In 2025, automated trading has become essential for crypto investors who want to operate efficiently in a 24/7 market. Coinbase now offers one of the strongest automation ecosystems through its coinbase advanced trade API, native AI-agent tools, and integrations with top bot platforms like 3Commas and Bitsgap. Recent updates—including the February 2025 legacy API key expiration, October’s scaled order types, and 1inch Swap API integration—make coinbase api trading tutorial setups easier and more secure.

This guide covers the best crypto bot for beginners, ai crypto trading bots, and automated crypto strategies available on Coinbase. You’ll learn how to connect tradingview to coinbase, deploy Coinbase AI agents, and implement crypto bot backtesting while addressing risks like API rate limits. For secure, signal-driven execution, we’ll highlight PickMyTrade integration. All info is current as of November 2025, with step-by-step Coinbase automation setup guide elements and disclaimers for safe trading.

Disclaimer: Crypto trading involves high risk. Bots don’t guarantee profits; always use risk management and consult professionals. This isn’t financial advice.

Why Automate Trading on Coinbase in 2025?

Coinbase’s coinbase algorithmic trading tools shine with 550+ markets, including 237 USDC pairs, and low fees (0.05% for high-volume traders). The Advanced Trade API supports WebSocket feeds for real-time data, while Coinbase AI agents via AgentKit enable autonomous onchain actions like swaps and staking. In Q3 2025, AI agent transactions surged 10,000%, driven by tools like Based Agent for 3-minute setups.

Benefits of crypto automation: Reduces emotional decisions, captures 24/7 opportunities, and scales strategies. However, outages (e.g., October 20 AWS issue) and rate limits (10 req/sec) require safeguards. Is Coinbase API safe? Yes—with trade-only keys, IP allowed listing, and 2FA. Legacy keys expired February 5, 2025; migrate via CDP for granular access.

Top Crypto Trading Bots for Coinbase in 2025

We’ve evaluated crypto trading bots 2025 based on Coinbase integration, backtesting, and user reviews (Trustpilot/X averages). All connect via API; focus on best Coinbase bots for beginners 2025 with no-code options.

| Bot | Key Features | Pricing (2025) | Pros | Cons | Ideal For |

|---|---|---|---|---|---|

| 3Commas | DCA, GRID, Signal bots; crypto bot backtesting; TradingView integration | $22–$99/mo | Easy Smart Trades; 4.7/5 rating | Needs tweaks for signals | Swing traders |

| Bitsgap | GRID, BTD, Arbitrage; AI-assisted | $29–$149/mo | Strong volatility tools; demo mode | Higher fees for futures | Scalpers |

| TradeSanta | Long/Short, Basic AI signals; Presets | Free–$25/mo | Beginner-friendly; Mobile alerts | Limited metrics | Newbies |

| GoodCrypto | DCA, GRID; 35-exchange support | $10–$50/mo | Low-stress automation | Fewer advanced AI | Passive investors |

| Altrady | QFL signals, GRID; Backtesting up to 1 month | $15–$60/mo | Real-time signals | Signal-dependent | Signal followers |

Click Here To Start Crypto Trading Automation For Free

3Commas: Best Overall for Automated Crypto Strategies

How it Works: Link Coinbase API for DCA (buy dips) or GRID (range trading). Backtest on historical data; set trailing stops.

Pricing: Starter $22/mo (unlimited bots).

Pros: No-code; how to connect tradingview to coinbase via alerts.

Cons: Manual adjustments needed for volatile 2025 markets.

Risk Factors: Slippage in high-volume; test in sandbox.

Ideal for: Intermediate users building coinbase api trading tutorial flows.

Bitsgap: Top for Volatility Plays

How it Works: GRID bots ladder buys/sells; BTD auto-buys dips. Integrates 1inch for cross-chain swaps (new 2025 Coinbase feature).

Pricing: Basic $29/mo.

Pros: AI arbitrage; secure API-only.

Cons: No free tier beyond demo.

Risk Factors: Over-optimization in backtests; monitor tariffs impacting BTC.

Ideal for: Best Coinbase bots for beginners 2025 in choppy ETH.

TradeSanta: Easiest Entry for AI Crypto Trading Bots

How it Works: Preset bots for long/short; basic AI predicts signals.

Pricing: Free limited; Pro $25/mo.

Pros: Quick setup; 2FA audits.

