In trading, early losses can feel like a punch in the gut. That’s where absolute drawdown comes in—and why using FunderPro automation can help you understand the risk before you commit real capital.

What Is Absolute Drawdown?

Absolute drawdown is the biggest drop in your trading account from the starting balance before it makes any gains. It’s a key metric that shows the initial risk your trading strategy carries.

Example:

You start with $100,000. Your account dips to $90,000 before recovering.

Your absolute drawdown is $10,000.

Why Absolute Drawdown Matters

High absolute drawdown early in a strategy can be alarming—even if the strategy ends up being profitable. It shows how much capital you’re risking right out of the gate.

FunderPro automation helps you assess this upfront. Before you fund any strategy, you’ll want to know how much drawdown it experienced in testing.

Absolute Drawdown vs. Total Losses

Absolute drawdown tells you the first major dip, not the total loss over time.

A strategy may recover—and even thrive—after a sharp early dip.

Using FunderPro automation, you can instantly spot drawdown patterns from backtests and historical performance, saving time and reducing emotional decision-making.

Real-World Examples

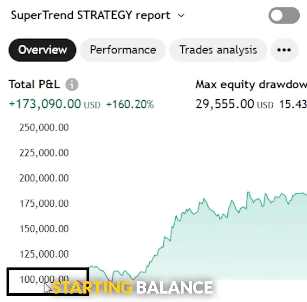

Supertrend Strategy

- Starting Balance: $100,000

- Dropped to: $90,000

- Absolute Drawdown: $10,000

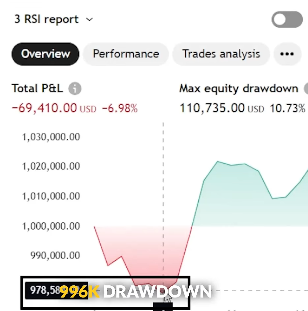

3 RSI Strategy

- Starting Balance: $1,000,000

- Dropped to: $996,000

- Absolute Drawdown: $4,000

Even with fewer trades, a strategy can carry higher risk if that early dip is deep.

How to Find Absolute Drawdown in TradingView

- Open the Strategy Tester.

- Run your strategy.

- Look for “Initial Drawdown” or “Absolute Drawdown” in the results.

Pro Tip: Use this data with FunderPro automation to filter out strategies that don’t match your risk profile.

Why Drawdown Isn’t the Whole Story

A big drawdown doesn’t mean the strategy is bad. Look at:

- Recovery Potential

- Profitability Over Time

- Consistency Across Markets

FunderPro automation gives you access to more than just one metric—helping you automate and evaluate strategies holistically.

What to Look at Besides Drawdown

- Net Profit: Total earnings after all trades

- Risk-Reward Ratio: How much you risk vs. potential gain

- Win Rate + Equity Curve: Frequency of wins and overall performance trend

When combined with absolute drawdown, these metrics give you a complete view.

Take the Next Step with FunderPro Automation

Want to test and automate your trading strategies with full visibility on risk?

FunderPro lets you:

Backtest with real data

See absolute drawdown instantly

Automate trades from TradingView

Align strategies with your risk tolerance

Explore tools at PickMyTrade to automate with brokers like FunderPro, Tradovate, IBKR, and more.

Conclusion

Absolute drawdown is the silent signal you shouldn’t ignore. It reveals how much you’re risking from the very start. With FunderPro automation, you can catch these red flags early and avoid funding high-risk strategies blindly.

Ready to protect your capital and trade smarter?

Let FunderPro automation guide your next move.

Also Checkout: Don’t Be Fooled by Win Rate: The Trading Pit Automation Strategy