In the high-stakes world of futures trading, choosing the right API can make or break your bot execution. ProjectX vs Rithmic API debates rage on as traders seek the edge in automation for scalping E-minis or managing prop accounts. With 2025’s latency tweaks and AI integrations, which platform dominates bot execution futures? This guide dives deep, spotlighting speed, ease, and tools like PickMyTrade to automate your edge.

ProjectX vs Rithmic API: A Quick Overview for Futures Traders

Futures bots thrive on precision—low slippage, real-time data, and flawless order routing. Enter ProjectX vs Rithmic API, two powerhouses tailored for prop firms and algo pros.

What Powers the ProjectX API?

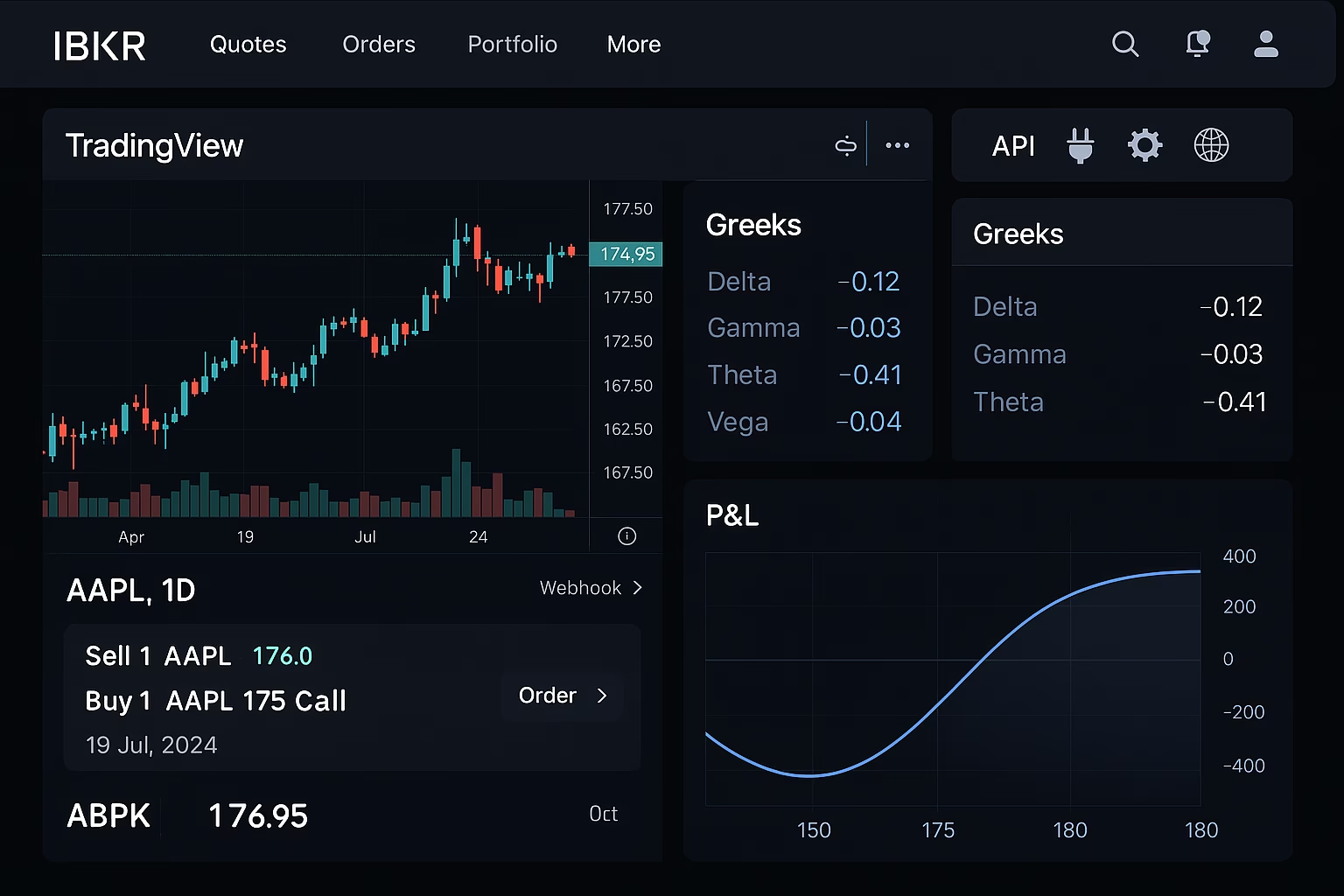

ProjectX, launched as a prop-focused platform, delivers a web-based futures hub with TradingView charts, DOM, and auto-liquidation safeguards. Its API unlocks strategy automation, real-time updates via SignalR, and serverless scaling for multi-account bots. Ideal for DayTrader users, it enforces risk like daily loss locks, curbing emotional trades in volatile bot execution futures.