Cons: Lacks deep crypto bot backtesting.

Risk Factors: Limited customization; pair with manual oversight.

Ideal for: Absolute beginners exploring coinbase algorithmic trading.

Step-by-Step Coinbase API Setup Guide

Follow this Coinbase automation setup guide for secure integration (updated post-February 2025 key changes).

- Generate Keys: Log into Coinbase Advanced Trade > API Settings. Create CDP key (trade/view only; no withdrawals). allowlist IPs; set passphrase.Example: Use TypeScript SDK: npm i coinbase-api (supports ED25519 keys).

- Test in Sandbox: Endpoint: https://api-public.sandbox.exchange.coinbase.com. Place test order:text

curl -X POST "https://api-public.sandbox.exchange.coinbase.com/api/v3/brokerage/orders" \ -H "Authorization: Bearer YOUR_KEY" \ -d '{"client_order_id":"test","product_id":"BTC-USD","side":"buy","order_configuration":{"market_market_ioc":{"base_size":"0.001"}}}'Verify via /accounts balances. - Handle Rate Limits: Coinbase API rate limits explained: 10 req/sec private; use idempotency keys (client_oid) for retries. Monitor via headers.

- Go Live: Switch to production; enable WebSockets for feeds (wss://ws-feed.exchange.coinbase.com).

Coinbase AI Agents: Deploying Autonomous Tools in 2025

Coinbase AI agents via AgentKit and Based Agent enable how to deploy Coinbase AI agents for onchain tasks—swaps, staking, tipping—without prompts. March 2025’s OpenAI SDK support adds tools like web search; October’s Payments MCP integrates wallets/stablecoins for agentic commerce.

Quick Deployment Guide

- Fork Based Agent on Replit; add OpenAI key.

- Integrate CDP SDK for wallet actions (e.g., USDC swaps via 1inch).

- Test: Prompt “Swap 10 USDC for ETH on Base.” Pros: Model-agnostic (Claude/Llama); LangChain compatible. Cons: Hallucination risks; audit logs essential. Risk Factors: 80% of 2025 blockchain txns predicted AI-driven—volatility amplifies errors. Ideal for: DeFi yield farmers.

Automating Crypto Trades with PickMyTrade (TradingView → Crypto)

PickMyTrade provides a fast, reliable way to convert TradingView alerts into live Crypto orders. This is especially useful for traders who rely on signals, pattern alerts, or indicator-based entries and want consistent execution without manual intervention.

How it Works:

- Connect your tradelocker API keys (trade-only permissions).

- Create a TradingView alert with your entry/exit conditions (e.g., RSI<30 buy).

- Paste the custom PickMyTrade generated alert code & webhook URL.

- The alert triggers a Coinbase market or limit order within milliseconds.

- Optional: Add automated stop-loss or take-profit rules (1:2 RR).

Use Cases:

- RSI-based entries for BTC dips.

- Indicator breakouts on ETH.

- Structure-based bots (CHoCH/SMC).

- Multi-account trading across USDC pairs.

- Hybrid GRID + DCA automation.

For traders who prefer automation, PickMyTrade supports to manage positions or execute tasks using TradingView signals as triggers. $49/month; 5-day free trial.

Risk Factors: Webhook delays during outages; always backtest.

