Futures traders have multiple options for professional trading platforms. This ProjectX vs Tradovate review provides a complete comparison of features, pricing, supported assets, and automation capabilities for traders at all levels.

This review compares the two platforms across performance, pricing, usability, supported assets, and key features to help traders decide which best fits their workflow.

1. Platform Overview

ProjectX is a modern trading infrastructure built with an emphasis on speed, automation, and custom integrations. It supports direct market access for futures and offers flexibility for traders using algorithmic or rule-based strategies.

Tradovate, acquired by NinjaTrader Group, remains one of the most recognized futures brokers in the U.S. It combines a simple interface with cloud-based trading and commission-free pricing options for active traders.

Both platforms focus on minimizing latency and providing a seamless order execution experience, though their ecosystems differ in design philosophy.

2. User Experience

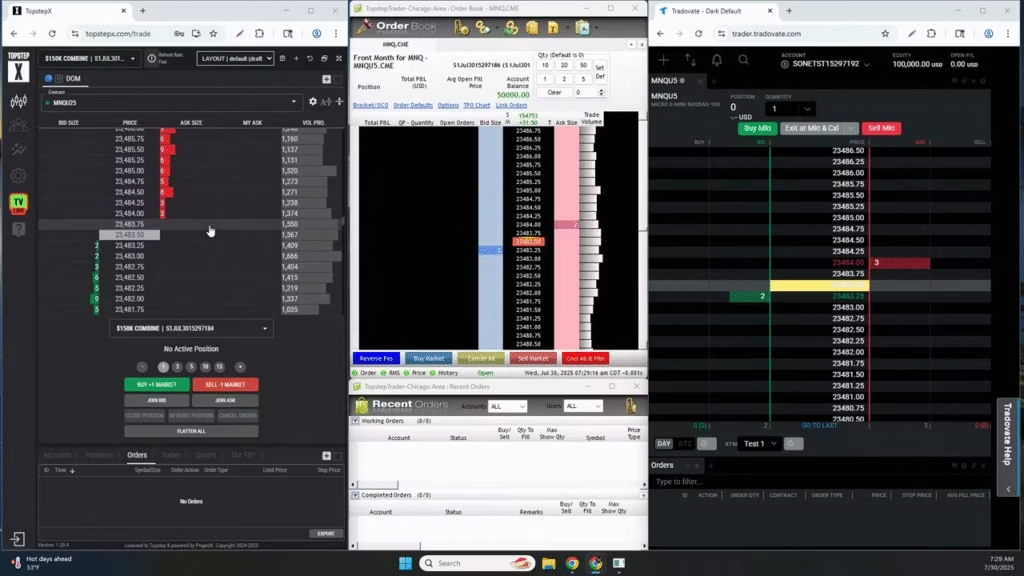

- ProjectX features a clean, modular interface that appeals to algorithmic and professional traders. Its lightweight design allows fast navigation between order books, market depth, and strategy management tools.

