Why predicting the future crypto market matters

The phrase future crypto captures the idea of not just tracking current price moves, but anticipating the next leg of growth or decline in cryptocurrency markets. Given the 24/7 nature of crypto, high volatility, and rapid innovation in tokens, tools that help forecast future crypto trends can give traders and investors a real edge. However, “prediction” is never certain—it’s about increasing probability, not guaranteeing outcomes.

Categories of tools to predict future crypto trends

Technical & chart-analysis tools

These help you identify patterns, momentum shifts, support/resistance breaks, trend reversals. Think of platforms you might already use for stocks or forex, but applied to crypto.

On-chain & network-data tools

These look under the hood of blockchains—tracking wallet behaviour, flows into exchanges, miner activity, active addresses—to give signals for future crypto momentum. For example:

- Glassnode offers deep on-chain intelligence across Bitcoin, Ethereum and other chains.

- CryptoQuant provides a broad set of on-chain + derivative-market metrics for actionable insight.

- Santiment blends on-chain, social and development data to help dig into what the market may be anticipating.

Sentiment & social-data tools

These gauge crowd behaviour, hype cycles, large wallet moves (“whales”), social media volume—important for future crypto trends because much of crypto’s price moves are sentiment-driven.

AI & forecasting tools

Platforms now use machine learning, large data sets and predictive analytics to estimate future moves in crypto. For example:

- Token Metrics uses AI to analyse thousands of tokens for momentum and fundamentals.

- Prediction markets or Web3 markets (e.g., Polymarket, Augur) aggregate collective wisdom for future outcomes.

Top tools to predict future crypto trends (2025 edition)

1. Glassnode – for deep on-chain insights

Glassnode delivers market-moving analytics: active addresses, HODLer behaviour, supply concentration, etc. These metrics help you infer future crypto momentum (e.g., if large holders stop selling).

Why use it: Helps see the “invisible” side of markets—where big money is moving.

Limitations: On-chain data is lagging relative to price in some cases; needs interpretation.

2. CryptoQuant – holistic data platform for market signals

CryptoQuant offers pre-built charts, APIs, and customisable metrics such as exchange flows, miner revenue, derivatives data.

Why use it: Combines multiple data types (exchange, chain, derivatives) for richer signals.

Limitations: Complexity can be high; you’ll need to learn which metrics matter for your strategy.

3. Santiment – social + development + on-chain blend

Good for seeing future crypto trends driven by community momentum, dev activity, social hype.

Why use it: Especially relevant for altcoins or tokens where sentiment drives moves.

Limitations: Social data can be noisy or manipulated; treat signals carefully.

Click Here To Start Futures Crypto Automation Trading For Free

4. Token Metrics – AI-powered forecasting engine

Token Metrics uses AI to scan thousands of tokens for long-term and short-term signals.

Why use it: If you want algorithmic support or guidance in scanning many tokens.

Limitations: AI forecasts are only as good as their model/data; no guarantee of accuracy.

5. Prediction markets & Web3 event tools

Platforms like Polymarket or Augur allow you to gauge collective market beliefs about future crypto price or events.

Why use it: Provides an alternate viewpoint—what the crowd expects might show future crypto direction.

Limitations: Liquidity may be low; markets may be influenced by arbitrage or bias.

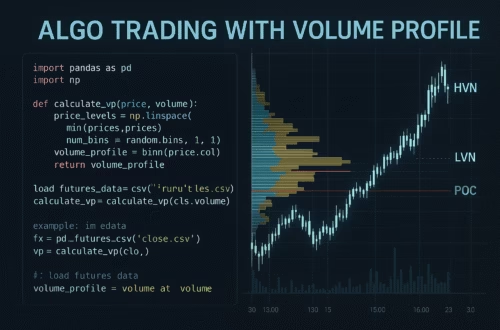

How to integrate “future crypto” forecasting with automation (via PickMyTrade)

As someone using automation tools (like PickMyTrade) for execution, you can link forecasting tools to your workflow:

- Use a platform like Glassnode or CryptoQuant to generate signal triggers when on-chain thresholds hit (e.g., large inflow into exchange).

- Use Token Metrics (or similar) to validate token outlook before entering automation.

- Feed signal + validation into PickMyTrade: when criteria for “future crypto trend” are met, execute trade, set stop-loss/take-profit, log results.

- Build fallback logic: if sentiment drops or a signal is reversed, automation closes/trims position.

- Backtest your entire flow: forecasting tool → trigger → automated execution via PickMyTrade, to refine performance.

By combining forecasting tools + automation, you shift from reactive to proactive. You’re not just waiting for price to move; you’re programming the system to act on anticipated movement.

Best practices & pitfalls when predicting future crypto trends

- Always diversify signals: don’t rely solely on social hype or AI predictions. Combine technical, on-chain and sentiment.

- Time-horizon matters: short-term vs long-term trends require different tools and thresholds.

- Understand data delays: some on-chain metrics lag; sentiment may lead but also reverse quickly.

- Don’t ignore risk management: forecasting doesn’t remove risk; use stop-loss, position sizing, automation checks.

- Beware of over-optimization: automation plus forecasting can create complex systems—keep them transparent and monitor performance regularly.

Key takeaways

- Predicting future crypto trends is viable but complex: best done via layered tools (on-chain, sentiment, AI).

- Platforms like Glassnode, CryptoQuant, Santiment and Token Metrics give you edge data.

- Prediction markets offer a unique collective-wisdom angle.

- Integrating your forecasts with automation (PickMyTrade) turns insight into action.

- Even the best tools are not magic: signal quality, automation discipline and risk control matter most.

FAQ – Most Asked Questions on Predicting Future Crypto Trends

No. Tools improve probability and insight, but crypto remains highly volatile and subject to unexpected events.

Short term: sentiment/social platforms + on-chain flows. Long term: AI forecasting tools (Token Metrics), fundamentals + on-chain supply behaviour.

Set alert/triggers from your forecasting tool → link to PickMyTrade automation engine → execute as per strategy rules with stop-loss/take-profit logic.

They provide an interesting perspective (crowd sentiment) but vary in liquidity and should be one of many tools rather than the only tool.

Useful, especially for altcoins and hype-driven moves, but social data can be manipulated and often reacts faster than fundamentals – so use with caution.

Also Checkout: Algorithmic Trading Systems: Enhance Futures Trading Efficiency