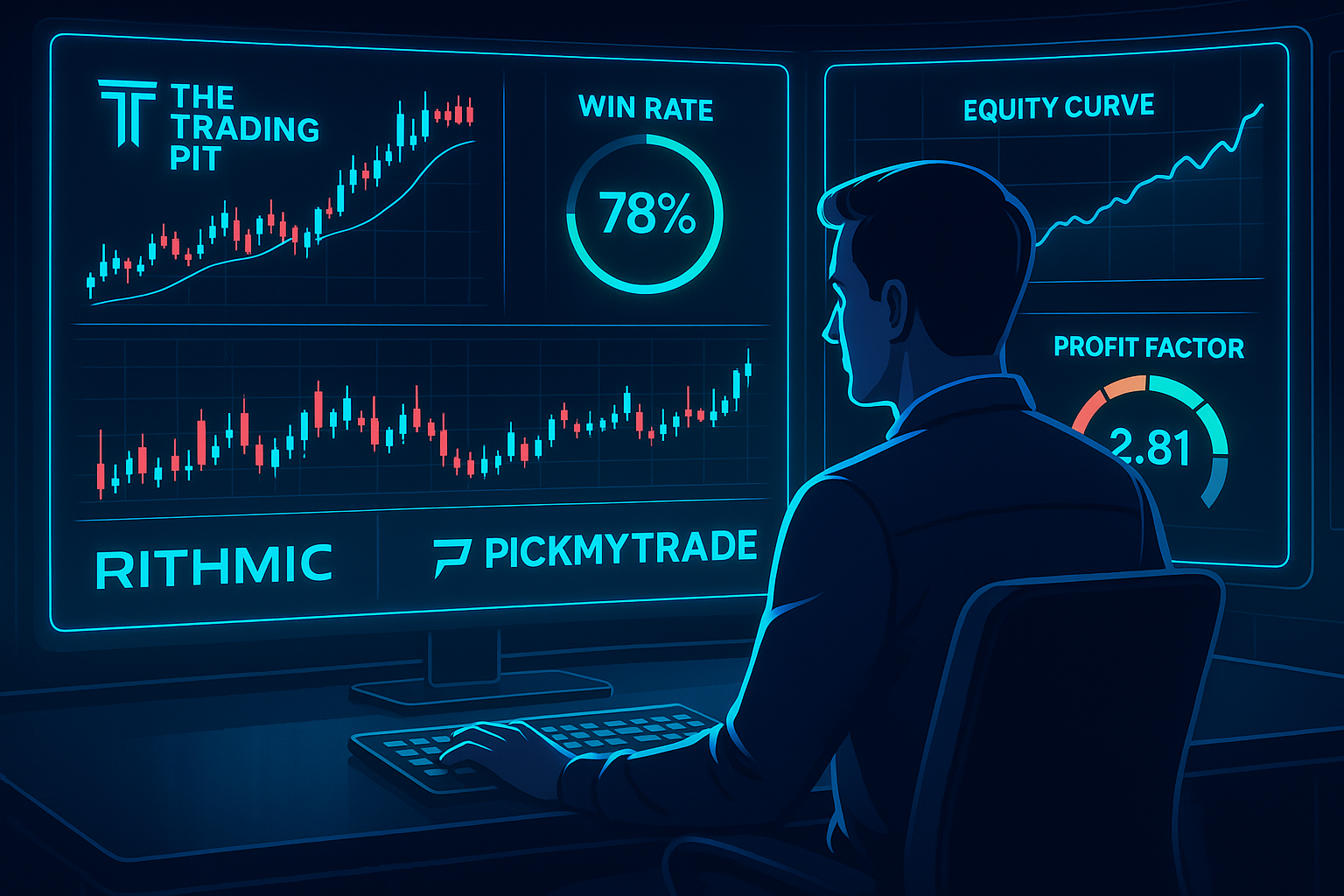

Many traders get excited about high win rates. But a 70% win rate doesn’t always mean profits. In fact, it could hide deep flaws in your strategy. In this post, we’ll show how The Trading Pit Automation helps traders evaluate the real performance of a strategy using metrics that matter.

Why Strategy Testing Matters

The Trading Pit Automation integrates seamlessly with TradingView’s Strategy Tester — a powerful tool that reveals much more than just the win rate.

Using it, you can analyze:

- Net profit

- Profit factor

- Drawdown

- Equity curve

This data-driven approach helps you spot strengths and weaknesses early, before risking real capital.

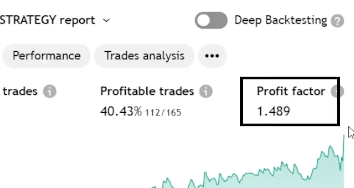

Case Study 1: Supertrend Strategy Wins with a Lower Win Rate

Take the Supertrend strategy tested through The Trading Pit Automation. The win rate was just 40%, but:

- Total Profit: $146,000

- Profit Factor: 1.489

- Max Drawdown: 14%

- Equity Curve: Smooth and upward

Despite the modest win rate, this strategy shows solid risk-to-reward and consistency.

Case Study 2: RSI Strategy Fails Despite High Win Rate

Now look at an RSI-based strategy with a 63.33% win rate:

- Total Loss: $50,000

- Profit Factor: 1.163

- Max Drawdown: 10%

- Equity Curve: Starts well, then collapses

This proves that win rate alone is not enough. The equity curve was weak, and losses erased early gains.

Metrics That Matter in The Trading Pit Automation

Here’s what you should prioritize over raw win rate:

- Profit Factor: Profit ÷ Loss. Above 1.5 = healthy.

- Drawdown: Measures risk. Keep it low.

- Equity Curve: Visual proof of strategy consistency.

- Total Net Profit: Real bottom line results.

Why The Trading Pit Automation Makes It Easy

With The Trading Pit Automation, you can automate your TradingView strategies across brokers like:

- Tradovate

- Interactive Brokers (IBKR)

- TradeLocker

- TradeStation

You can easily sync, test, and optimize your strategy using real metrics, not just attractive win rates.

Final Thoughts

Don’t fall for a high win rate. Use The Trading Pit Automation and TradingView’s Strategy Tester to dig deeper. Look at your profit factor, max drawdown, and the shape of your equity curve.

Ready to trade smarter?

Try The Trading Pit Automation today and build strategies based on truth, not just hope.

Also Checkout: Why High Win Rates May Fail in Stock Prop Firm Automation