Rithmic remains one of the top choices for low-latency futures trading in 2025, powering platforms for prop firms and retail traders alike. However, many experience rithmic latency issues that cause futures fills to differ dramatically between simulation and real execution. These “secrets” often lead to frustration—strategies that crush in sim falter live due to hidden delays, slippage, or queue positioning.

This guide uncovers the core reasons behind inconsistent futures fills on Rithmic, backed by recent trader reports and 2025 updates. We’ll explore physical limits, network factors, and practical fixes to bridge the sim-live gap.

Why Rithmic Latency Causes Different Futures Fills Live

The main culprit for varying real execution? Latency isn’t constant—it spikes under pressure.

- Physical Distance and Speed of Light Limits: CME servers sit in Chicago (Aurora data center). Traders far away face inherent delays. For example, Seattle adds 14-18ms round-trip; New York about 12ms; Europe 100-150ms. Even optimized setups can’t beat physics.

- Network and Server Queueing: During high volume (like opens or news), Rithmic processes bursts of orders. Slower connections queue behind faster ones, adding milliseconds that compound at the exchange. Trader reports from 2024-2025 highlight spikes to 250ms+ on standard VPS, versus 4ms on co-located.

- Platform and Configuration Overheads: Tools like NinjaTrader or Sierra Chart can introduce delays if not tuned. Aggregated quotes cap updates at 4/second for stability but lag in fast markets. Unaggregated floods data, overwhelming local machines.

Recent 2025 integrations (e.g., with YourPropFirm) and server-side copy trading aim to stabilize, but core rithmic latency persists in volatile conditions.

Sim vs Live: The Hidden Gap in Real Execution

Simulation feels perfect—no slippage, instant fills. Live trading exposes reality:

- No Real Queue or Slippage in Sim: Sim assumes ideal fills at touched prices. Live orders join the actual FIFO queue; faster traders front-run you by microseconds.

- Latency Not Fully Simulated: Many sim environments add minimal artificial delay, missing real-world bursts. Orders that “fill perfectly” in backtests/sim get partial fills or worse prices live.

- Fill Confirmation Delays: Live acknowledgments route back through networks; sim skips this. Traders report delayed confirmations, creating uncertainty in fast markets.

This explains why high-win-rate sim strategies drop sharply in real execution—rithmic latency amplifies market realities.

Minimizing Rithmic Latency for Better Futures Fills

Traders achieve sub-5ms averages with optimizations:

- Use Co-Located VPS: Chicago/Aurora servers (e.g., QuantVPS at 0.5ms) slash ping dramatically versus home connections.

- Direct/Plugin Modes: Avoid multi-hop setups; enable plugin for shared connections without extra fees.

- Tune Your Setup: Disable aggregated quotes for raw speed (handle the data flood). Pin CPUs, minimize background processes.