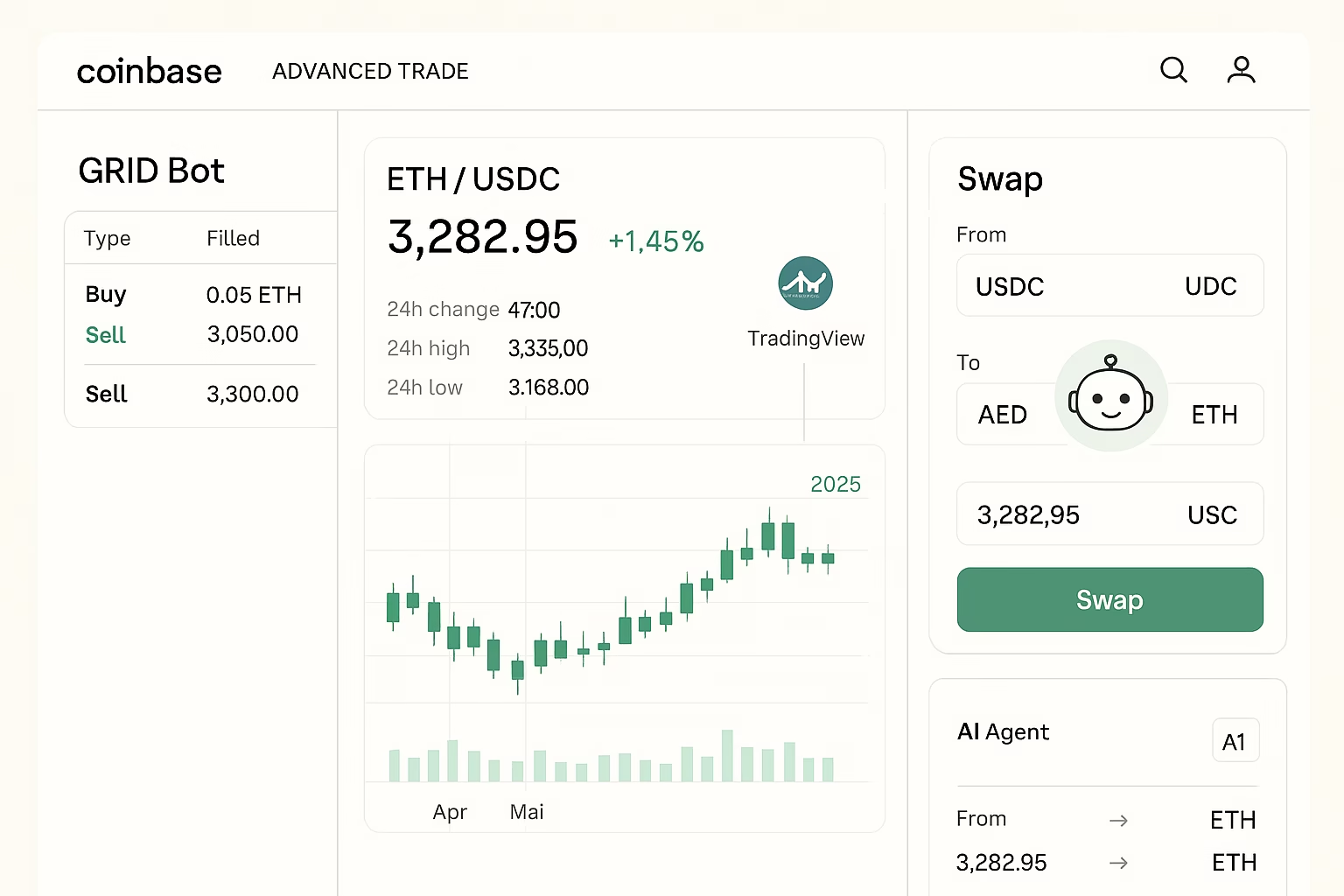

Coinbase GRID Bot: A Simple Automated Crypto Strategies Example

Coinbase’s native GRID (launched April 2025) automates range trading on coinbase advanced trade.

Setup Steps:

- Select ETH-USD; allocate $1K.

- Set 10 levels, 2% spacing (buy low, sell high).

- Enable trailing for trends.

Example: In sideways ETH ($2,500–$2,700), nets 20–40% via ladders.

Pros: No extra fees (0.6% taker).

Cons: Fails in breakouts; combine with AI signals.

Risk Factors: Slippage in volatility; Coinbase API rate limits explained apply.

Risks of Coinbase Bot Trading: What to Watch in 2025

- Exchange Outages: AWS issues (Oct 20) halted APIs—use multi-exchange backups.

- API Limits/Slippage: 10 req/sec; high-volume causes delays.

- Market/Regulatory: Tariffs impact BTC; audit for compliance.

- Security: Rotate keys quarterly; enable alerts.

Mitigate with sandbox testing and diversified bots.

FAQs: Common Questions on Coinbase Trading Automation

Yes—with trade-only API keys and 2FA. Migrate from legacy keys (expired Feb 2025); tools like 3Commas audit access. Always test in sandbox.

TradeSanta—free tier, presets for DCA/GRID. Start with $100; backtest first.

Use Based Agent template: Fork on Replit, add keys, prompt for swaps. Supports Claude/OpenAI.

1inch integration for swaps; scaled orders in API.

10 req/sec private; use client_oid for idempotency. Exceed? Throttle with sleeps.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Best Trading Signals 2025: Top Providers & High-Accuracy Alerts