In 2025, selecting the right trading platform is crucial for maximizing both profits and efficiency. Interactive Brokers vs. TradeStation 2025 remains a common comparison among traders seeking robust tools, competitive fees, and reliable execution.

In this in-depth analysis, we’ll compare Interactive Brokers and TradeStation to help you decide which platform aligns best with your trading style, whether you’re a global investor or a U.S.-focused active trader.

Overview

Interactive Brokers is ideal for traders who value global access, low fees, and a broad range of asset classes, including cryptocurrencies. It’s designed for both beginner and professional traders who want strong research and education tools.

TradeStation is tailored for U.S.-focused active traders who prioritize automation, technical charting, and backtesting tools. It has strong appeal among algorithmic traders and professionals who value customization and speed.

In summary:

- Choose IBKR if you want global markets, low fees, and comprehensive investment choices.

- Choose TradeStation if you need advanced charting, automation, and plan to focus on U.S. markets.

Company Snapshot

Interactive Brokers (IBKR)

- Founded: 1978, publicly traded (NASDAQ: IBKR)

- Headquarters: Greenwich, Connecticut

- Clients: Over 3.4 million accounts

- Daily Trades: ~3 million

- Supported Assets: Stocks, ETFs, options, futures, forex, bonds, mutual funds, and 11 cryptocurrencies

- 2025 Update: Introduced Forecast Contracts in Canada for market prediction

TradeStation

- Founded: 1982, a Monex Group subsidiary

- Headquarters: Plantation, Florida

- Focus: Primarily U.S. equities, futures, options, and mutual funds

- 2025 Update: Added micro futures contracts and TipRanks integration

Feature Comparison

| Category | Interactive Brokers (IBKR) | TradeStation |

|---|---|---|

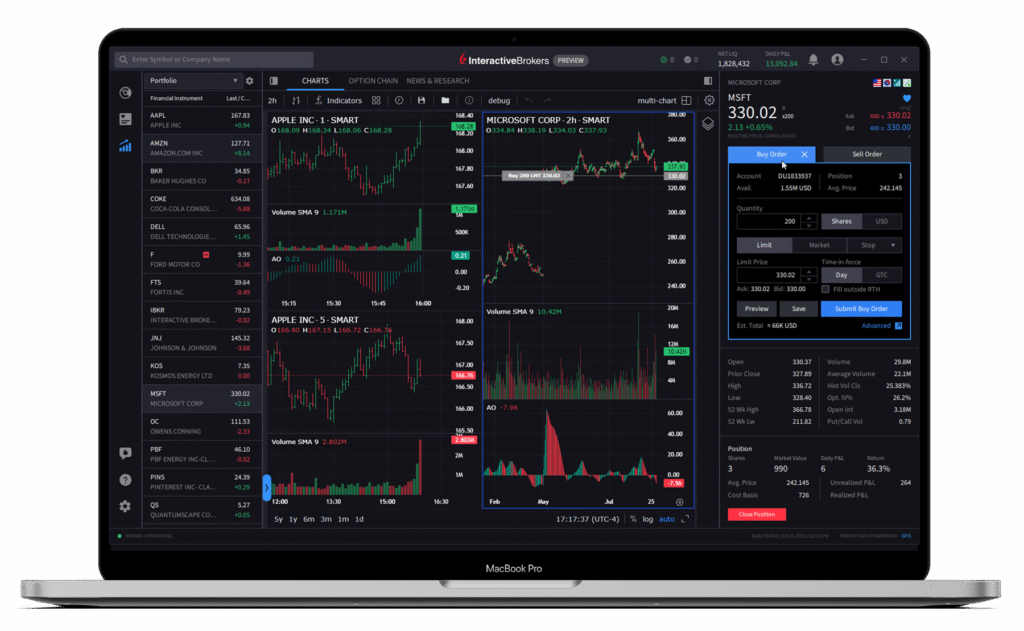

| Platforms | TWS, GlobalTrader, Client Portal (cross-platform) | TradeStation 10 (Windows only), Web, Mobile |

| Charting | 155 indicators, 85 drawing tools | 294 indicators, custom studies |

| Research | 5/5 – multi-asset, ESG, downloadable reports | 2/5 – limited to U.S. equities |

| Education | 5/5 – structured learning with quizzes | 3/5 – basic education, no interactivity |

| Mobile App | Full-featured, supports Apple Watch and TV | Solid, but lacks wearable integrations |

Conclusion: IBKR offers more in terms of research, education, and platform compatibility. TradeStation leads in customizable charting and strategy tools.

