Want to know how the pros sense market panic before it hits? The VIX index, often called the “fear gauge,” can help you read the market’s emotional state. When combined with smart tools like IBKR trade automation, you can not only detect volatility early but also act on it—automatically.

What Is the VIX?

The VIX (Volatility Index) measures expected volatility in the S&P 500. It’s a real-time fear meter for financial markets.

- Low VIX (under 15) → Calm market, bullish bias

- High VIX (over 25) → Fear or panic, possible bearish bias

Smart traders use the VIX as a market filter—knowing when to risk more and when to pull back.

How to Use the VIX in Your Trading Strategy in IBKR Automation

You can use the VIX in two major ways:

1. Filter Your Trades

Use the VIX to avoid risky conditions or fakeouts. For example:

- Only enter long trades when the VIX is below a certain level

- Avoid shorting in calm markets where volatility is low

2. Trigger Your Trades

Let the VIX act as your trade signal. You can create rules like:

- If VIX crosses above 25, enter short positions

- If VIX drops below 15, enter long positions

These filters are especially effective when automated.

VIX Strategy for Momentum Traders with IBKR Automation

Here’s a simple VIX-based approach:

- Avoid trading when VIX is flat or below 15 → Market is too calm

- Wait until VIX spikes above 25 → Volatility kicks in

- Execute trend or breakout strategies only during high VIX periods

Want to take it further? You can automate this strategy using tools like Pick My Trade connected to Interactive Brokers (IBKR).

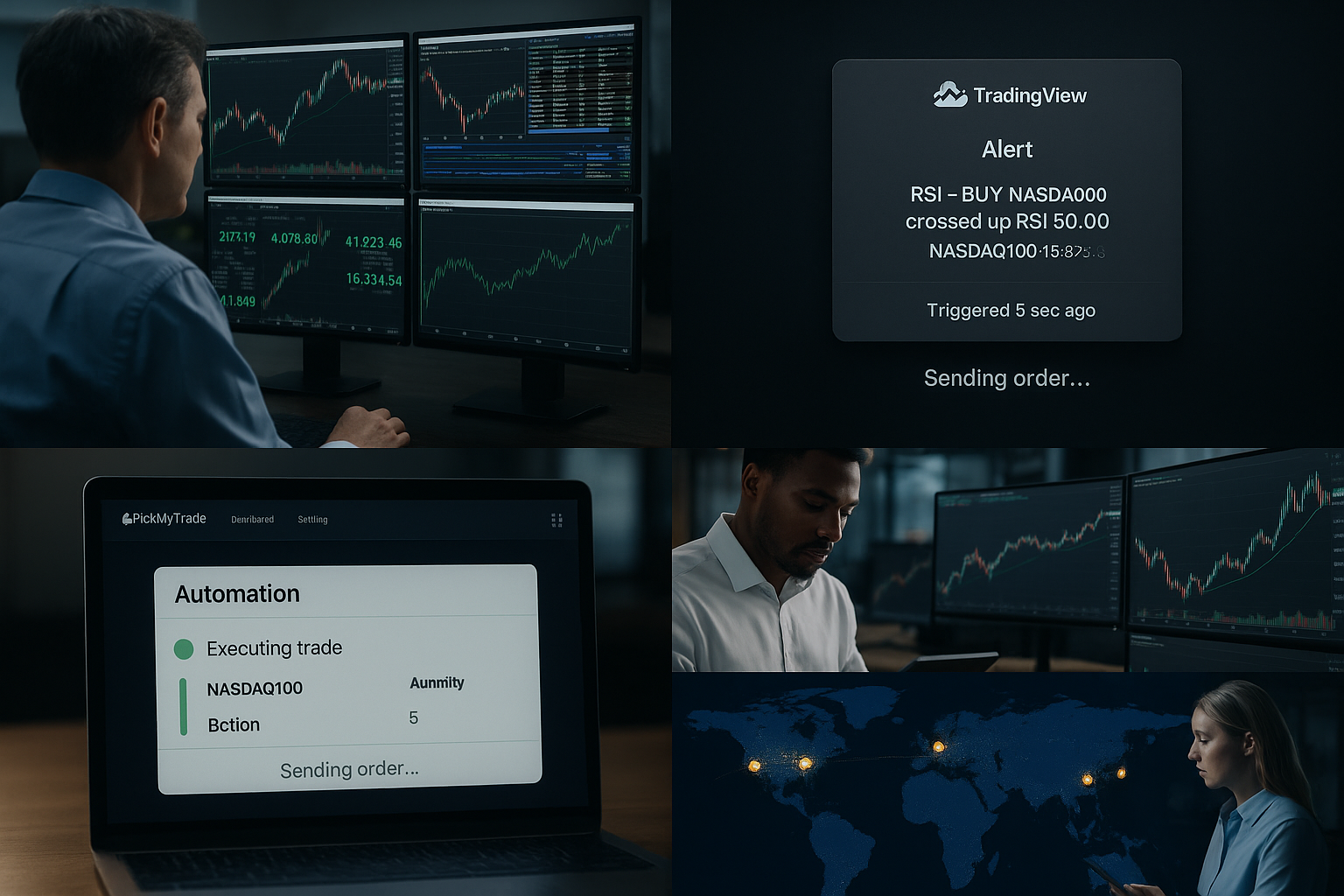

Automate VIX Trading with IBKR Automation

Manual trading during volatile moments is tough. By using IBKR automation, you can:

- Set VIX-based rules on TradingView

- Trigger trades automatically using PickMyTrade

- Execute across multiple accounts instantly via Interactive Brokers (IBKR)

You can also connect with other brokers like:

- Rithmic

- TradeLocker

- TradeStation

- ProjectX

With IBKR automation, your system reacts in milliseconds—faster than human hands.

Conclusion

The VIX index is more than just a volatility gauge—it’s a powerful filter and trigger for better trades. When combined with IBKR trade automation, you can fully automate your VIX-based strategies, avoid emotional errors, and seize opportunities in volatile markets.

Ready to level up your trading?

Start using the VIX—and let automation do the heavy lifting.

Also Checkout: Alpha Trader Firm: Your 2025 Trading Adventure Awaits!