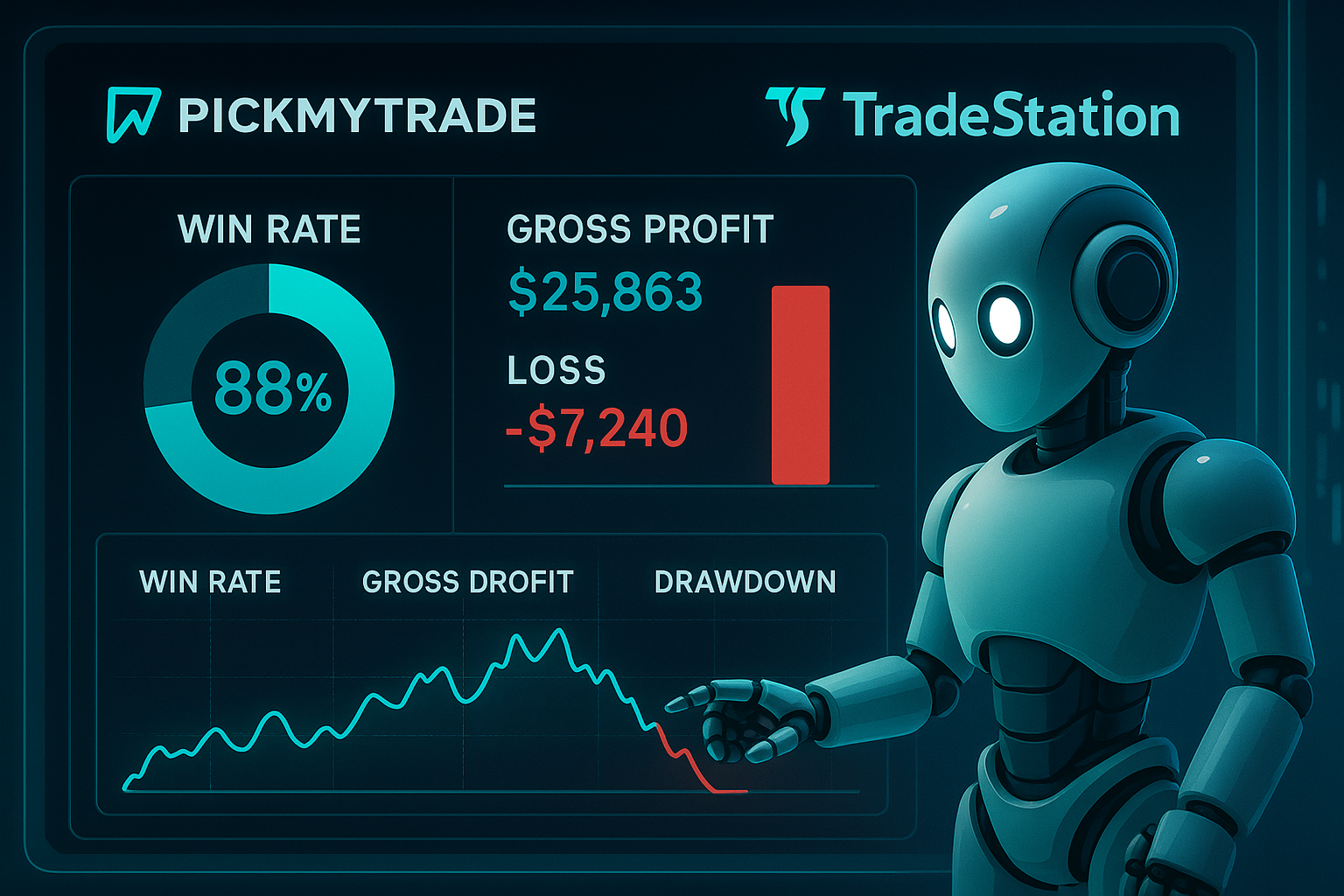

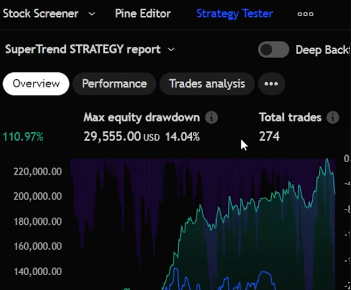

The Strategy Tester in TradingView lets you backtest trading strategies using historical market data. It gives you insights like:

- Win Rate: How often your trades would have won

- Total Profit: How much you could have made

- Drawdown: The worst-case loss scenario

- Number of Trades: How many trades the strategy executed

This data helps you tweak your plan before risking real money—a huge advantage for serious traders.

Why Combine Strategy Testing with Tradelocker Automation?