Performance and Execution

Interactive Brokers supports high-frequency, global trading. Its SmartRouting system helps secure the best execution prices across multiple venues. Although some users report occasional login issues, overall reliability is excellent.

TradeStation offers fast execution specifically optimized for U.S. equities and options. It’s well-regarded among active traders but less flexible for global access.

Winner: Interactive Brokers, thanks to its broader market coverage and smart execution capabilities.

Automation and Strategy Development

Interactive Brokers provides basic automation features such as API access, paper trading, backtesting, and ladder trading. However, its tools are more execution-oriented than strategy-focused.

TradeStation, by contrast, is highly regarded for its advanced automation features:

- EasyLanguage scripting for custom strategies

- Portfolio Maestro for multi-strategy testing

- Advanced backtesting and scenario analysis

Winner: TradeStation, for its industry-leading support for custom automation.

Customer Satisfaction

| Platform | Trustpilot Rating | Common Praise | Common Criticism |

|---|---|---|---|

| Interactive Brokers | 3.0/5 (4,000+ reviews) | Low fees, global access, robust tools | Complex interface, slower customer support |

| TradeStation | 4.5/5 (800+ reviews) | Fast execution, responsive support | Inactivity fees, withdrawal delays |

Professional Ratings:

- IBKR: 5/5 (96.9%) from StockBrokers.com

- TradeStation: 4/5 (80.2%) from StockBrokers.com

Winner: TradeStation, based on user experience and support responsiveness.

Fees and Costs

| Fee Type | IBKR | TradeStation |

|---|---|---|

| Stock Trades | $0.00 (or tiered $0.005–$0.01/share) | $0.00 ($0.01/share, $1 min) |

| Options | $0.65 per contract | $0.60 per contract |

| Futures | $0.25 per contract (varies) | $1.50 per contract (varies) |

| IRA Fees | No fees | $35 annual, $50 closure |

| Inactivity Fees | None | $10/month (unless conditions met) |

| Margin Rate | 7.33% (<$25,000) | 13.0% (<$25,000) |

| Minimum Deposit | $0 (Lite), $1,000 (Pro) | $0 |

Conclusion: Interactive Brokers offers more favorable pricing overall, especially for margin traders, IRA accounts, and long-term investors.

Additional Considerations

- Cryptocurrency: IBKR supports trading in 11 major coins; TradeStation does not currently offer crypto access.

- Banking Services: IBKR provides products like certificates of deposit (CDs); TradeStation lacks banking features.

- Global Market Access: IBKR gives access to over 200 international markets. TradeStation is limited to U.S. markets.

- Security: Both are FINRA members and SIPC-insured. IBKR offers higher excess SIPC coverage (up to $30 million vs. TradeStation’s $300 million).

Final Recommendation

Go with Interactive Brokers if you:

- Want access to global markets and cryptocurrencies

- Care about lower trading fees and better margin rates

- Value professional-level research, education, and platform flexibility

Go with TradeStation if you:

- Focus on U.S.-based, high-frequency trading

- Want best-in-class charting and strategy development

- Appreciate strong customer support and tailored automation tools

Conclusion

Both Interactive Brokers and TradeStation have earned their place as top trading platforms in 2025, but they cater to different needs. Interactive Brokers is the more versatile, cost-effective choice for global and multi-asset traders. TradeStation excels for algorithmic and active U.S. traders who need deep customization and automation.

The best choice depends on your trading priorities whether it’s cost and global reach, or strategy automation and technical analysis.

You May also Like:

Trading with Interactive Brokers (IBKR) and PickMyTrade Automation

TradeStation Review (2025): Unlocking Advanced Trading Tools

Ready to Trade Smarter?

Take your trades to the next level with sniper entries and automated stock trading tools. Pair technical setups with the best futures trading platforms and make your execution precise and automatic.

Disclaimer: Trading involves risk. Only invest what you can afford to lose. No strategy guarantees future performance.