In the high-stakes world of futures trading, where every millisecond counts, Rithmic integration has become a game-changer for traders seeking speed, reliability, and automation. Whether you’re a seasoned prop trader or an algo enthusiast, mastering Rithmic integration with futures automation tools can unlock low-latency execution that keeps you ahead of market swings. As we dive into 2025’s updates, we’ll explore how these advancements, including seamless low latency trading setups, are revolutionizing the landscape—and how platforms like PickMyTrade are making it accessible without the coding hassle.

What Is Rithmic Integration and Why It Matters for Modern Traders

At its core, Rithmic integration refers to connecting Rithmic’s robust trade execution platform to your trading ecosystem. Rithmic, a broker-neutral powerhouse, delivers direct market access (DMA) to major exchanges like CME Group, CBOT, NYMEX, and COMEX. This means real-time quotes, market depth, and order routing with institutional-grade precision—perfect for futures contracts in commodities, indices, or currencies.

Why prioritize Rithmic integration? In volatile 2025 markets, influenced by geopolitical shifts and AI-driven volatility, delays can erase profits. Rithmic’s infrastructure minimizes slippage, supports high-throughput orders, and integrates with tools like NinjaTrader, TradingView, and Excel for custom workflows. For retail and prop traders, it’s the backbone for scaling strategies without building custom servers.

Recent Rithmic Updates: Powering Futures Automation in 2025

2025 has been a banner year for Rithmic, with innovations tailored to futures automation and efficiency. The standout? Rithmic’s server-side copy trading modules, launched February 6, 2025. This feature automates order replication across unlimited accounts on Rithmic’s servers, slashing latency by up to 40% compared to client-side methods. Ideal for introducing brokers (IBs) and prop firms, it ensures precise, reliable duplication—boosting client retention without manual oversight.

Other key updates include:

- Enhanced Platform Compatibility: R | Trader Pro now streams real-time data into Excel for automated signal generation, enabling no-code futures automation via simple formulas.

- YourPropFirm Integration: As of June 30, 2025, prop firms can enable Rithmic directly from their admin panels for ultra-low latency execution and direct exchange access. This turnkey solution launches firms in under 10 days while retaining 100% profits.

- TradingView and Tradovate Synergy: October 2025 guides highlight seamless Rithmic integration with TradingView for charting and Tradovate for orders, complete with redundancy backups.

These updates align with CME’s January 20, 2025, market segment changes, ensuring Rithmic’s continued support for Globex data post-FIX/FAST retirement. Traders report 15% win-rate boosts from automated momentum strategies on these platforms.

The Role of Futures Automation in Rithmic Integration

Futures automation transforms manual trading into a systematic powerhouse. With Rithmic’s R | API+ and R | Diamond API, developers build high-frequency trading (HFT) bots that connect directly to exchange gateways, achieving transit times under 250 microseconds. This is crucial for scalping Micro E-mini futures during events like CPI releases.

Key automation perks:

- Server-Side Orders: Place OCOs, brackets, and trailing stops on Rithmic’s servers for 24/7 execution, even offline.

- Excel-Powered Bots: Stream quotes into spreadsheets for custom indicators, then auto-submit trades—ideal for non-coders.

- Colocation Benefits: For overseas or rural traders, Rithmic’s Chicago-based servers minimize network risks, enhancing futures automation reliability.

In prop environments like Take Profit Trader (updated January 2025 with no daily loss limits for PRO+ accounts), Rithmic enforces rules automatically, supporting up to five accounts across 15 platforms.

Click Here To Start Rithmic Trading Automation For Free

Achieving Low Latency Trading with Rithmic Integration

Low latency trading is Rithmic’s hallmark, powering pros who can’t afford delays. In 2025 benchmarks, Rithmic edges out competitors like CQG with sub-1ms execution for futures algos. Its Diamond Programs™ route orders in microseconds, outperforming aggregated feeds for order flow analysis.

Pro tips for optimizing low latency trading:

- Use VPS like QuantVPS (0.52ms to CME) for automated setups.

- Leverage full market-by-order (MBO) data for depth insights, spotting breakouts 20 ticks early.

- Pair with brokers like AMP Futures for CQG/Rithmic flexibility and clean execution.

Rithmic’s stability shines in high-volume periods, with fewer issues than alternatives for third-party integrations.

