Introduction: Why Prop Firm Technology Is the Real Competitive Edge

Launching a proprietary trading firm is no longer about who has the most capital—it’s about who has the smartest technology stack. In today’s prop trading landscape, firms live or die by execution speed, automation, trader experience, and operational efficiency. The firms that scale successfully are built on modern Prop Firm Technology that automates evaluations, enforces risk rules flawlessly, and supports traders 24/7 without friction.

White-label platforms have made entry easier—but not all technology is created equal. Many solutions prioritize speed to launch over long-term scalability, while others overwhelm founders with enterprise complexity.

This guide breaks down the leading prop firm technology and white-label solutions, explains where each fits, and shows why PickMyTrade stands apart as a trader-centric, automation-first platform designed for serious futures and systematic traders.

What Is Prop Firm Technology?

Prop Firm Technology refers to the software infrastructure that powers a proprietary trading business. This includes everything from:

- Trader onboarding and evaluations

- Risk management and rule enforcement

- Account scaling and payouts

- Broker and data feed integrations

- Automation, APIs, and analytics

At a high level, modern prop firm platforms fall into three categories:

1. Full-Stack White-Label Solutions

Best for fast launches with minimal technical effort.

2. Enterprise Trading Platforms

Designed for firms with large volumes, multiple asset classes, and internal tech teams.

3. Modular & Automation-Focused Systems

Built for firms that want flexibility, deep control, and custom workflows.

PickMyTrade belongs to the third category—purpose-built for automation, futures trading, and rule-driven consistency.

How to Set Up a White-Label Prop Firm (High-Level Overview)

Launching a prop firm typically involves:

- Choosing a technology provider

- Defining evaluation rules and risk parameters

- Connecting trading platforms and data feeds

- Setting up payouts, dashboards, and compliance flows

- Deploying reliable low-latency infrastructure

While many vendors promise “launch in days,” the real differentiator is what happens after launch—scalability, trader retention, and operational control.

Top Prop Firm Technology & White-Label Platforms Compared

PropAccount – Simple, Influencer-Friendly White Label

Best for: Educators and influencers monetizing an audience

PropAccount offers a turnkey setup with branding, dashboards, and automated payouts. It’s attractive for non-technical founders who want a quick start without ongoing fees.

Strengths

- One-time setup cost

- Handles backend operations

- Minimal technical involvement

Limitations

- Limited customization

- Less control over execution logic and automation

- Not optimized for advanced futures traders

YourPropFirm – Fast Deployment, Managed Infrastructure

Best for: Entrepreneurs prioritizing speed to market

YourPropFirm delivers a fully managed experience with branding, payments, and broker connections included.

Strengths

- Quick launch timelines

- Centralized CRM and billing

- Futures support via Rithmic

Limitations

- Ongoing platform dependency

- Less flexibility for custom rule engines

FPFX Technologies – Enterprise-Grade Prop Firm Technology

Best for: Large, globally scaling firms

FPFX supports FX, futures, and crypto with deep integrations and enterprise APIs.

Strengths

- Highly scalable

- Multi-asset support

- Institutional-level tooling

Limitations

- Complex implementation

- Higher cost and technical overhead

Quadcode WL Prop – Unified Trading & CRM Platform

Best for: FX and crypto-focused prop firms

Quadcode combines trading, CRM, and mobile apps into one ecosystem.

Strengths

- Modern UI

- Built-in CRM and KYC

- Mobile accessibility

Limitations

- Monthly licensing

- Limited futures depth

Axcera PropTech – Automation-Driven Rule Management

Best for: Startups focused on evaluations and rule enforcement

Axcera emphasizes challenge automation and CRM workflows.

Strengths

- Custom rule engines

- Automated evaluations

- API connectivity

Limitations

- FX/CFD focus

- Less futures-specific optimization

Match-Trader – Scalable, Mobile-First Platform

Best for: Firms seeking modern UX and scalability

Match-Trader offers prop-specific modules, APIs, and mobile-first execution.