Unpacking the Rithmic API Edge

Rithmic’s R|API+ shines for low-latency pros, offering microsecond timestamps, unfiltered tick data, and direct exchange gateways. Built for C#/.NET devs, it supports brackets, OCOs, and server-side copy trading—perfect for high-frequency bot execution futures. Prop firms like Apex swear by its reliability for algo-heavy setups.

Bot Execution Futures: What Really Matters in ProjectX vs Rithmic API

Speed kills—or saves—in bot execution futures. Latency under 50ms, slippage below 0.1 ticks, and seamless webhook handling define winners. Both APIs excel, but 2025 benchmarks reveal clear frontrunners.

Speed and Latency: Rithmic’s Raw Power

Rithmic API response is faster than ProjectX, clocking sub-50ms fills in live tests across ES and NQ contracts. Its Diamond API bypasses ticker plants for direct market access, slashing delays by 40% post-2025 optimizations. ProjectX counters with AI-driven routing and cloud caching, hitting 100ms averages—solid for prop bots but trailing in raw velocity.

| Feature | ProjectX API | Rithmic API |

|---|---|---|

| Avg Latency | 80-100ms | <50ms |

| Slippage (ES Futures) | 0.15 ticks | 0.08 ticks |

| Best For | Prop Risk Controls | High-Freq Bots |

Automation Ease: Bridging Gaps with PickMyTrade

Not all setups are API-native. Bulenox’s ProjectX skips direct API access, forcing Rithmic for bots. Enter PickMyTrade: This no-code wizard automates TradingView alerts to ProjectX vs Rithmic API without headaches. For $50/month, it handles unlimited strategies, multi-accounts, and instant execution—3M+ trades automated in 2025 alone. Pair it with Rithmic for millisecond webhooks or ProjectX for risk-enforced scaling. Traders rave: “PickMyTrade turns ideas into profits seamlessly.”

2025 Updates: Fresh Twists in ProjectX vs Rithmic API

Innovation keeps bot execution futures evolving. ProjectX rolled out Trade Clock (Jan 2025) for timed risk blocks and Python SDK v3.3 (Aug 2025) with 50% faster pooling. Rithmic countered with v8.5 API (Q1) for .NET high-speed strategies and server-side copying (Feb), boosting bot replication by 40%. X buzz? Devs hail Rithmic’s futures workflow wins, while ProjectX shines in prop migrations.

Supercharge Bots: PickMyTrade in ProjectX vs Rithmic API

Why wrestle APIs when PickMyTrade automates it all? Connect TradingView MACD crossovers to Rithmic for <50ms fills or ProjectX for auto-liquidation. 2025’s indicator support (RSI, Bollinger) and VPS integration make it a bot builder’s dream—no coding, just profits. Over 3,000 users executed 3M+ trades; join the automation revolution.

Verdict: Which API Rules Bot Execution Futures?

For blistering speed in bot execution futures, Rithmic API takes the crown—its faster responses and low-latency edge crush ProjectX in HFT scenarios. But ProjectX wins prop peace-of-mind with built-in guards. Hybrid tip: Rithmic core + PickMyTrade for ultimate automation. Test in sims, scale with confidence—your bots deserve the best.

Ready to automate? Start your PickMyTrade free trial and level up ProjectX vs Rithmic API today.

FAQs: ProjectX vs Rithmic API for Bot Execution

Yes, Rithmic’s sub-50ms latency outpaces ProjectX’s 80-100ms, ideal for high-speed bot execution futures.

Absolutely—PickMyTrade bridges the gap, enabling seamless bot trades even on API-limited setups like Bulenox

v8.5 adds .NET strategy tools and 40% faster copy trading, boosting bot execution futures efficiency.

Yes, its serverless design handles 100K+ users with AI routing—pair with PickMyTrade for effortless automation.

$50/month for unlimited strategies across platforms—no API hassles, just instant bot execution futures.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: TradingView Webhook Automation for Trading Alerts (2025 Guide)