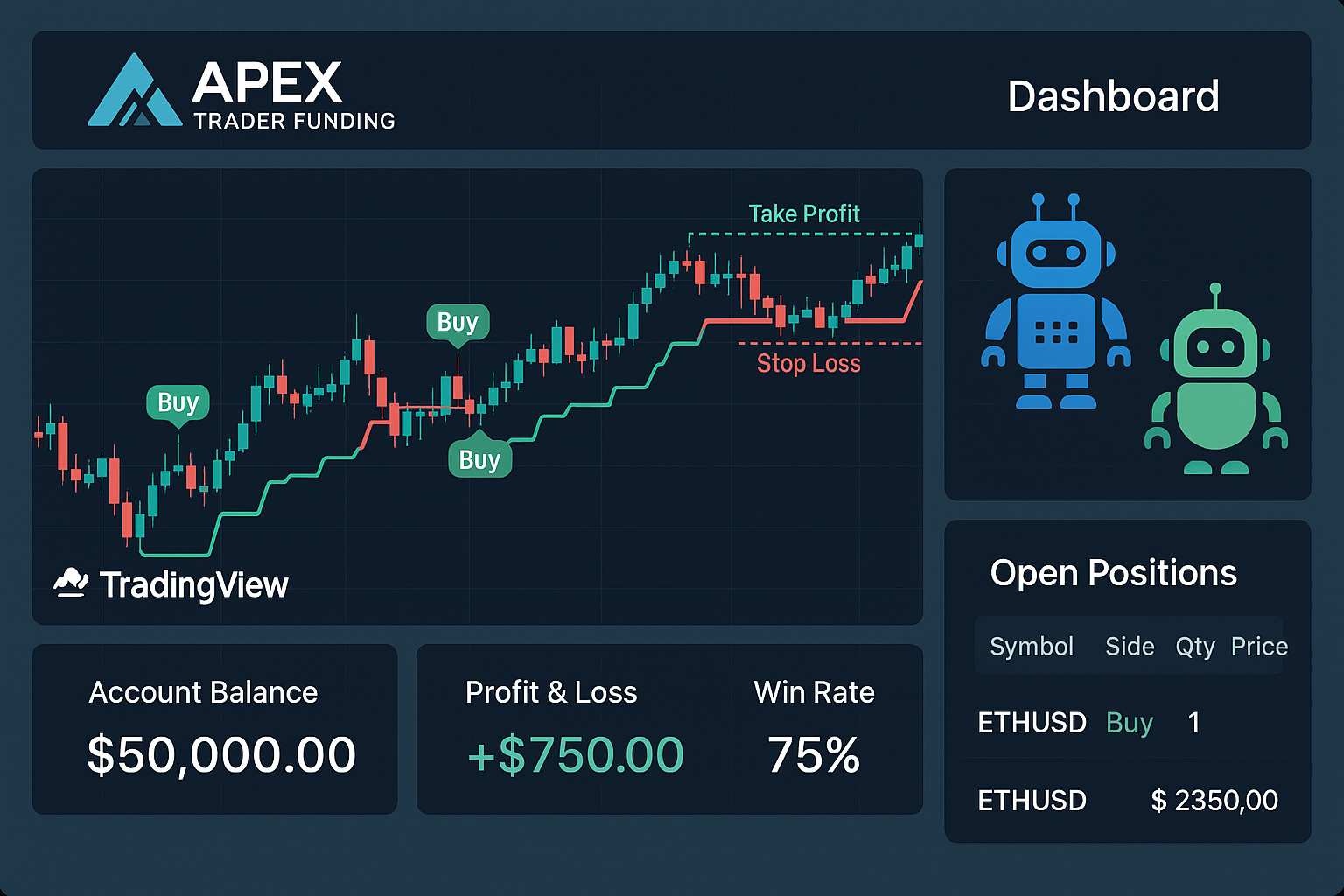

- Automate Smartly for Consistent Real Execution: No-code tools bridge charting and execution seamlessly.

PickMyTrade excels here—connect TradingView alerts directly to Rithmic for millisecond-precision automation. It supports live/demo accounts, advanced risk (SL/TP by ticks/%), and multi-account scaling. Traders report reliable futures fills even in volatility, bypassing manual delays. Start with their free trial for automated real execution without coding.

Click Here To Start Futures Trading Automation For Free

2025 Rithmic Updates and Outlook

Rithmic rolled out server-side copy trading, mobile/web enhancements, and prop firm integrations (e.g., YourPropFirm). No major latency overhauls announced, but infrastructure scales better with volume. Alternatives like CQG or dxFeed gain traction for analytics, yet Rithmic leads in raw speed for scalpers.

Most Asked FAQs on Rithmic Latency and Futures Fills

Live includes real queueing, slippage, and variable latency—sim idealizes these.

Hugely—co-located VPS drops to <1ms; remote can hit 100ms+.

Yes for futures execution, especially co-located; spikes occur in bursts.

Yes—tools like PickMyTrade execute TradingView signals instantly on Rithmic, minimizing human/network delays.

Switch to unaggregated quotes, use low-ping VPS, or check broker settings.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Automated Prop Firm Trading: Pass BluSky Challenges Fast