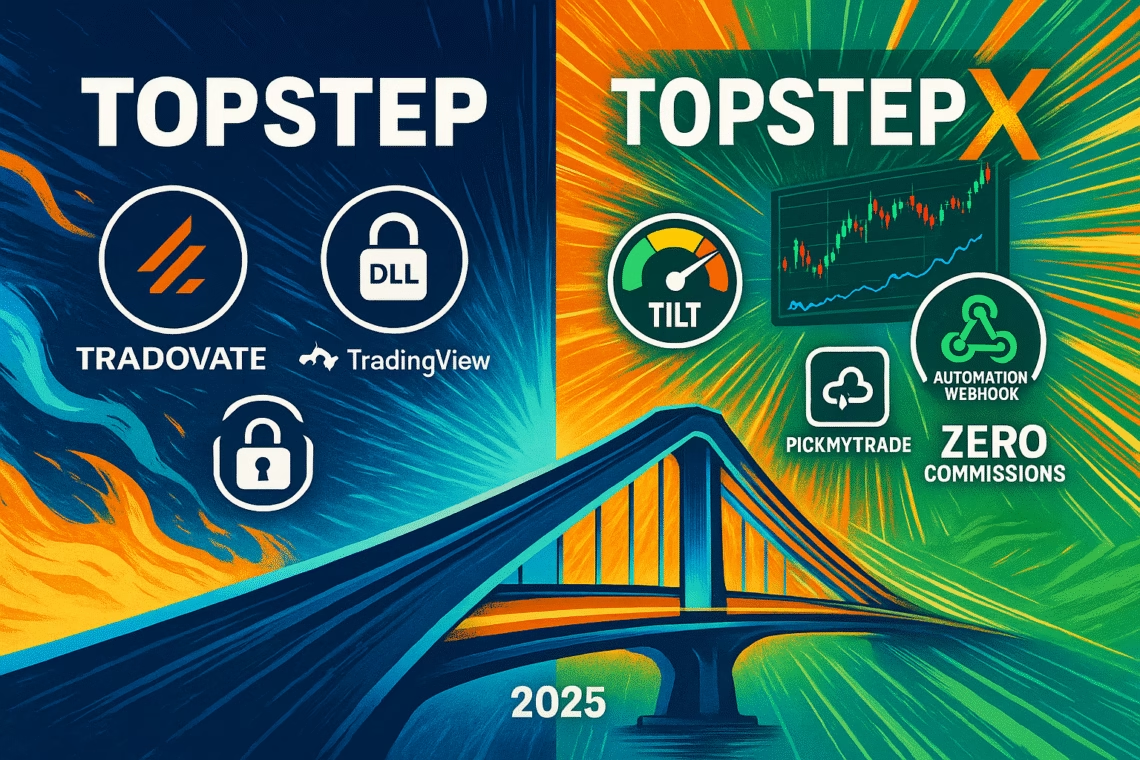

In the evolving landscape of proprietary futures trading, the TopstepX vs Classic Topstep debate rages on—especially as 2025 mandates TopstepX for all new Trading Combines starting July 7. Powered by ProjectX technology, TopstepX delivers projectx advantages like zero commissions, 86% higher pass rates, and $1K bigger average payouts ($3,250 vs. $2,400), per Topstep’s mid-2025 data. Meanwhile, Classic Topstep clings to legacy platforms like Tradovate and NinjaTrader for existing accounts until August 1 resets. This SEO-optimized showdown—drawing from Reddit threads, Trustpilot 4.3/5 scores, and Q3 updates like CME data fee waivers—compares rules, costs, and features to crown the topstepx 2025 champ. Plus, amplify either with PickMyTrade automation trading for seamless TradingView alerts on ProjectX. Day traders to scalpers: Uncover if TopstepX vs Classic Topstep flexibility or structure suits your 2025 edge in ES, NQ, and CL.

TopstepX vs Classic Topstep: 2025 Overview of Futures Prop Evolution

Topstep Classic, the OG since 2012, offered multi-platform freedom (Tradovate, NinjaTrader, Quantower) with a two-phase Trading Combine emphasizing discipline via daily loss limits (DLL). It funded 81K+ traders with $9M+ payouts by 2024, but 2025’s shift sidelines it for newbies.

Enter TopstepX 2025: Topstep’s proprietary browser-based powerhouse on ProjectX tech, mandatory for new Combines post-July 7. With built-in TradingView charts, Tilt™ sentiment tools, and copy trading, it boasts 82% trader adoption and near-double pass rates (~86% higher than Classic). Projectx advantages include unfiltered 50ms data and mobile access—no installs needed. Legacy Classic persists for active funded accounts, but resets force the switch by August 1. In TopstepX vs Classic Topstep, X edges innovation; Classic offers familiarity.