Integrating PickMyTrade for Effortless Futures Automation

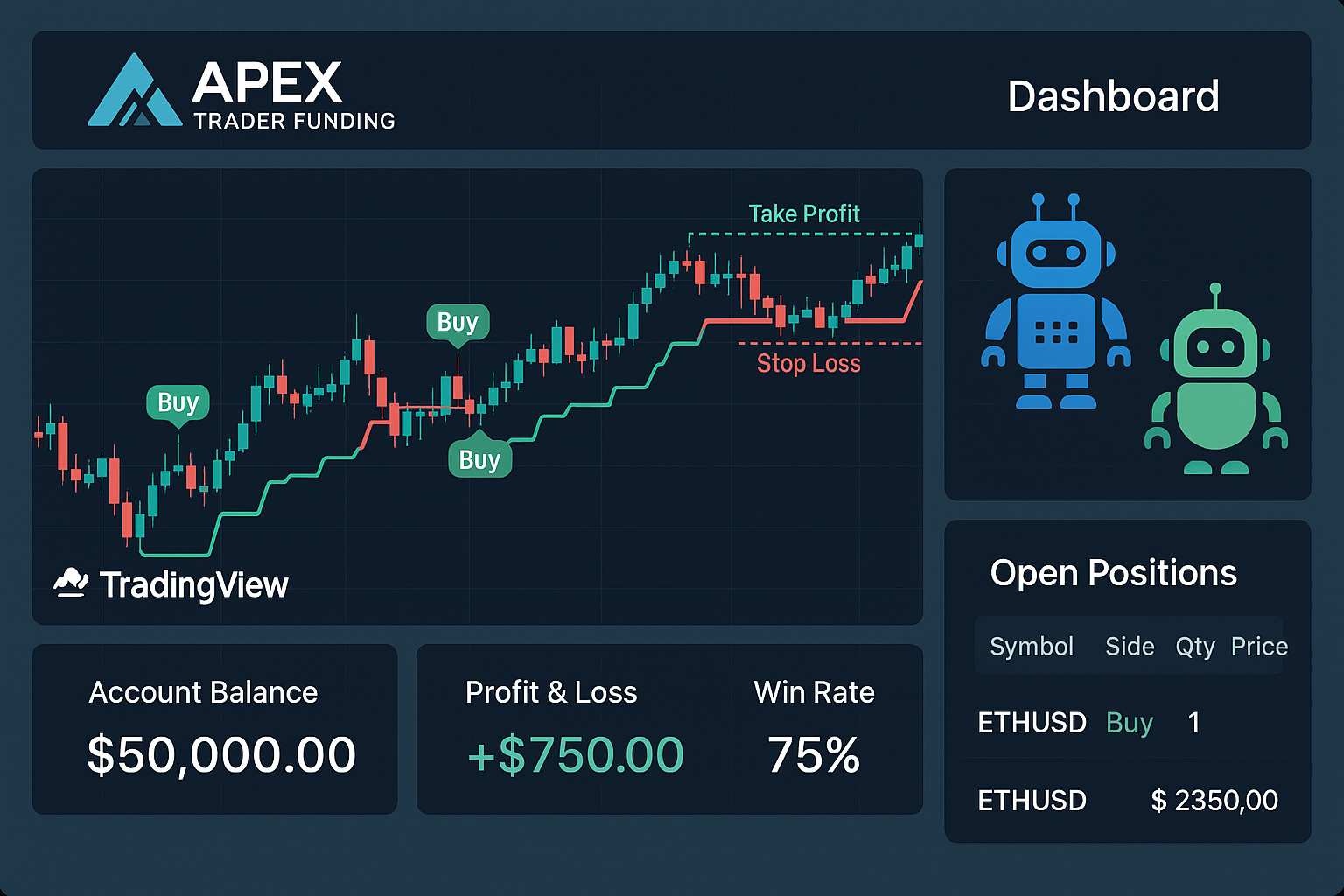

Enter PickMyTrade: the no-code bridge supercharging Rithmic integration with futures automation. This cloud-based tool automates TradingView alerts to Rithmic in under 2 minutes, executing strategies 24/7 with millisecond precision—no API tweaks needed. Over 3,000 traders have executed 3M+ trades via PickMyTrade, linking multiple Rithmic accounts with risk multipliers and auto-sizers.

Why PickMyTrade excels:

- Seamless Setup: Connect Rithmic credentials, set alerts for indicators/strategies, and define stops/profits by ticks or percentage.

- Multi-Broker Power: Handles Rithmic alongside IB, TradeStation, and Tradovate for diversified low latency trading.

- Risk-First Design: Built-in trailing stops and position sizing prevent overexposure, perfect for prop challenges.

A funded trader using PickMyTrade with Rithmic reported consistent fills during NFP volatility, crediting its webhook-free automation. At $50/month for unlimited strategies, it’s a trending must-have for 2025.

Conclusion: Elevate Your Edge with Rithmic Integration Today

Rithmic integration isn’t just tech—it’s your ticket to dominating futures automation and low latency trading in 2025’s dynamic markets. From server-side copy trading to PickMyTrade’s intuitive automation, these tools empower traders to execute with precision and scale effortlessly. Start with Rithmic’s 14-day trial, integrate PickMyTrade for alerts, and watch your strategies thrive. Ready to automate? The markets won’t wait.

Frequently Asked Questions (FAQs) on Rithmic Integration

Rithmic starts at $25/month plus $0.10 per contract routed, with prop firms accessing via platforms like YourPropFirm at no extra build cost.

It automates TradingView alerts to Rithmic without coding, supporting multi-account execution and advanced risk tools for 24/7 trading.

Yes, via user-friendly integrations like TradingView and Excel, though pros benefit most from its HFT APIs.

Key additions include server-side copy trading (Feb 2025) and YourPropFirm enablement (June 2025) for faster prop setups.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Automate Iron Condor: Multi-Leg Options Automation Guide