Quick Start Checklist for IBKR Options Automation

- Open an IBKR account and enable API access (paper trading first).

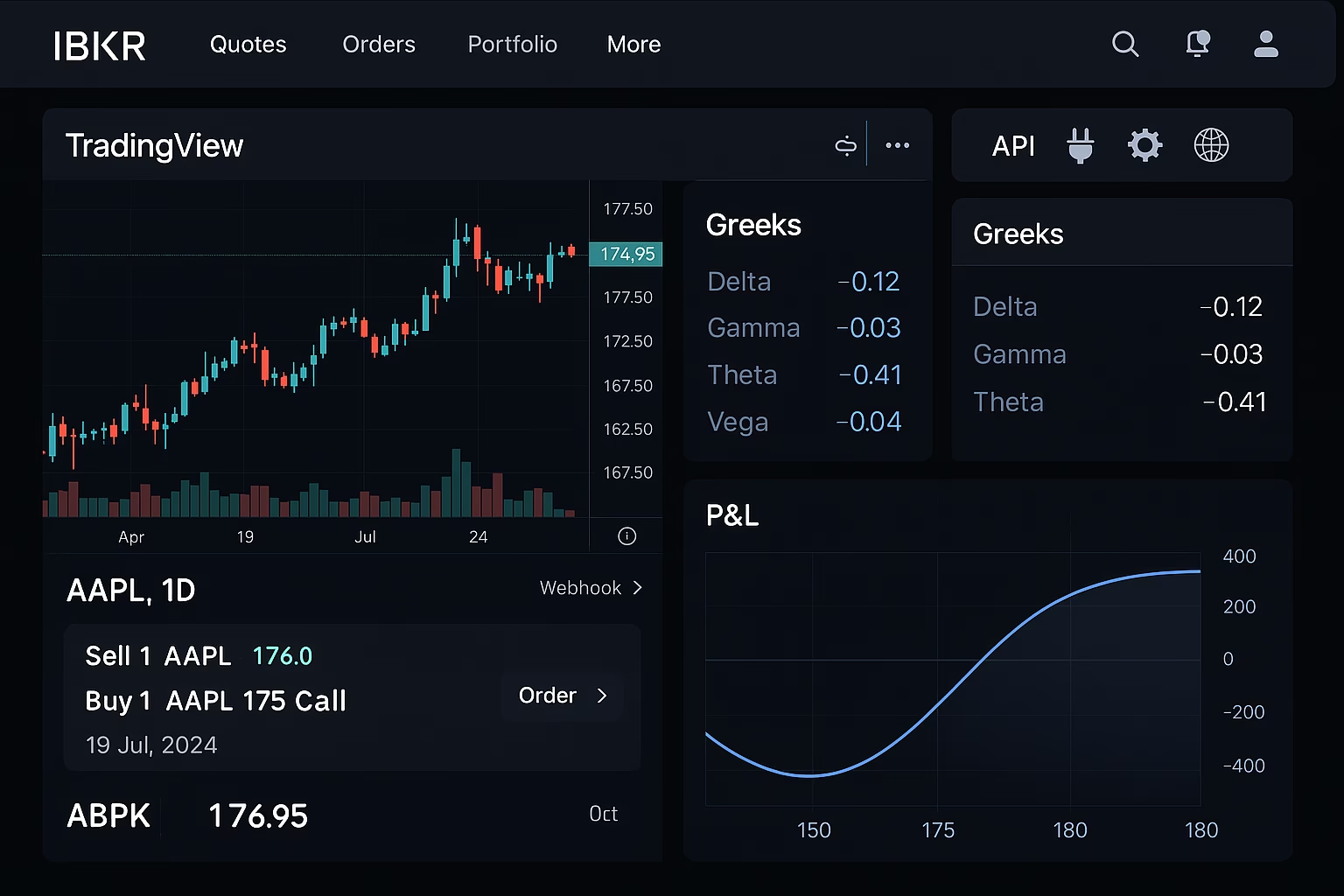

- Connect TradingView for signal-based trades (5-minute setup).

- Test API with a simple Python script for order placement.

- Integrate PickMyTrade for no-code webhook automation.

- Backtest strategies using historical options data.

- Monitor risks: Set daily limits and audit executions weekly.

In 2025’s volatile options landscape—fueled by AI catalysts and global shifts—interactive brokers options automation delivers precision without the grind. Interactive Brokers (IBKR), with $10B+ in equity and 150+ markets, powers automated options trading via its upgraded API and tools like the October 2025 IBKR Desktop v1.2 release. This guide streamlines IBKR automated trading setup, from ib tradingview integration to API bots, with real examples for SPX iron condors or NVDA straddles. Updated with November 2025 insights from IBKR Campus and trader forums, it’s designed for beginners to pros. Dive in to execute faster and scale smarter.

Disclaimer: Options trading risks capital loss. Automation aids efficiency but isn’t foolproof—use paper accounts and seek advice. Not financial advice.

Why Automate Options Trading on IBKR in 2025?

IBKR excels in interactive brokers options automation due to low costs ($0.15–$0.65/contract) and global chains across U.S., Europe, and Asia. The May 2025 platform upgrade added advanced options tools and charting, while August’s FINRA fine ($650K) tightened automated approvals for better compliance.