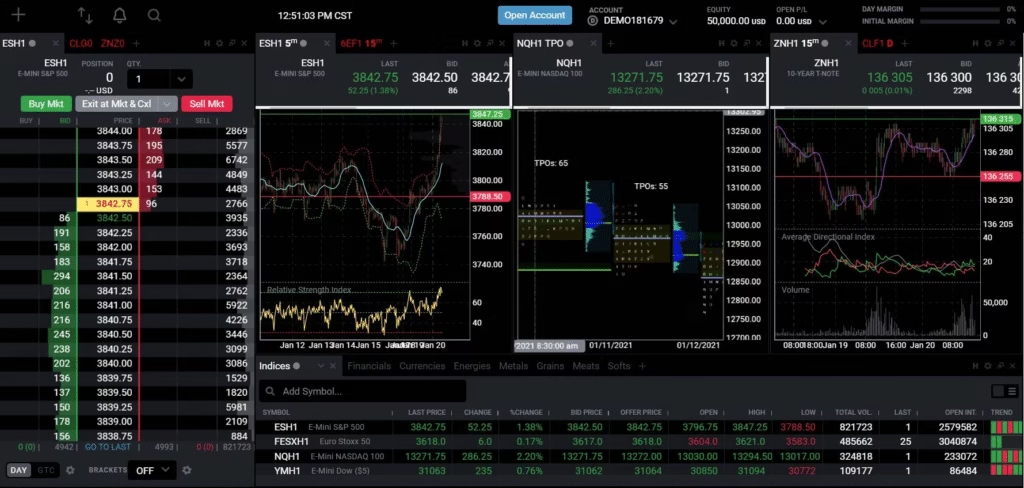

- Tradovate provides an intuitive, browser-based interface accessible from desktop and mobile. It’s particularly beginner-friendly, with well-organized dashboards and no software installation required.

Both platforms emphasize speed and stability, but ProjectX is more tailored toward advanced customization, while Tradovate prioritizes accessibility and ease of use.

3. Fees and Commissions

ProjectX operates under the funded account model of DayTraders.com. Instead of paying per-trade commissions, traders pay a fixed program fee (for example, $24.90 for a $25K trial account) with no recurring data or access costs. This model makes costs predictable — and since trading is simulated within funded accounts, there are no brokerage commissions.

Tradovate uses a tiered model:

- Free Plan: $1.29 per side (standard contracts), $0.39 for micros.

- Active Trader Plan ($99/month): $0.99 standard / $0.29 micro.

- Lifetime Membership ($1,499 one-time): $0.59 standard / $0.09 micro.

All plans include access to CME, CBOT, NYMEX, and COMEX markets, with exchange and clearing fees applied as standard.

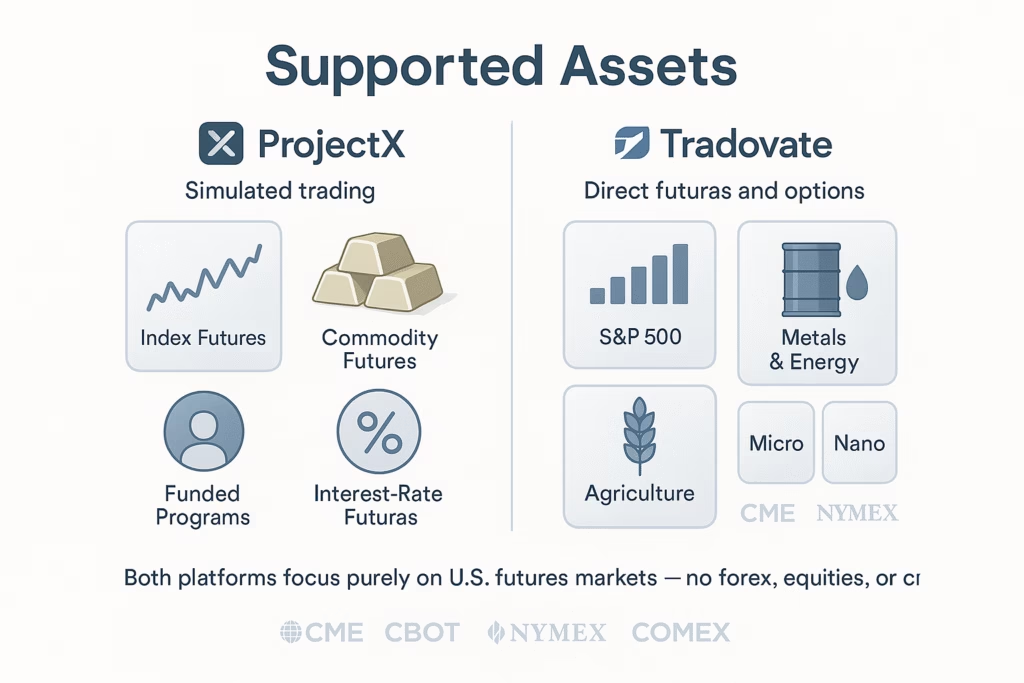

4. Supported Assets

Both ProjectX and Tradovate specialize in U.S. futures markets, offering access to CME, CBOT, NYMEX, and COMEX contracts.

