In the fast-paced world of futures trading, slippage can erode profits and amplify risks. As markets evolve with higher volatility and advanced tech in 2026, mastering futures slippage prevention is crucial for traders. This guide dives into partial fill logic and order splitting as top defenses, backed by recent research and updates. Whether you’re a day trader or managing large positions, these strategies can transform your execution efficiency. We’ll also explore how tools like PickMyTrade automation trading streamline these processes for automated, low-slippage trades.

Understanding Slippage in Futures Trading

Slippage occurs when the executed price of a futures trade differs from the expected price, often due to market volatility, low liquidity, or large order sizes. In futures markets like commodities or indices, even minor delays can lead to significant losses. According to recent studies from QuantVPS and StoneX in 2025, slippage affects up to 30% of high-volume trades during volatile periods, such as economic announcements.

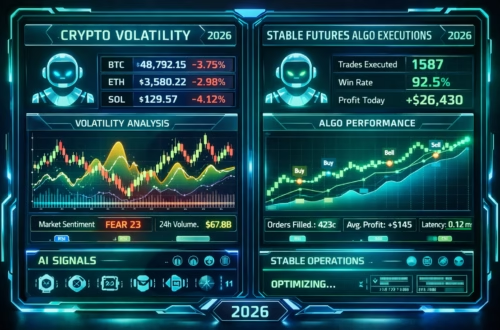

To combat this, futures slippage prevention focuses on smarter order management. Key factors include trading during peak liquidity hours (e.g., U.S. session overlaps) and using advanced order types. With 2026 bringing AI-driven market predictions, slippage risks are rising in automated systems, making proactive strategies essential.

The Power of Partial Fill Logic in Futures Slippage Prevention

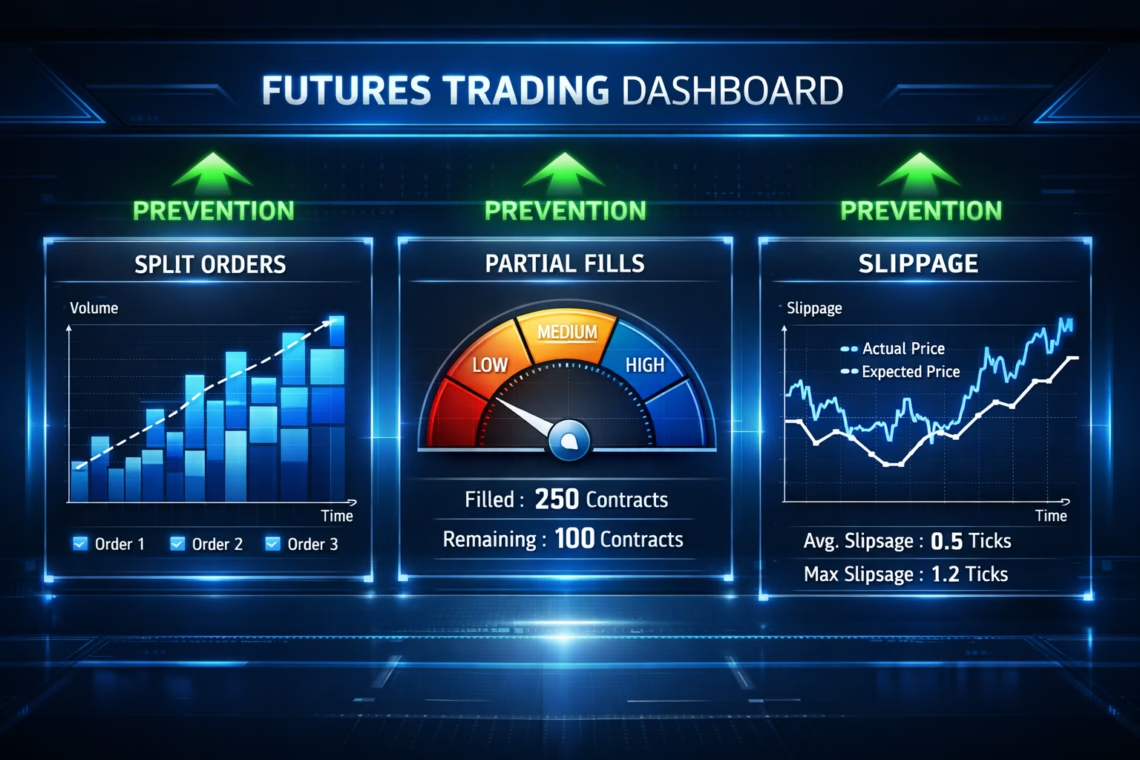

Partial fill logic allows orders to execute in increments rather than all at once, reducing the risk of unfilled trades in illiquid conditions. As explained by Warrior Trading and Investopedia, a partial fill happens when only part of your order matches available liquidity at the desired price, with the remainder pending or canceled based on your settings.

