What Is Algorithmic Trading?

Algorithmic trading, or algo trading, uses computer programs to execute trades based on predefined criteria like price, timing, or volume. For retail investors, this means automating strategies to monitor markets 24/7 without constant oversight, processing vast data for opportunities humans might miss. Common strategies include trend following (buying on upward momentum) and mean reversion (betting prices return to averages).

Benefits and Risks at a Glance

Algo trading offers speed and emotion-free decisions but carries risks like system glitches. Here’s a quick overview:

| Aspect | Benefits | Risks |

|---|---|---|

| Execution | Faster trades, reduced costs | Technical failures, slippage |

| Decision-Making | No emotional bias, backtesting | Over-optimization, black swan events |

| Accessibility | Low entry barriers for retail | High learning curve, regulatory compliance |

Ready to experience automation yourself?

Start your free 5-day trial today → Click here

How to Get Started

- Build Foundations: Learn markets, programming (e.g., Python), and strategies.

- Choose a Platform: Opt for user-friendly ones like QuantConnect for backtesting.

- Test Thoroughly: Backtest strategies, then paper trade.

- Go Live Safely: Start with small capital, comply with local rules (e.g., SEBI in India).

For India-based investors, SEBI’s 2025 rules require broker-approved algos to ensure safer participation.

Introduction to Algorithmic Trading: Empowering Retail Investors in 2025

In the evolving landscape of financial markets, algorithmic trading has transitioned from a tool of institutional heavyweights to an accessible avenue for retail investors. As of November 2025, with global markets increasingly digitized and tools like cloud-based APIs lowering barriers, individual traders in regions like India, the US, and EU can leverage automation to compete more effectively. This guide draws from authoritative sources to provide a comprehensive roadmap, emphasizing practical steps, balanced insights on opportunities and pitfalls, and region-specific considerations. Whether you’re in Lucknow exploring NSE opportunities or trading US equities, the principles remain: education first, cautious implementation second.

Algo trading involves deploying pre-programmed instructions—algorithms—to execute trades based on variables such as price thresholds, volume spikes, or technical indicators. Unlike manual trading, it operates at speeds unattainable by humans, analyzing terabytes of data in milliseconds to capitalize on fleeting inefficiencies. For retail investors, this means shifting from gut-feel decisions to data-driven systems, potentially yielding higher consistency but demanding technical savvy.

The global algo trading market, valued at $2.03 billion in 2022, is projected to reach $3.56 billion by 2030, driven by retail adoption via affordable platforms. In India, SEBI’s February 2025 circular on “Safer Participation of Retail Investors in Algorithmic Trading” marks a pivotal shift, allowing retail access under strict oversight to mitigate risks like manipulation. Similarly, US brokers like Alpaca offer commission-free APIs, while EU’s MiFID II enforces resilience testing for algorithms.

This survey expands on the essentials, delving into strategies, tools, regulations, and real-world applications, with tables for quick reference and citations for verification.

