In the fast-paced world of algorithmic trading, API rate limits and request throttling are critical factors that can make or break your automation strategies. As markets evolve rapidly in 2025, understanding these constraints ensures reliable, uninterrupted trade execution.

What Are API Rate Limits in Trading Automation?

API rate limits restrict the number of requests you can send to a broker’s or exchange’s API within a specific timeframe. This prevents server overload, ensures fair resource allocation, and protects against abuse.

In trading automation, exceeding these limits triggers errors like HTTP 429 (Too Many Requests), halting data fetches, order placements, or position updates. This can lead to missed opportunities or flawed executions.

Common limits include:

- Requests per minute

- Per second bursts

- Order-specific caps

Why Request Throttling Matters for Automation

Request throttling is the mechanism APIs use to enforce rate limits—slowing or blocking excess requests. For automated systems relying on frequent polling for quotes, order status, or market data, poor throttling management causes delays or bans.

In high-frequency setups, unhandled throttling disrupts backtesting, live trading, and multi-account management. Platforms like PickMyTrade excel here by automating TradingView strategies without direct API polling, bypassing many traditional rate limit issues through efficient webhook-based execution.

Common API Rate Limits Across Major Platforms (2025 Updates)

Rate limits vary by provider and haven’t seen major universal changes in 2025, but always check official docs for real-time accuracy:

- Alpaca: 200 requests per minute per account (upgradable to higher for non-retail).

- Interactive Brokers (IBKR): Up to 50 requests/messages per second.

- Tradier: 60-120 requests per minute depending on endpoint.

- Binance (Spot): Weight-based, typically ~1200-6000 per minute (IP-based).

- Kraken: Counter-based, decreasing over time.

Crypto exchanges like Binance emphasize order limits separately to prevent spam.

Best Practices for Handling API Rate Limits in Trading Automation

To thrive in automation:

- Monitor Headers: Use response headers (e.g., X-RateLimit-Remaining) to track usage dynamically.

- Implement Backoff: On 429 errors, apply exponential backoff retries.

- Batch Requests: Fetch multiple symbols or data points in one call.

- Switch to Streaming/WebSockets: Reduce polling with real-time pushes (available on many platforms).

- Cache Data: Store non-volatile info locally.

- Use Efficient Tools: Platforms like PickMyTrade automate TradingView alerts to brokers (e.g., Tradovate, Rithmic, IBKR, Binance) via webhooks—no constant API polling needed. This sidesteps rate limits while enabling millisecond-precision execution across multiple accounts.

PickMyTrade’s cloud-based approach runs 24/7, handling complex strategies without coding or API management headaches—ideal for prop firms and multi-account traders.