TopstepX vs Classic Topstep: Rules & Risk Management in 2025

Both follow Topstep’s core: Two-phase Combine (Step 1: Profit target; Step 2: Consistency), end-of-day (EOD) drawdown, no time limits, and 5 winning days for payouts. But topstepx 2025 liberates with no enforced DLL—personalized risk via manual lockouts and trailing limits, reducing blowups for disciplined traders. Classic enforces hard DLLs ($1K-$3K based on size), pausing trades on breaches.

| Feature | TopstepX 2025 | Classic Topstep |

|---|---|---|

| Eval Phases | Two-step; personalized DLL optional | Two-step; strict DLL enforced |

| Drawdown | EOD trailing; no daily cap | EOD + hard DLL |

| Consistency | Best day <50% total profit | Same; platform-specific enforcement |

| News Trading | Allowed; Tilt™ for sentiment | Allowed; basic alerts |

| Prohibited | Overtrading; must self-lock | Same + platform glitches |

Projectx advantages shine: TopstepX’s auto-profit locks and micro-crypto adds (e.g., MBT) boost 25% funding likelihood vs. Classic’s rigidity. Reddit r/TopStepX users note: “No DLL = freedom, but demands discipline.” In TopstepX vs Classic Topstep, X suits pros; Classic for rule-followers.

Click Here To Start TopstepX PropFirm Trading Automation For Free

TopstepX vs Classic Topstep: Platforms & ProjectX Advantages Breakdown

Classic Topstep’s strength? Platform variety—Tradovate for mobile, NinjaTrader for algos, with Rithmic/CTS data. But 2025 limits it to legacy, with potential lag in peaks.

TopstepX 2025 leverages projectx advantages: Web-native (PC/Mac/mobile), integrated TradingView (100+ indicators), and CQG data for 50ms unfiltered feeds. No commissions on X (vs. $0.79/contract on Tradovate), plus API for custom bots. Drawback: Isolated—can’t switch mid-Combine without reset. Per ProjectX case study, it handles 100K+ users scalably, with 90% satisfaction in forums.

ProjectX Advantages in TopstepX 2025:

- Low-Latency Execution: Sub-50ms fills vs. Classic’s 100ms+ on third-party.

- Copy Trading: Mirror pros risk-adjusted; 2025 update adds AI portfolios.

- Risk Tools: Tilt™ real-time sentiment; manual lockouts prevent overtrading.

- Cost Savings: Zero fees + CME data waiver (July 22 onward, $133/mo saved).

In TopstepX vs Classic Topstep, ProjectX’s seamlessness wins for modern traders.

TopstepX vs Classic Topstep: Costs & Account Sizes in 2025

Both start at $49/mo for $50K Combine, scaling to $165 for $150K—no upfront fees, but $149 activation on funded. Classic adds platform licenses ($25-99/mo); TopstepX is free-inclusive.

| Size | TopstepX 2025 Cost/Mo | Classic Topstep Cost/Mo |

|---|---|---|

| $50K | $49 (zero commissions) | $49 + $25 Tradovate |

| $100K | $129 | $129 + $50 NinjaTrader |

| $150K | $165 | $165 + data fees |

Projectx advantages cut extras: No commissions/data fees on X. Reset Bank: One free reset/mo. Funded splits: 100% first $10K, 90/10 after—daily payouts post-5 wins. Classic lags with per-trade costs. TopstepX vs Classic Topstep value? X for budget efficiency.

Payouts & Support in 2025

Payouts identical: Daily after 5 wins in Express Funded; $10K/mo cap, via ACH/PayPal in 1-3 days. TopstepX averages $3,250 (25% higher), thanks to higher passes. 2025: CME waiver boosts net.

Support: Both 24/7 chat/Discord, but TopstepX adds Coach Robert’s 5-min videos and Tilt™ analytics. Classic relies on third-party forums. Reddit: “TopstepX lag rare; support faster.”

Supercharge TopstepX & Classic Topstep with PickMyTrade Automation Trading

Automation elevates both, but topstepx 2025 thrives on ProjectX’s API. PickMyTrade automation trading bridges TradingView alerts to TopstepX/Tradovate: Webhook RSI signals → Instant orders with SL/TP. 2025: 40% faster scalps, multi-account copying (up to 5). Setup: Dashboard link → Alert mapping. Users love it for no-DLL freedom on X, PickMyTrade unlocks edges seamlessly.

Pros & Cons: 2025 Edition

TopstepX Pros: Projectx advantages like zero fees, high passes, copy trading; Cons: Mandatory switch, occasional lag. Classic Topstep Pros: Platform choice, familiarity; Cons: Higher costs, enforced DLL, phasing out.

Verdict: TopstepX Wins in 2025

TopstepX 2025 dominates with projectx advantages—86% pass uplift, cost savings, and innovation—making it the clear upgrade over fading Classic. For legacy holders, migrate by August; newbies, start on X. Add PickMyTrade automation trading for autopilot success.

Frequently Asked Questions (FAQs)

TopstepX 2025 drops enforced DLL for personalized risk; Classic keeps hard limits—X offers more freedom via projectx advantages.

Yes, new Combines since July 7, 2025; resets by August 1—legacy funded OK, but TopstepX vs Classic Topstep favors X’s 86% higher passes.

Zero commissions, 50ms data, TradingView integration, copy trading—boosting payouts $1K avg over Classic.

Absolutely—PickMyTrade automation trading webhooks alerts to ProjectX/Tradovate for both, with X’s API shining.

TopstepX’s Tilt™ tools and videos win; Classic’s platforms suit if you have setups, but migrate for 2025.

Same structure (100% first $10K), but TopstepX averages $3,250 vs. $2,400—thanks to higher success rates.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Complete Guide to Automated Futures Trading Systems with PickMyTrade