The bot friendly markets 2026 landscape is evolving rapidly, driven by advancements in AI, regulatory clarity, and high-volatility environments ideal for automation. As of January 2026, traders are leveraging bots for efficiency, emotion-free execution, and 24/7 operation across various asset classes.

This comprehensive guide explores the best markets for automation in 2026, highlighting why certain markets excel for trading bots, recent updates, and tools like PickMyTrade that make automation accessible.

Why Bot-Friendly Markets Matter in 2026

Automated trading has surged, with estimates showing over 65% of crypto volume involving bots. Key drivers include:

- AI integration for smarter strategies (e.g., predictive analytics, sentiment analysis).

- Regulatory progress, such as U.S. GENIUS Act for stablecoins and EU MiCA full implementation, providing clearer frameworks.

- High-liquidity, 24/7 markets that reward speed and precision.

Bots thrive where volatility creates opportunities, liquidity ensures execution, and APIs enable seamless integration.

Top Bot-Friendly Markets in 2026

1. Cryptocurrency Markets: The Ultimate Bot Haven

Crypto remains the most bot friendly market due to 24/7 trading, extreme volatility, and abundant API access from exchanges like Binance, Bybit, and OKX.

In 2026, futures and derivatives dominate, with bots excelling in grid, DCA, arbitrage, and AI-driven strategies. Platforms like Pionex (free built-in bots), 3Commas, and Cryptohopper lead, handling billions in volume.

Recent updates: Stablecoin regulations (e.g., GENIUS Act) boost confidence, while AI bots analyze on-chain data for edges.

Crypto’s best market for automation status stems from non-stop action—no weekends or holidays—and leverage up to 100x.

(Imagine a dynamic chart of crypto volatility here – bots capitalize on these swings.)

2. Forex Markets: High Liquidity and Precision Automation

Forex is a classic best market for automation, with $7+ trillion daily volume, tight spreads, and 24/5 access.

Bots using MT4/MT5 expert advisors (EAs) automate scalping, trend-following, and news-based trades. Platforms like Interactive Brokers and NinjaTrader support multi-asset algo trading.

2026 updates favor regulated brokers with advanced tools, making forex ideal for consistent, low-volatility strategies compared to crypto.

3. Futures Markets: Prop Firm and High-Speed Execution

Futures (indices, commodities, crypto-linked) are increasingly bot friendly in 2026, especially for prop trading firms like Apex.

Tools automate entries/exits with precision. Recent CFTC shifts allow more digital asset integration.

(Futures charts showing automated signals – speed is key.)

4. Stocks and Equities: AI-Powered Scanning and Execution

Stock markets suit bots for scanning thousands of assets, pattern recognition, and backtesting.

Platforms like Trade Ideas, TrendSpider, and StockHero offer AI bots for signals and automation. Regulated U.S. brokers ensure compliance.

2026 sees growth in AI agents for decision augmentation, though full automation lags crypto due to market hours.

5. Emerging: Prediction Markets and AI Agents

Prediction markets (Polymarket, Kalshi) explode in 2026, with billions traded on events. Bots could automate bets, though regulatory scrutiny applies.

AI agents in fintech (e.g., autonomous payments) hint at broader automation.

Spotlight: PickMyTrade for Seamless Automation

For traders seeking no-code solutions, PickMyTrade stands out as a top tool for bot friendly markets in 2026.