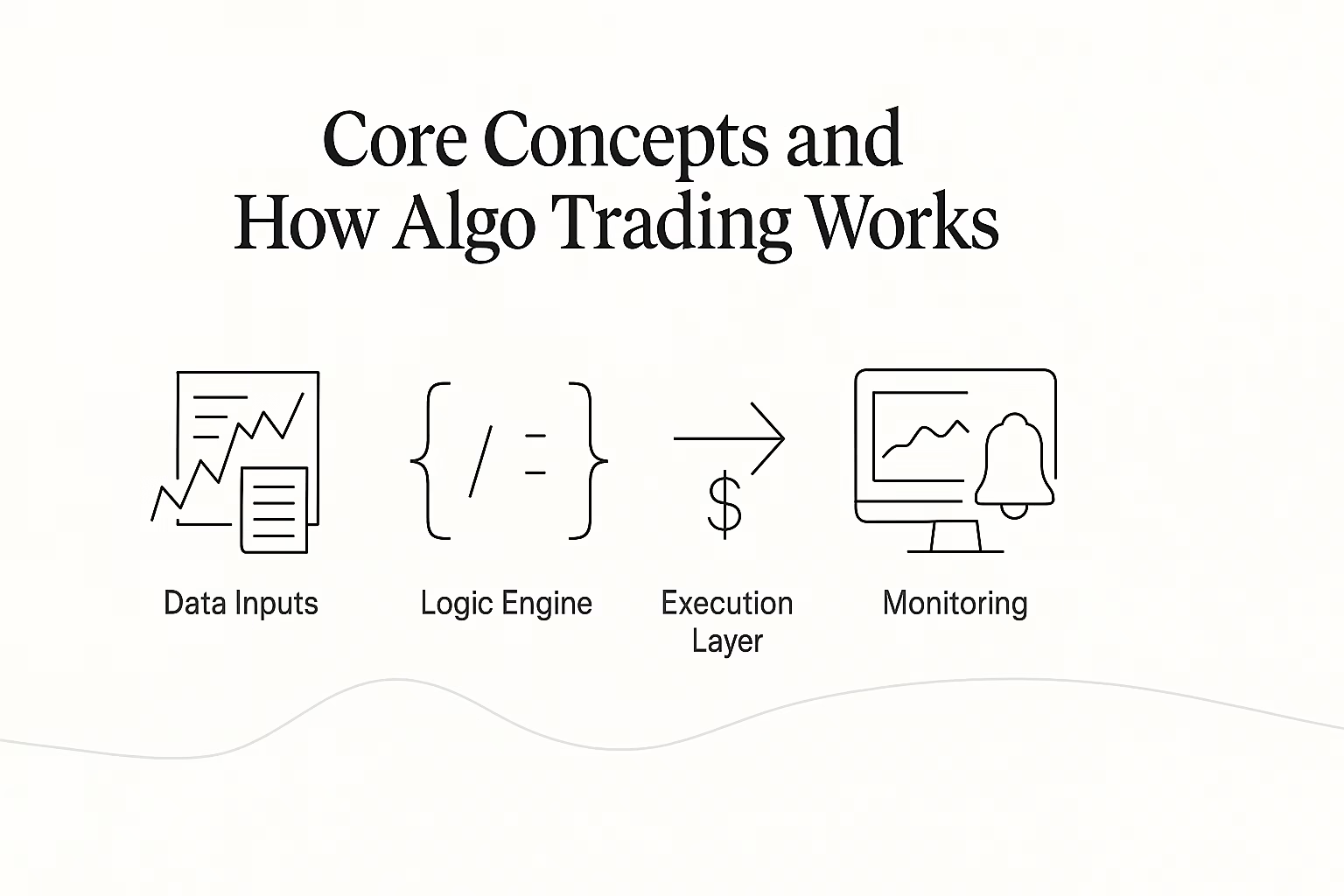

Core Concepts and How Algo Trading Works

At its heart, algo trading automates the trade lifecycle: signal generation, order placement, and execution. An algorithm might scan for a 50-day moving average crossing the 200-day line, triggering a buy order if volume exceeds a threshold. Key components include:

- Data Inputs: Real-time feeds (prices, news) and historical datasets for analysis.

- Logic Engine: Rules coded in languages like Python, using libraries such as Pandas for data handling or TA-Lib for indicators.

- Execution Layer: APIs connecting to brokers for order routing, often with risk checks like stop-losses.

- Monitoring: Dashboards for performance tracking, alerting on anomalies.

For retail users, the process starts with hypothesis formation—e.g., “Post-earnings momentum persists for 3 days”—followed by coding, testing, and deployment. High-frequency trading (HFT), a subset, executes thousands of trades per second but is less feasible for retail due to latency needs; instead, focus on mid-frequency strategies over minutes to days.

