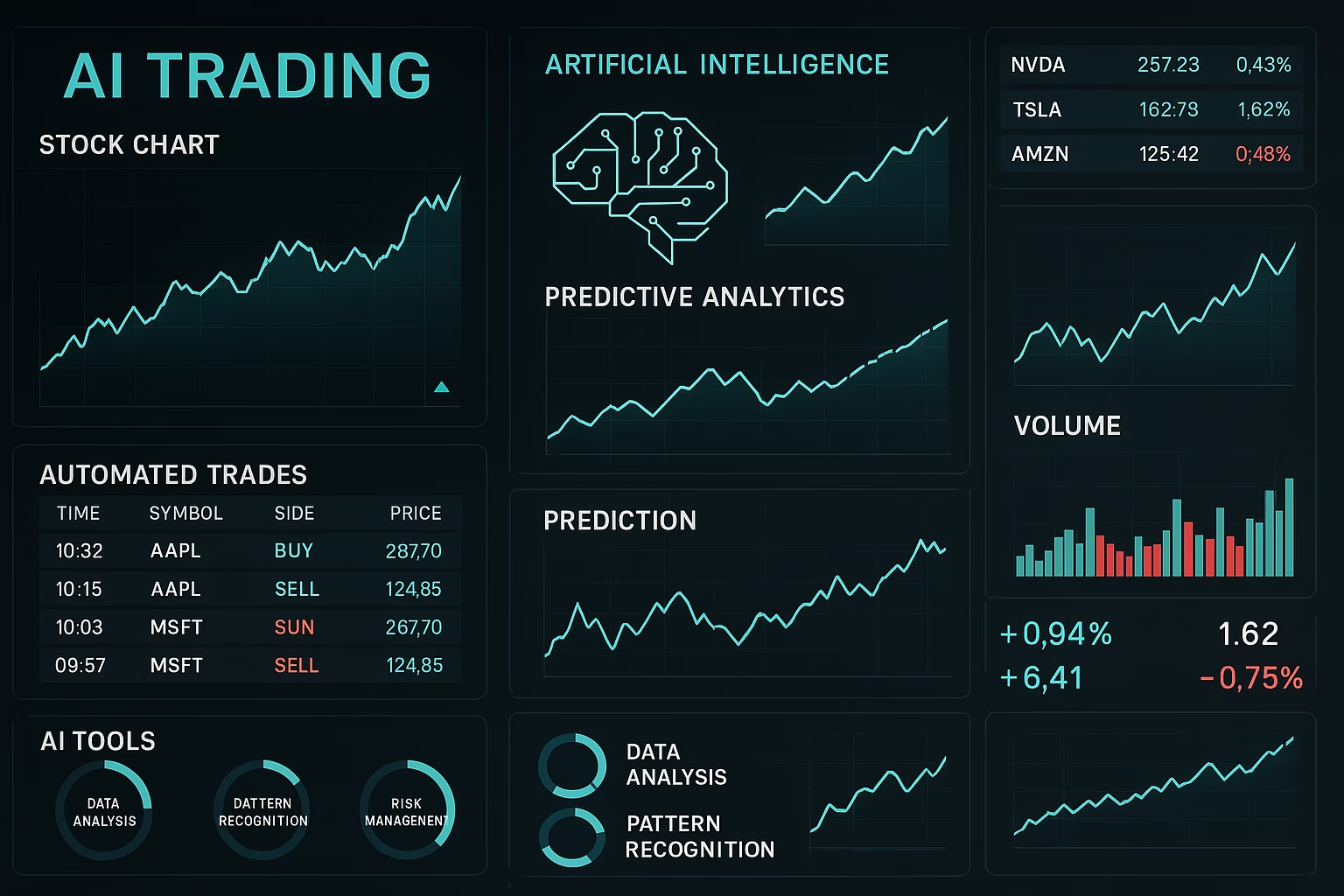

AI tools for trading leverage artificial intelligence and machine learning to analyze market data, automate trades, and provide predictive insights. These tools help investors—from beginners to experts—make informed, data-driven decisions across asset classes like stocks, options, and commodities.

Key features include:

- Data Analysis: Quickly process large datasets for smarter insights

- Automation: Execute trades based on pre-defined algorithms

- Predictive Analytics: Forecast market trends and identify opportunities

By integrating AI tools, traders gain a competitive edge through faster, more accurate, and consistent decision-making.