Key perks: Sub-second fills via Scale Trader for trend-based entries. Drawbacks include API rate limits (50 msg/sec)—solvable with retries. For automated multi-leg options trading, IBKR’s IBot AI queries strategies in natural language, cutting setup time by 40%. Before automation: Manual SPX condor entry during earnings risks slippage. After: Webhook triggers fill at optimal Greeks, netting 15% edges per X traders.

TradingView + Interactive Brokers Integration

Ib tradingview integration turns TradingView’s charts into live execution hubs—perfect for signal-driven automated options trading. The 2025 update supports multi-leg spreads and bracket orders, bridging visuals with IBKR’s depth.

Step-by-Step Setup for TradingView-to-IBKR Automation

- Launch TradingView Panel: Open charts > Trading Panel > Select Interactive Brokers > Connect.

- Enable IBKR API: In TWS/IB Gateway > Global Configuration > API > Settings > Check “ActiveX and Socket Clients” (port 7497 paper/7496 live). White list TradingView IPs.

- Log In Securely: Use IBKR credentials; fund account if required (min $0 for Lite).

- Test Single Order: Chart AAPL 250C > Right-click > Trade > Place limit. Confirm in TWS.

- Automate Alerts: Create RSI<30 alert > Add webhook URL > Route to IBKR for call buys.

Internal Link: TradingView Alerts Automation Guide.

Tips for Reducing Execution Lag in Ib Tradingview Integration

- Run TWS on a VPS for 50ms faster fills.

- Use bracket orders post-execution to lock 1:2 RR on NVDA straddles.

- Backtest in TradingView Strategy Tester before live—avoids 20% common errors.

Why it shines: Signals execute in seconds, ideal for earnings volatility. X feedback: “TV + IBKR condors? Game-changer for QQQ plays.”

| Aspect | Native IBKR | With TradingView |

|---|---|---|

| Visuals | Basic chains | 100+ indicators |

| Speed | Sub-second | Webhook-boosted |

| Legs | Manual spreads | Auto-multi-leg |

| Cost | $0.15/contract | + TV Pro $14.95/mo |

Automating Options with the IBKR API

IBKR’s TWS API v974+ drives Interactive Brokers API options bot setups, supporting REST/WebSockets for real-time Greeks and orders. 2025’s Python/TypeScript SDKs simplify async handling.

Supported Order Types for Automated Multi-Leg Options Trading

- Limit/Market: Basic calls/puts.

- Bracket/OCO: Auto SL/TP on straddles.

- Combo: Iron condors with delta-neutral tweaks.

Common Strategies via IBKR API

- Covered Calls: Roll monthly on rises (SPX example: Buy 100 shares, sell 1 call).

- Earnings Straddles: ATM legs pre-event; exit at 50% profit.

- Iron Condors: Bracket QQQ ranges; trail on IV crush.

Python Example for IBKR API Options Bot

Test in paper mode—simulates $10K notional without risk.

Python

from ib_insync import *

ib = IB()

ib.connect('127.0.0.1', 7497, clientId=1) # Paper port

contract = Option('AAPL', '20251219', 250, 'C', 'SMART') # Call example

order = LimitOrder('BUY', 10, 5.0) # 10 contracts at $5

trade = ib.placeOrder(contract, order)

ib.sleep(1) # Wait for fill

if trade.isDone():

print("Filled:", trade.filled())

ib.disconnect()Handles errors: Add try/except for pacing violations.

IBKR Options Wizard for Strategy Selection

The May 2025-upgraded Options Wizard automates picks: Input “bearish QQQ” for put debit spreads. In IBKR Desktop: Click Wizard > Outlook > Generate. Pairs with API for auto-adjusts on IV shifts—e.g., exit condors at 20% profit.

Risks and Safeguards in Interactive Brokers Options Automation

Automation pitfalls: August 2025’s FINRA fine exposed vetting gaps—quiz for options levels first. Tech risks: TWS disconnects (use Gateway); gamma squeezes on NVDA (cap 5% exposure).

Safeguards:

- Paper trade 2 weeks; simulate $5K condors.

- API retries for 50 msg/sec limits.

- Daily audits via PortfolioAnalyst for assignment fees ($0.01/share).

- Diversify: QuantRocket for backtests.

Final Takeaway: Scale Your Options Game with IBKR Automation

Interactive Brokers options automation via ib tradingview integration and API bots unlocks efficient, low-cost automated options trading. From Wizard picks to PickMyTrade webhooks, 2025’s upgrades make it accessible—test a QQQ straddle today. Automate wisely: Paper first, risks managed. Your edge awaits.

FAQs: Most Asked Questions on Interactive Brokers Options Automation

Q: How do I set up ib tradingview integration for options? A: Use Trading Panel > Connect IBKR; enable API in TWS. Test with AAPL chains—full steps above.

Q: Is interactive brokers options automation safe for beginners? A: Start paper trading; Wizard guides simple calls. Risks low with 1% limits.

Q: Can PickMyTrade handle automated multi-leg options trading on IBKR? A: Yes—webhooks for condors/spreads; seamless with TradingView signals.

Q: What’s new in IBKR API for 2025 options automation? A: v974+ with scaled orders; better async for bots.

Q: How much does automated options trading cost on IBKR? A: $0.15–$0.65/contract; tiers for volume. No platform fees.

Q: Does IBKR support backtesting for options strategies? A: Yes—API historical data; IBridgePy for Python sims.