In futures, partial fill logic shines during news events or thin markets. For instance, if you’re entering a 100-contract E-mini S&P 500 position, partial fills might execute 40 contracts at your limit price, then seek the rest without forcing a worse fill. TastyFX and TradeLocker’s 2024-2025 updates highlight how enabling partial fills in platforms prevents “all-or-nothing” rejections, cutting slippage by 15-20% in backtests.

Recent 2026 advancements, per Quadcode’s report, integrate AI to predict partial fill probabilities, optimizing entry points. This logic pairs well with stop-limits, ensuring you don’t chase prices in volatile futures like crude oil or Bitcoin futures.

Order Splitting Strategies: A Key to Futures Slippage Prevention

Order splitting involves dividing large orders into smaller tranches, executed over time or across venues to minimize market impact. AlphaX and Binance Academy note that this strategy avoids “iceberg” effects where big orders move prices against you, common in futures like Nasdaq 100.

Effective order splitting tactics include:

- Time-based splitting: Release portions every few seconds or minutes to blend into natural flow.

- Volume-weighted average price (VWAP): Split based on historical volume, reducing slippage in low-liquidity sessions.

- Randomized splitting: Vary sizes and timings to evade detection by high-frequency traders.

StoneX’s 2025 guide reports that order splitting can slash slippage by 25-40% in prop trading. With 2026 trends from Traders Magazine emphasizing smart order routing (SOR), brokers now use AI to auto-split across exchanges like CME or Eurex, adapting to real-time liquidity.

Combining partial fill logic with order splitting creates a robust defense. For example, split a 500-contract order into five 100-contract lots, each using partial fills for precision.

Recent Advancements in Futures Slippage Prevention for 2026

Trading tech has leaped forward in 2025-2026, with innovations targeting slippage head-on. B2Broker’s analysis shows institutional adoption of crypto-futures hybrids driving low-latency executions, reducing slippage in volatile assets.

Key updates:

- AI and Machine Learning: Platforms now forecast slippage using predictive models, as per NewYorkCityServers’ 2026 forex strategies. This helps in preemptive order splitting.

- Smart Order Routing (SOR): Fintatech’s 2025 report details SOR optimizing paths to minimize delays, integrated in brokers like Interactive Brokers.

- Co-location and Cloud Execution: QuantVPS recommends server co-location near exchanges, cutting latency to microseconds and enhancing partial fill logic.

- Regulatory Shifts: ESMA’s 2025-2026 transparency rules push for better reporting, aiding slippage tracking in EU futures.

These advancements make futures slippage prevention more accessible, especially for retail traders via automated tools.

Leveraging PickMyTrade Automation Trading for Slippage Control

For hands-off implementation, PickMyTrade automation trading stands out. This platform connects TradingView strategies to brokers like Tradovate, Rithmic, and Interactive Brokers, enabling seamless automation of partial fill logic and order splitting. As detailed in PickMyTrade’s 2025 docs, users can set up bots to split orders based on alerts, executing futures trades 24/7 without manual intervention.

PickMyTrade’s no-API setup supports multi-account management, ideal for scaling strategies while minimizing slippage. In 2026, its integration with AI indicators from TradingView enhances prediction accuracy, making it a go-to for futures traders seeking efficiency. Get a 5-day free trial now

Conclusion: Mastering Futures Slippage Prevention Today

By embracing partial fill logic, order splitting, and cutting-edge tools like PickMyTrade automation trading, you can shield your futures trades from slippage pitfalls. As 2026 markets grow more dynamic, these strategies ensure precision and profitability. Stay informed, test in sim mode, and adapt to liquidity shifts for trading success.

Frequently Asked Questions (FAQs)

Slippage arises from market volatility, low liquidity, or large orders moving prices. High-impact news like Fed announcements often exacerbates it.

It allows incremental executions, ensuring parts of your order fill at desired prices without rejecting the whole due to insufficient liquidity.

Yes, especially in less liquid ones like agricultural futures, but it’s most beneficial for high-volume traders to avoid price impacts.

Absolutely—PickMyTrade automates strategies with built-in splitting and partial fills, executing trades faster than manual methods.

It varies; under 1-2 ticks in liquid markets like E-mini S&P is typical, but can spike to 5+ during volatility without prevention strategies.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Maximize Backtest Dataset Accuracy in 2026