Testing your ideas is great, but executing them automatically is where the real edge lies. With Tradelocker automation, you can:

- Run your backtested TradingView strategies in real markets

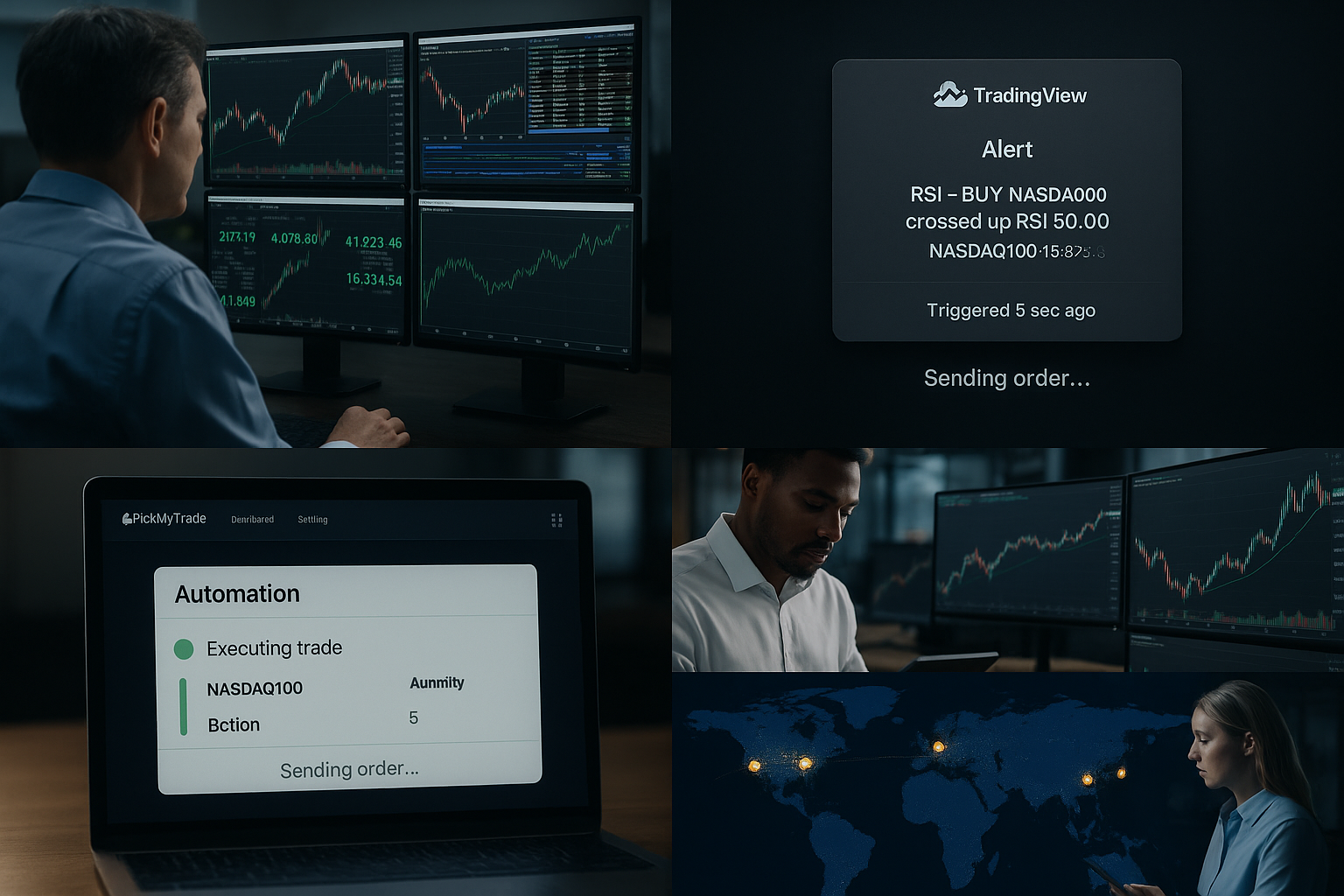

- Use alerts to trigger real-time trades via platforms like PickMyTrade

- Connect directly to brokers like Tradelocker, Tradovate, Interactive Brokers, TradeStation, and Rithmic

This setup ensures your trading plan is not just well-tested—it’s executed with precision.

How to Use the Strategy Tester in TradingView

Here’s how to get started:

- Open TradingView and click the Strategy Tester tab

- Load or write a Pine Script strategy

- Select a time range (days, weeks, months)

- Analyze the results: Look at win rate, drawdown, profit

- Tweak and retest: Make improvements and run again

- Connect to Tradelocker automation using PickMyTrade for seamless execution

What Metrics Matter Most?

When reviewing your test results, focus on:

- Profit: Did the strategy earn money over time?

- Win Rate: A good win rate shows consistency

- Drawdown: Lower drawdown means lower risk

- Sample Size: More trades = more reliable data

These key stats help you refine and build confidence in your strategy.

Tips to Improve Your Strategy Testing

Want to get better results from the Strategy Tester?

- Test Longer Periods: More data = better results

- Try Multiple Markets: See how your strategy performs across forex, crypto, stocks, etc.

- Be Realistic: No strategy wins 100%—account for losses

- Stay Educated: Markets evolve—keep learning and adapting

Automate Your Trading with Tradelocker

Once your strategy is solid, automate it with Tradelocker automation:

- Send TradingView alerts via PickMyTrade

- Execute trades on Tradelocker automatically

- Minimize emotional errors and stick to your plan

- Save time while maximizing consistency

Tradelocker automation makes it easier to scale your strategy—especially for day traders or prop firm account holders.

Conclusion

The TradingView Strategy Tester is your first step to smart, data-driven trading. Combine it with Tradelocker automation, and you can test, tweak, and automate your trades without stress.

Ready to trade smarter and faster?

Use the Strategy Tester and automate with Tradelocker today—because successful trading starts with a proven plan and precision execution.

Also Read: VIX Trading Made Easy: Spot Market Fear with IBKR Automation