Strengths

- Strong UI/UX

- TradingView integration

- High account capacity

Limitations

- Account-based pricing

- Requires careful infrastructure planning

DXtrade (Devexperts) – Multi-Asset Enterprise Platform

Best for: Institutional and multi-market prop firms

DXtrade supports futures, equities, FX, and crypto with deep customization.

Strengths

- Asset-agnostic architecture

- High performance

- Enterprise flexibility

Limitations

- Expensive

- Long implementation cycles

Where Most Prop Firm Technology Falls Short

Despite the variety of platforms available, many share the same weaknesses:

- Generic rule enforcement

- Limited automation beyond basic challenges

- Poor support for systematic futures traders

- Overreliance on manual admin processes

This is where PickMyTrade fundamentally differs.

Why PickMyTrade Is Different (And Superior)

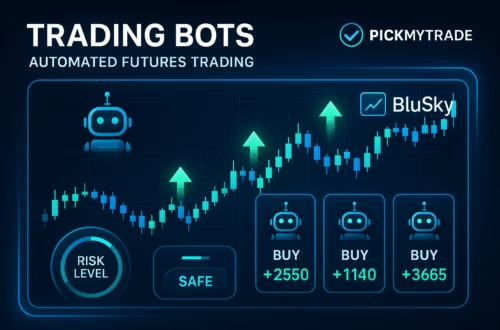

Built for Automation, Not Just Launch Speed

PickMyTrade is not a generic white-label wrapper. It’s a trader-centric, automation-first Prop Firm Technology platform engineered for precision, consistency, and scale.

Designed for Futures & Systematic Traders

Unlike FX-first platforms retrofitted for futures, PickMyTrade is optimized for:

- Rule-based futures trading

- Algo and semi-automated strategies

- Strict, transparent risk logic

Core Advantages of PickMyTrade

- Automated trade validation (no manual reviews)

- Real-time rule enforcement at execution level

- Clean trader dashboards focused on performance—not marketing fluff

- API-ready architecture for scaling and integrations

- Infrastructure-aware design that pairs perfectly with low-latency VPS hosting

Real-World Use Case

A futures trader running an automated strategy can:

- Deploy algorithms on a low-latency VPS

- Execute trades through PickMyTrade’s rule engine

- Get instant feedback on compliance

- Scale accounts without changing workflows

This is Prop Firm Technology built for professionals—not hobbyists.

PickMyTrade is a cloud-based automation service trusted by thousands of traders. Combined with QuantVPS infrastructure, you get the ultimate automated trading setup.

https://www.quantvps.com/pickmytrade

Use code: PICKMYTRADE for 15% discount

Click Here To Automate Futures Trading

The Role of Infrastructure: Why VPS Hosting Matters

Even the best prop firm platform fails without reliable infrastructure.

Low-latency VPS hosting ensures:

- Faster order execution

- Reduced slippage

- 24/7 uptime for algos and evaluations

For futures traders, pairing PickMyTrade with a Chicago-based, exchange-proximate VPS is not optional—it’s essential.

Choosing the Right Prop Firm Technology: A Practical Framework

Before committing to any platform, ask:

- Do I need speed to launch—or long-term scalability?

- Will my traders use discretionary or automated strategies?

- How important is real-time rule enforcement?

- Can this platform grow without adding operational friction?

If your goal is to build a serious, scalable, futures-focused prop firm, automation and infrastructure should lead the decision.

Conclusion: The Future of Prop Firm Technology

Prop trading is evolving fast. Firms that rely on generic white-label tools will struggle to differentiate, while automation-driven platforms will define the next generation.

Key takeaways:

- Full-stack white labels are best for fast, simple launches

- Enterprise platforms suit large, capital-heavy firms

- Automation-first systems like PickMyTrade offer the best balance of control, scalability, and trader trust

If you’re building a prop firm for the long run—especially in futures—PickMyTrade delivers the technology edge generic platforms can’t match.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Best TradingView Automation Tools 2026