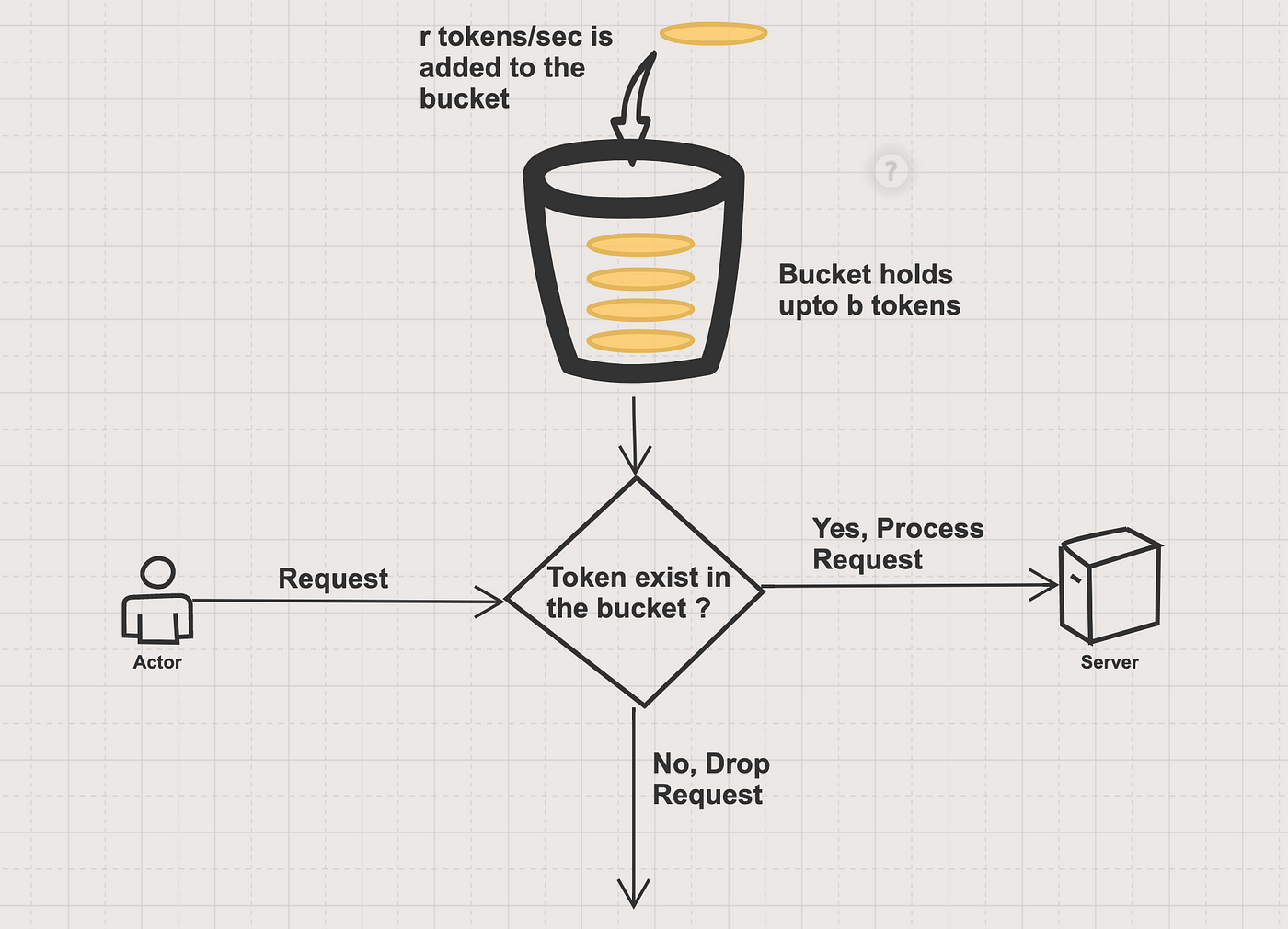

Rate limiter and its algorithms with illustrations

Click Here To Start Futures Trading Automation For Free

Overcoming Request Throttling in Automation

Advanced techniques:

- Leaky Bucket or Token Bucket algorithms in custom code.

- Prioritize critical requests (e.g., orders over quotes).

- Distribute load across multiple API keys (where allowed).

For webhook-driven automation like PickMyTrade, throttling becomes minimal since alerts trigger executions directly.

Conclusion: Stay Ahead with Smart Automation

Mastering API rate limits and request throttling is essential for robust trading automation in 2025. By optimizing requests and leveraging tools like PickMyTrade, you ensure consistent performance without disruptions.

Ready to automate seamlessly? Explore PickMyTrade for webhook-based TradingView integration today.

Most Asked FAQs on API Rate Limits in Trading

Typically, you receive a 429 error. Repeated violations may lead to temporary bans or IP blocks.

Some brokers (e.g., Alpaca) allow upgrades via support; others tie it to account type or volume.

Use streaming data, batching, caching, and exponential backoff. Tools like PickMyTrade minimize direct API calls.

Often similar, but live accounts may have stricter enforcement or higher tiers.

Yes, it’s industry standard for stability and fairness.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: TradingView Paper Trading: Fix Issues & Master Simulations