The Evening Star candlestick pattern is one of the most reliable bearish reversal signals — especially when it forms at a key resistance zone. When combined with automated futures trading tools like PickMyTrade, Rithmic, or ProjectX charts, you can trade this pattern with speed, precision, and confidence.

Let’s explore how to spot the pattern, set up the trade, and automate your entries with TradingView.

What is the Evening Star Candlestick Pattern?

The Evening Star is a three-candle bearish reversal pattern that often marks the end of an uptrend:

- Large Green Candle – confirms strong buying pressure.

- Small-Bodied Candle (Doji or Spinning Top) – shows indecision.

- Large Red Candle – closes below the midpoint of the first green candle, confirming bearish reversal.

This pattern signals a shift from bullish to bearish momentum and is even stronger when it forms near a resistance zone.

Why Resistance Zones Strengthen the Pattern

A resistance zone is where price has struggled to move higher in the past. When the Evening Star pattern forms at resistance:

- It suggests sellers are stepping in again.

- It adds confirmation to the bearish reversal.

- It’s ideal for high-probability automated short entries.

Use tools like ProjectX chart overlays or custom TradingView indicators to identify resistance zones quickly.

Trade Setup: Entry, Stop Loss, and Take Profit

Entry Rule:

Enter a short position after the third (red) candle of the Evening Star pattern closes below the midpoint of the first candle.

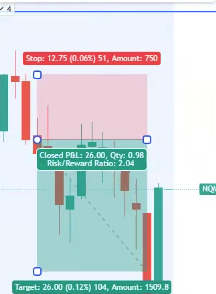

Stop Loss:

Place the stop loss above the wick of the second candle (the indecision candle). This protects you from false breakouts.

Take Profit:

Use a 2:1 risk-reward ratio. For example:

- Risk = 10 points

- Reward target = 20 points

This keeps your strategy profitable over the long term.

Automate It with PickMyTrade + TradingView

Tired of missing trades? Automate your Evening Star at resistance strategy using:

- TradingView alerts (pattern + zone match)

- PickMyTrade.io for webhook-based execution

- Support for Rithmic, TopstepX, TradeStation, and more

Once the alert fires, your trade is auto-executed — including stop-loss and take-profit — without needing to monitor charts all day.

This is the future of automated futures trading.

Real Example Using ProjectX & Auto Execution

- Resistance Level: 4400 on ES Futures

- Evening Star Pattern Forms: At the zone

- Alert Triggers on TradingView: Pattern + resistance match

- PickMyTrade Webhook: Instantly executes a short trade via Rithmic

Result? Fast, rule-based, emotion-free trading.

Key Benefits of Automated Futures Trading

- Consistent execution without delay

- Instant reaction to chart patterns

- Works with platforms like ProjectX chart and TopstepX

- Integrates with futures bots, risk rules, and multi-broker automation

Conclusion

The Evening Star pattern becomes a high-probability short setup when it forms at resistance — especially on futures charts. Add automation with PickMyTrade and brokers like Rithmic or TopstepX to remove emotion and increase precision.

Start automating your favorite price action setups today — and trade smarter, not harder.

Also Check-Out: Comparing the Best Prop Trading Firms on TradeLocker in 2025