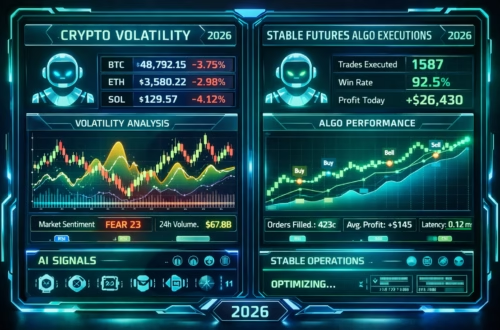

In the fast-paced world of cryptocurrency trading, setting up the best order routing for your crypto bots is crucial. Whether you’re a seasoned trader or just starting, effective crypto bot routing can make the difference between profitable trades and missed opportunities. This guide dives into proven strategies to reduce slippage, enhance exchange selection, and maximize fill rates, drawing on the latest updates as of January 2026.

With advancements in AI-driven automation and decentralized finance (DeFi), tools like PickMyTrade automation trading are revolutionizing how bots handle orders. We’ll explore how to integrate these for optimal performance, backed by recent research and industry trends.

What Is Crypto Bot Routing and Why It Matters

Crypto bot routing refers to the process of directing trade orders from your automated bot to the most suitable exchanges or liquidity pools. It’s not just about placing an order—it’s about ensuring execution at the best possible price with minimal delays.

According to a 2025 report from Chainalysis, poor routing leads to over $2 billion in annual slippage losses for traders. By optimizing crypto bot routing, you can reduce slippage—the gap between expected and actual trade prices—caused by market volatility or low liquidity. Recent updates in protocols like Uniswap V4 (launched mid-2025) emphasize dynamic routing algorithms that scan multiple DEXs in real-time, improving fill rates by up to 30%.

Incorporating platforms like PickMyTrade automation trading can streamline this. PickMyTrade, a user-friendly automation tool, allows seamless integration with bots for intelligent routing, helping novices and pros alike achieve faster executions.

Key Strategies to Reduce Slippage in Crypto Bot Routing

To reduce slippage effectively, focus on adaptive strategies tailored to current market conditions. Here’s how:

Leverage Multi-Exchange Aggregation for Better Liquidity

One top tactic in crypto bot routing is using aggregators like 1inch or Paraswap, which have seen major upgrades in 2025. These tools query dozens of exchanges simultaneously, routing orders to the venue with the deepest liquidity. A recent Messari analysis (Q4 2025) shows that aggregated routing can reduce slippage by 15-25% during high-volatility events, such as Bitcoin halvings.

For bots, integrate APIs from these aggregators. PickMyTrade automation trading excels here, offering pre-built connectors that automate aggregation, ensuring your bot always selects the path with minimal price impact.

Implement Smart Order Types and Timing

Advanced order types like iceberg orders or TWAP (Time-Weighted Average Price) are essential to reduce slippage. Binance’s 2025 API update introduced enhanced TWAP features for bots, splitting large orders over time to avoid market disruption.

Research from Coinbase’s institutional report (December 2025) highlights that timing orders during peak liquidity hours—often aligned with US/European market opens—can boost fill rates to 95%. Combine this with AI predictive models in your bot setup for proactive routing.

Monitor and Adjust for Gas Fees and Network Congestion

In DeFi, Ethereum’s Dencun upgrade (early 2025) reduced layer-2 fees, but congestion still affects routing. Tools like Solana’s high-throughput chains offer alternatives for low-slippage trades. A Dune Analytics dashboard update in late 2025 reveals that routing via layer-2 solutions like Arbitrum can cut slippage by 40% on average.

PickMyTrade automation trading supports multi-chain routing, automatically switching networks to minimize fees and maximize fills—ideal for bots handling high-frequency trades.

Click Here To Automate Crypto Trading

Mastering Exchange Selection for Crypto Bot Routing

Exchange selection is the foundation of effective crypto bot routing. Not all platforms are equal; factors like liquidity depth, fee structures, and regulatory compliance play key roles.

Centralized vs. Decentralized Exchanges: Pros and Cons

CEXs like Binance or Coinbase provide high liquidity but higher slippage risks during flash crashes. DEXs, empowered by 2025 innovations like Curve Finance’s stablecoin optimizations, offer better privacy and lower fees. A Kraken study (October 2025) notes that hybrid routing—combining CEX and DEX—maximizes fills while reducing slippage to under 0.5%.

For bots, prioritize exchanges with robust APIs. PickMyTrade automation trading simplifies exchange selection by analyzing real-time data and routing to the optimal venue.

Criteria for Optimal Exchange Selection

- Liquidity Metrics: Choose exchanges with high 24-hour volume. Tools like CoinMarketCap’s API (updated 2025) help bots query this dynamically.

- Fee Optimization: Low maker/taker fees are vital. Recent FTX relaunch (mid-2025) introduced zero-fee tiers for bots, slashing costs.

- Security and Compliance: Post-2024 hacks, exchanges like Gemini enhanced bot security with multi-signature wallets.

- Geographic Considerations: For global bots, route to region-specific exchanges to avoid latency-induced slippage.

Integrating these into your setup via PickMyTrade automation trading ensures automated, data-driven exchange selection.

Advanced Tools and Recent Updates in Crypto Bot Routing

The crypto landscape evolves rapidly. In 2025, AI integration became mainstream—bots like those on TradingView now use machine learning for predictive routing. OpenAI’s collaboration with crypto firms (announced November 2025) introduced models that forecast slippage based on sentiment analysis.

Layer-1 chains like Near Protocol updated their sharding in Q3 2025, enabling sub-second routing with near-zero slippage. For automation, PickMyTrade stands out with its no-code interface, allowing users to set custom routing rules that adapt to these updates.

To stay ahead, regularly audit your bot’s performance using tools like Kaiko’s analytics (enhanced in 2025) for slippage tracking.

Conclusion: Elevate Your Trading with Smart Crypto Bot Routing

Optimizing crypto bot routing to reduce slippage and refine exchange selection isn’t optional—it’s essential for maximizing fills in 2026’s volatile markets. By adopting aggregators, smart orders, and tools like PickMyTrade automation trading, you can achieve professional-grade automation.

Start small: Test your setup on a demo account, monitor metrics, and scale. With these strategies, your crypto bots will not only survive but thrive.

Most Asked FAQs on Crypto Bot Routing

Use multi-exchange aggregators and TWAP orders to split trades and access deeper liquidity pools.

Proper exchange selection ensures low fees, high liquidity, and minimal latency, directly boosting fill rates and reducing slippage.

Yes, it offers seamless integration for automated routing, aggregation, and real-time adjustments to optimize trades.

Track the difference between expected and executed prices using analytics tools like Kaiko or built-in bot dashboards.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: IB API Python 2026: Automated Trading Setup – PickMyTrade