Key Benefits of Using AI Tools for Trading

AI tools bring multiple advantages to modern investors:

- Enhanced Data Processing – Handle vast market datasets efficiently

- Error Reduction – Minimize emotional and human mistakes through automation

- Consistency – Maintain disciplined, strategy-driven trading

- Personalization – Tailor strategies to your risk profile and investment goals

These tools enable investors to optimize portfolios, react faster to market changes, and improve overall trading performance.

Top AI Tools for Investment Research and Analysis

Investment research has been transformed by AI. These tools provide real-time insights, uncover patterns, and predict market movements with high accuracy.

Popular AI research and analysis tools include:

- Sentiment Analysis Platforms: Gauge market sentiment from news and social media

- Pattern Recognition Software: Detect historical trends and opportunities

- Predictive Analytics Solutions: Forecast future price movements and market volatility

For stock traders, bond investors, and real estate enthusiasts, AI research tools help identify opportunities quickly and make data-driven decisions.

Best AI Trading Bots and Automated Trading Solutions

AI trading bots are revolutionizing the execution of trades by operating 24/7, with precision, speed, and minimal human error.

Key features of AI trading bots:

- Algorithmic Trading: Execute trades based on advanced strategies

- Backtesting: Test strategies on historical data before going live

- Dynamic Risk Management: Monitor and adjust risk levels in real-time

PickMyTrade automation can integrate seamlessly with AI tools, allowing you to convert TradingView alerts into automated trades on platforms like Interactive Brokers, Rithmic, ProjectX, TradeStation & TradeLocker. This synergy enhances execution speed and reduces emotional trading errors.

Click Here To Start Stock Trading Automation For Free

AI Tools for Real Estate and Investment Banking

AI’s impact goes beyond stocks and trading. In real estate, AI tools evaluate properties, predict market trends, and optimize investment decisions. In investment banking, AI enhances data analysis, risk assessment, and opportunity detection.

Benefits include:

- Accurate property and asset valuations

- Comprehensive risk assessments

- Market trend forecasting for strategic decisions

These AI tools enable smarter decision-making, operational efficiency, and long-term strategic planning.

How to Choose the Right AI Tool for Trading

Selecting the right AI tool is critical for investment success.

Consider these factors:

- Features: Ensure it matches your trading goals (automation, analysis, or portfolio management)

- Ease of Use: User-friendly interfaces reduce errors and improve adoption

- Integration: Works with existing platforms like TradingView or brokerage accounts

Thorough research and comparisons will help you select AI tools for trading that align with your strategies and risk appetite.

Future Trends in AI Trading Tools

The evolution of AI tools for trading promises smarter, faster, and more secure investment strategies.

Emerging trends include:

- Personalized AI Solutions: Tailored to individual trader needs

- Enhanced Real-Time Data Processing: Faster insights and execution

- Blockchain Integration: Improved security, transparency, and verification

Staying updated on these trends ensures traders leverage AI effectively and maintain a competitive edge.

Conclusion: Smarter Investing with AI

AI tools for trading are transforming financial markets by combining automation, predictive analytics, and efficient decision-making. Incorporating platforms like PickMyTrade can further optimize execution and minimize human error, allowing traders to focus on strategy and analysis.

By leveraging AI, investors can enhance their trading performance, make data-driven decisions, and stay ahead in 2025’s dynamic markets.

FAQs

Q1: What are the best AI tools for trading in 2025?

A: Tools that combine predictive analytics, algorithmic execution, and portfolio management, such as PickMyTrade for automation and TradingView AI integrations, are highly recommended.

Q2: Can AI trading bots outperform human traders?

A: Yes, AI bots can execute faster, analyze more data, and minimize emotional bias, often outperforming manual trading in specific strategies.

Q3: Is PickMyTrade compatible with AI trading strategies?

A: Yes, PickMyTrade can automate trades based on AI-generated signals from TradingView or other platforms.

Q4: How do AI tools help reduce trading risks?

A: They use algorithmic strategies, backtesting, and dynamic risk management to minimize losses and optimize risk-reward ratios.

Q5: Are AI tools suitable for beginner traders?

A: Yes, AI tools simplify decision-making and automate execution, making them accessible for both novices and experienced traders.

Also Checkout: AMD Stock: Overview & Why It’s Making Headlines in 2025