- ProjectX supports simulated trading in index, commodity, and interest-rate futures through DayTraders’ funded programs.

- Tradovate allows direct trading of both futures and futures options, including micro and nano contracts across asset classes like indices, metals, energy, and agriculture.

Neither platform offers spot forex, equities, or cryptocurrencies they remain purely futures-focused.

5. Tools and Functionality

ProjectX integrates TradingView’s full charting suite hundreds of indicators, drawing tools, and real-time data — directly into its platform. Traders also get configurable risk controls, including auto-liquidation, profit and loss brackets, and maximum drawdown protection.

It also features a REST API for algorithmic integration, performance analytics, and depth-of-market (DOM) visibility with unfiltered CME data.

Tradovate provides an equally powerful toolkit, including:

- Built-in DOM ladder trading.

- On-demand market replay for strategy backtesting.

- OCO and multi-bracket orders.

- TradingView, Jigsaw, and Collective2 integrations.

Tradovate’s modular workspace allows traders to customize their dashboard extensively, while ProjectX offers a more standardized yet faster interface optimized for prop-style trading.

6. Performance and Reliability

ProjectX leverages a serverless, cloud-native architecture capable of handling “hundreds of thousands of concurrent traders” without lag. DayTraders reports near-instant execution speeds and minimal downtime, making it ideal for high-frequency and intraday strategies.

Tradovate also runs on a robust cloud infrastructure and performs exceptionally well under load. Its mobile app delivers high-speed order entry, although a small number of users report occasional disconnections. Importantly, Tradovate’s cloud-based order engine ensures that open orders remain active even if the user loses connection.

7. Customer Support and Community

Tradovate has an active community and responsive support through live chat, email, and documentation. Its integration with the broader NinjaTrader ecosystem adds educational and technical resources.

ProjectX maintains focused support through partner brokers and technology providers, with specialized assistance for automation and connectivity-related setups.

8. Security and Regulation

Both platforms operate under regulated broker environments and comply with U.S. futures trading standards.

Data is encrypted, and both use secure login protocols. ProjectX’s modular design allows firms to host infrastructure privately if needed, while Tradovate’s cloud-based model emphasizes secure, centralized access.

9. Which One Is Right for You?

| Trader Type | Recommended Platform | Reason |

|---|---|---|

| Beginner | Tradovate | Simple interface, cloud access, educational tools |

| Intermediate | Either | Both provide advanced order management and analytics |

| Advanced / Algo Trader | ProjectX | Greater flexibility, API automation, custom setups |

| Mobile User | Tradovate | Smooth web and mobile trading environment |

| Institutional Setup | ProjectX | Connectivity, low latency, and scalable infrastructure |

Final Thoughts

Both ProjectX and Tradovate have positioned themselves as top-tier futures trading solutions.

While Tradovate focuses on accessibility, simplicity, and transparent pricing, ProjectX caters to traders who value speed, flexibility, and advanced automation capabilities.

Ultimately, the best choice depends on your trading style Tradovate for ease and convenience, ProjectX for performance and customization.

Either way, both platforms continue to raise the bar for what modern futures traders can expect.

Automate Your Trades with PickMyTrade

PickMyTrade offers seamless automation for futures traders on both Tradovate and ProjectX. Tradovate automation (pickmytrade.trade) enables effortless strategy execution, order automation, and risk management, including stop-loss, take-profit, trailing stops, and bracket orders. ProjectX automation (pickmytrade.io) provides low-latency execution, strategy monitoring, and backtesting, ideal for prop firms and algorithmic traders. Both platforms require no coding, integrate smoothly with TradingView, and offer secure, efficient tools to help traders automate strategies and manage risk effectively.