Common Strategies for Retail Investors

Retail algos thrive on simple, robust strategies adaptable to stocks, forex, or options. Here’s a table of foundational ones, with examples:

| Strategy | Description | Example Implementation | Suitability for Retail |

|---|---|---|---|

| Trend Following | Identifies and rides market trends using moving averages or breakouts. | Buy if 50-day MA > 200-day MA; sell on reverse. | High; works in volatile markets like NSE equities. |

| Mean Reversion | Assumes prices revert to historical averages after deviations. | Sell if price > upper Bollinger Band; buy below lower. | Medium; ideal for range-bound assets like forex pairs. |

| Momentum | Buys assets showing upward velocity, exits on slowdown. | Enter after RSI > 70 post-earnings; trail stops. | High; leverages short-term inefficiencies. |

| Arbitrage | Exploits price discrepancies across exchanges. | Buy low on NSE, sell high on BSE for same stock. | Low; requires low latency, better for pros. |

| VWAP/TWAP | Executes large orders at volume- or time-weighted averages to minimize impact. | Slice 10,000 shares into chunks matching daily volume. | High; useful for portfolio rebalancing. |

These can be coded in Python: For trend following, use if sma_short > sma_long: buy(). Start with open-source libraries like Backtrader for prototyping.

Ready to experience automation yourself?

Start your free 5-day trial today → Click here

Benefits: Why Retail Investors Are Turning to Algos

Algo trading addresses key pain points in manual trading, offering empirical advantages backed by market data. Primary benefits include:

- Speed and Precision: Executes in milliseconds, capturing opportunities like arbitrage spreads that vanish quickly.

- Emotion Elimination: Removes fear/greed, sticking to rules—studies show this boosts consistency by 20-30% in backtests.

- Backtesting and Optimization: Simulate years of data to refine strategies, calculating metrics like Sharpe ratio (risk-adjusted returns) or maximum drawdown.

- Diversification and Scalability: Monitor multiple assets simultaneously, scaling from $500 portfolios to larger ones without proportional effort.

- Cost Efficiency: Commission-free platforms reduce fees; in India, SEBI-approved algos lower entry barriers for retail.

For Indian retail investors, adoption surged post-2025 SEBI reforms, with platforms reporting 40% growth in API sign-ups, enabling safer automation.

Risks and Challenges: Navigating the Downsides

While promising, algo trading isn’t risk-free; evidence from flash crashes (e.g., 2010 Dow plunge) highlights systemic vulnerabilities. Key risks:

- Technical Glitches: API downtime or coding errors can trigger erroneous trades, amplifying losses in volatile sessions like budget days in India.

- Over-Optimization (Curve-Fitting): Strategies tuned too closely to historical data fail live; mitigate with out-of-sample testing.

- Market and Liquidity Risks: Algos can exacerbate volatility if many follow similar logic; black swan events (e.g., 2022 crypto crash) expose rigidity.

- Regulatory and Compliance Hurdles: Non-adherence leads to bans—SEBI requires algo tagging and broker empanelment; EU MiFID II mandates kill switches.

- Psychological and Cost Factors: Initial setup (VPS, data feeds) costs $100-500/month; drawdowns test resolve, with 25% losses common even in winning strategies.

A balanced view: Pros outweigh cons for educated users, but beginners should allocate <10% of capital initially. Counterarguments from skeptics note that 70% of retail algos underperform benchmarks due to overfitting, underscoring the need for realism.

| Risk Category | Mitigation Strategy | Example Tool/Resource |

|---|---|---|

| Technical | Redundant servers, error logging | Cloud VPS like AWS; Python’s try-except |

| Overfitting | Walk-forward analysis, fewer parameters | QuantConnect for out-of-sample tests |

| Regulatory | Algo registration, compliance audits | SEBI’s February 2025 circular guidelines |

| Psychological | Position sizing (1-2% risk per trade) | Kelly Criterion in code |

Step-by-Step Guide: Building and Deploying Your First Algo

Step 1: Acquire Essential Skills

Master basics via free resources: Investopedia for concepts, QuantStart for backtesting pitfalls, or Groww’s India-focused tutorials. Learn Python (via Codecademy) for its libraries—e.g., NumPy for math, Matplotlib for visualizations.

