Trade Like a Pro Using PickMyTrade.io and ProjectX Charts

Want to make better trading decisions with less stress and more consistency? Mastering support and resistance levels is essential — especially when combined with tools for automated stock trading like PickMyTrade.io, which supports Rithmic and advanced charting through ProjectX.

This guide will teach you how to identify and trade key support and resistance zones — and how to automate entries and exits using these powerful concepts.

What Are Support and Resistance Levels?

Understanding support and resistance is the foundation of successful trading — whether you’re scalping indices, trading futures, or automating stock trades.

- Support is a price level where buying interest is strong enough to stop a price decline. Think of it as a floor.

- Resistance is where selling pressure typically halts price advances. Think of it as a ceiling.

These levels are watched by institutional traders and are often where the market reverses. With platforms like PickMyTrade.io, you can automatically execute trades when these key levels are touched — no more missed entries.

Finding Strong Support Levels in ProjectX Charts

Support levels are areas where the market has bounced multiple times, indicating buyer strength.

Here’s how to spot them:

- Use ProjectX charting or TradingView to look at historical price movements.

- Find zones where price has repeatedly bounced upward.

- Mark those zones as support

You can automate this entire setup using PickMyTrade.io, which lets you send orders via Rithmic when price re-enters a marked level or according to your strategy.

Finding Strong Resistance Levels in ProjectX Charts

Resistance occurs where the price has failed to break above multiple times — a zone where sellers dominate.

To find them:

- Use ProjectX charts or your preferred analysis tool.

- Identify price levels that the market has rejected at least twice.

- Mark these levels as resistance zones.

Risk Management Is Key

Whether manual or automated, risk management separates pros from beginners:

- Always set a stop loss to protect your capital.

- Aim for a minimum 2:1 risk-reward ratio.

- Never risk more than 1–2% of your capital on a single trade.

Tools like PickMyTrade.io make this simple — you can predefine your SL/TP levels, automate them, and let the bot handle the rest.

Automate Your Support & Resistance Trades

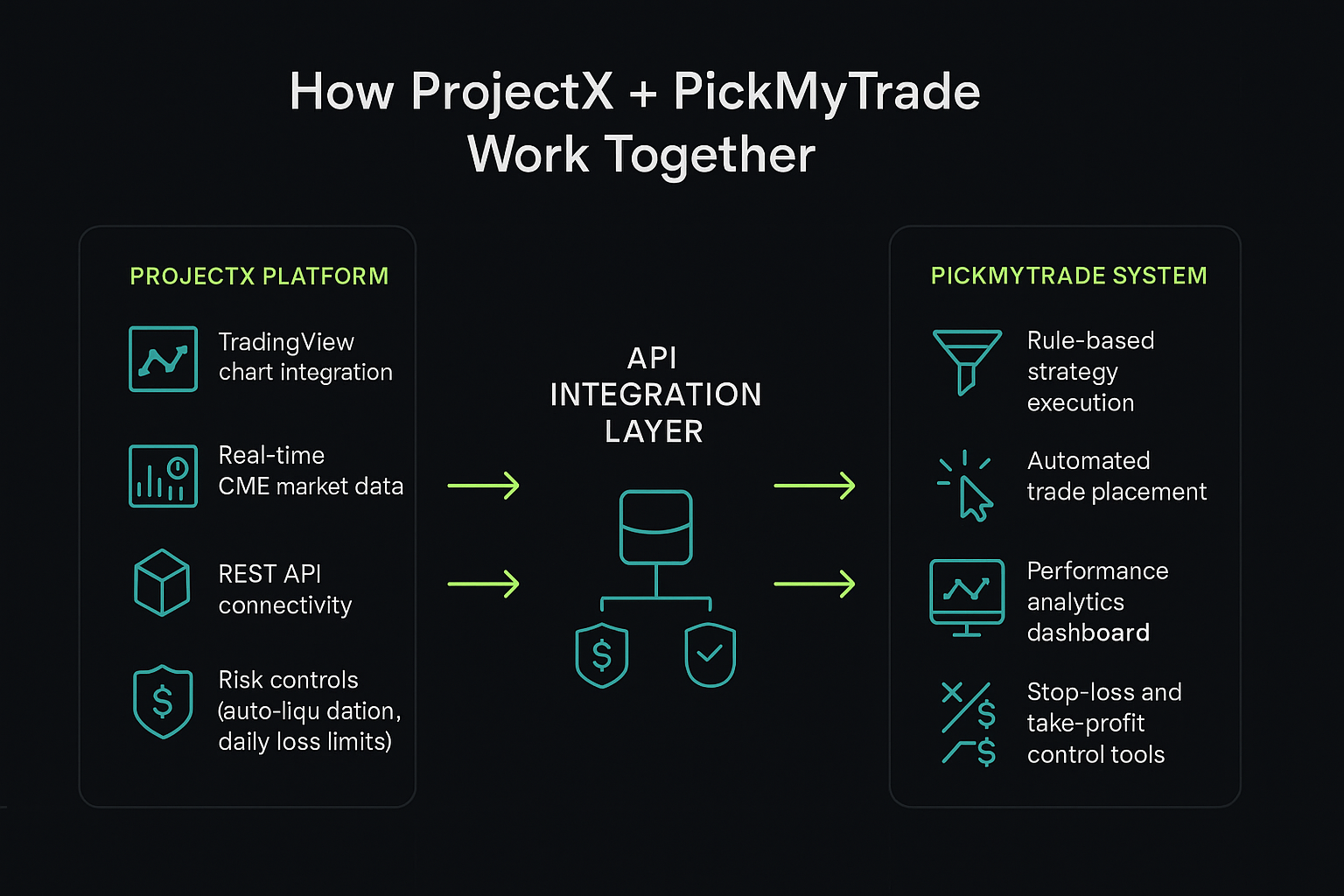

Automating your trades at support and resistance zones lets you remove emotion and trade with precision. Here’s how PickMyTrade.io helps:

- Compatible with brokers using Rithmic connection

- Use ProjectX charts or TradingView for analysis

- Auto-execute orders based on marked support/resistance zones

- Set SL/TP based on zone structure and volatility

- Monitor trade health with real-time updates

This is automated stock trading simplified — from your analysis to your broker’s execution.

Why Use PickMyTrade.io?

Whether you’re a beginner or experienced trader, PickMyTrade.io makes it easy to:

- Trade US indices, futures, and stocks automatically

- Set rules for supply/demand or support/resistance levels

- Connect directly with Rithmic-supported brokers

- Eliminate emotion from trade execution

And all this happens without coding, making it ideal for traders who just want to trade smarter, not harder.

Final Thoughts

Support and resistance trading is one of the most time-tested strategies in the market. When combined with automated execution via PickMyTrade.io, it becomes a powerful, repeatable edge.

If you’re ready to scale your trading or eliminate manual errors, start using these key levels with automated stock trading tools like PickMyTrade.io and take advantage of ProjectX charting and Rithmic connectivity.

🔗 Ready to Automate Your Trading?

Start using support and resistance zones with automation today. Visit PickMyTrade.io to get started — and take control of your trades like a pro.

Also Checkout: Demystifying ProjectX: The Engine Behind Prop Firm Automation