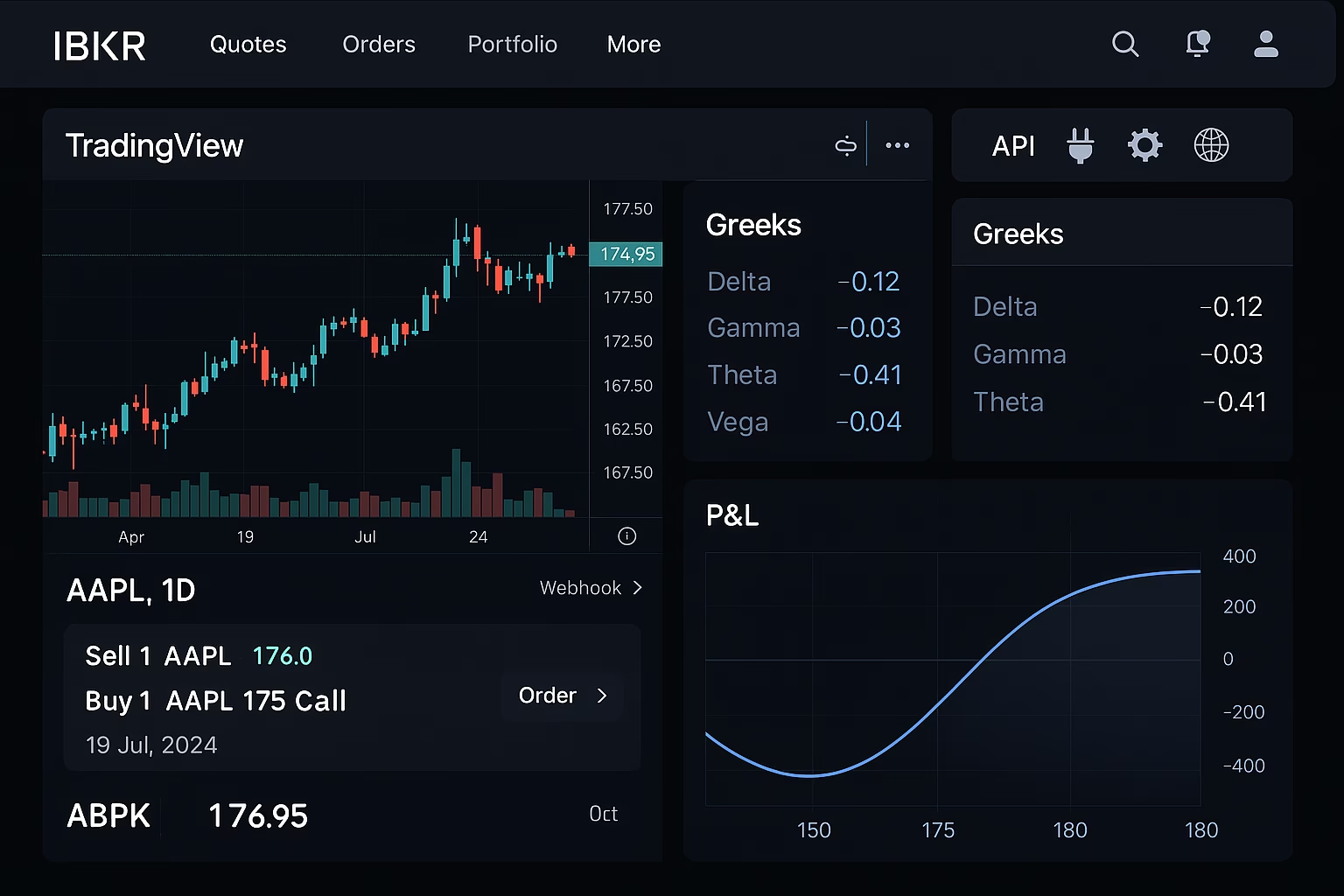

It connects TradingView alerts to brokers like Tradovate, Rithmic, Interactive Brokers, and TradeStation—automating futures, stocks, and more in minutes.

Key features:

- Zero coding required.

- Multi-account support with risk controls.

- Precise execution for prop firms and personal accounts.

Over 3,000 traders use it for reliable 24/7 automation, bridging strategies to live trades effortlessly.

Whether in crypto futures or traditional markets, PickMyTrade simplifies the best markets for automation.

Risks and Best Practices

Bots amplify gains—and losses. Key tips:

- Backtest thoroughly.

- Use risk management (SL/TP).

- Monitor for black swan events.

- Comply with regulations (e.g., no front-running).

Conclusion: Embrace Automation in 2026

The bot friendly markets 2026 favor crypto for volatility, forex for liquidity, futures for precision, and stocks for scale. With tools like PickMyTrade, automation is accessible to all.

Start a 5 – day Free Trial of Futures Trading Automation

Start small, test rigorously, and position for efficiency in this AI-driven era.

Most Asked FAQs on Bot Friendly Markets 2026

Crypto leads due to 24/7 access and volatility, followed by forex, futures, and stocks.

Yes, via regulated brokers and platforms—follow SEC, CFTC, and local rules.

PickMyTrade for no-code TradingView automation, or Pionex for free crypto bots.

Clearer rules (e.g., GENIUS Act, MiCA) boost confidence, especially in stablecoins and crypto.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Top Tick Data Futures Sources for 2025: Ultimate Guide