Step 2: Select Platforms and Brokers

Choose based on API quality, fees, and assets. For 2025 retail:

| Platform/Broker | Key Features | Best For | Fees (Approx.) | Region Focus |

|---|---|---|---|---|

| Alpaca | Free API, paper trading, Python/JS support | US stocks, beginners | Commission-free | US |

| Interactive Brokers | Global access, low latency, multi-language | International, advanced | $0.005/share | Global |

| QuantConnect | Open-source backtesting, cloud data | Strategy dev, multi-asset | Free tier | Global |

| Groww/Zerodha (India) | SEBI-compliant APIs, low brokerage | NSE/BSE equities | ₹20/order | India |

| OANDA | Forex-focused, 15+ years data | Currency pairs | Spread-based | EU/US |

Step 3: Develop and Backtest Strategies

Code a simple momentum algo: Use historical NSE data to test RSI crossovers. Backtesting pitfalls include look-ahead bias (using future info)—avoid by lagging indicators. Tools: Zipline (Python) for simulations; aim for Sharpe >1.0 and drawdown <20%.

Best practices:

- Use survivorship-free data (include delisted stocks).

- Incorporate costs: 0.1% slippage, commissions.

- Walk-forward: Optimize on 70% data, validate on 30%.

Step 4: Paper Trade and Go Live

Simulate live with demo accounts (e.g., Alpaca’s). Monitor for slippage, then deploy small—e.g., ₹10,000 in India. Integrate risk: Max 2% portfolio risk per trade.

Step 5: Monitor and Iterate

Use logs for audits; adjust quarterly. In EU, test for MiFID II resilience (e.g., no disorderly trading).

Regulations: A Global and India-Specific Overview

Regulations ensure fairness, with retail protections varying:

- US: CFTC’s Reg AT mandates risk controls; no retail bans, but PDT rules apply for day trades.

- EU (MiFID II): Firms must notify authorities, implement kill switches, and ensure algorithms don’t disrupt markets; continuous liquidity for market makers.

- India (SEBI 2025): Retail algos need exchange approval, white-box transparency (auditable code), and broker oversight. APIs must register by Nov 30, 2025; mock sessions by Jan 2026. Aims to curb manipulation, as in July 2025 Jane Street case.

Non-compliance risks fines or bans—always tag orders as “algo.”

Case Studies and Real-World Tips

- Success Example: A retail trader using QuantConnect’s mean reversion on Nifty 50 achieved 15% annualized returns in 2024 backtests, live-adjusted to 12% after costs.

- Failure Lesson: 2010 Flash Crash showed HFT rigidity; retail tip: Diversify strategies across assets.

Tips: Start with $500-1,000; join communities like Reddit’s r/algotrading; read “Quantitative Trading” by Ernest Chan. For Indians, leverage NSE’s May 2025 standards for seamless rollout.

Future Trends and Final Thoughts

By 2030, AI integration (e.g., ChatGPT for strategy ideation) and blockchain for transparent execution will further empower retail. Yet, success hinges on discipline: 80% of retail algos fail due to poor risk management, per forums. Approach with curiosity, verify via backtests, and scale gradually—this guide equips you to thrive.

Recommendation

For users seeking streamlined, beginner-friendly automation tools, consider exploring PickMyTrade, which provides simplified trade automation workflows suitable for retail algo traders.

You may also like:

Best Automated Trading Bots 2025: PickMyTrade vs Competition

Complete Guide to Automated Futures Trading Systems with PickMyTrade

GPT-4o vs GPT-4.5 vs o3 – How to Find the Right ChatGPT Model in 2025 for TradingView Strategy Development

Trading Bots Insights: Optimize Your Trading Strategies

Best AI Tools for Trading: Signal Generation, Strategy Building, and Automation

Key Citations

- Interactive Brokers: Retail Algorithmic Trading Guide

- Investopedia: Basics of Algorithmic Trading

- BrokerChooser: Best Brokers for Algo Trading 2025

- Investopedia: Algorithmic Trading Explained

- QuantStart: Successful Backtesting

- Groww: How to Start Algo Trading in India

- SEBI: Safer Participation in Algo Trading

- uTrade Algos: SEBI’s 2025 Rules

- ESMA: MiFID II Article 17

- QuantStart: Top Books for Algo Trading

- Reddit: Realistic Advice for Retail Algo Traders