Is your Guardeer Funding trading strategy not performing as well as you hoped? Do you have a low win rate or a high drawdown? Don’t worry — you can fix it without throwing your entire system away. Here are three quick tweaks to boost performance while keeping your core strategy intact.

1. Add a Trend Filter

A trend filter helps you only trade in the direction of the market’s main move. One of the simplest ways is by using the 200-day Simple Moving Average (SMA):

- If price is above the 200 SMA — only take long (buy) trades.

- If price is below the 200 SMA — only take short (sell) trades.

For Guardeer Funding traders, this approach can quickly improve win rates by keeping trades aligned with market momentum.

2. Apply a Volatility Filter

Not every market condition is worth trading. Using the Average True Range (ATR) helps you avoid low-volatility “chop” that eats into profits.

- ATR measures how much price typically moves.

- Skip trades when ATR is low — these periods are often noisy and unprofitable.

By applying a volatility filter, Guardeer Funding traders can reduce risk and avoid unnecessary drawdowns.

3. Control Risk with Position Sizing

Risk management is the backbone of any profitable strategy. Even if your system has an edge, poor position sizing can destroy your account.

- Risk only 1%–2% of your account balance per trade.

- Adjust position size to match volatility and stop-loss distance.

For Guardeer Funding challenges, tight risk control can mean the difference between passing and blowing your account.

Why These Tweaks Work

These three adjustments can rescue an underperforming Guardeer Funding strategy:

- Trend Filter – Avoids fighting the market.

- Volatility Filter – Keeps you out of dead zones.

- Risk Control – Smooths equity curves and limits big losses.

The beauty? You keep your original trade logic, just with better timing and safer execution.

Final Thoughts for Guardeer Funding Traders

Don’t ditch your Guardeer Funding trading strategy just because it’s struggling. Instead, use these quick fixes to reduce drawdown, increase consistency, and improve your chances of success.

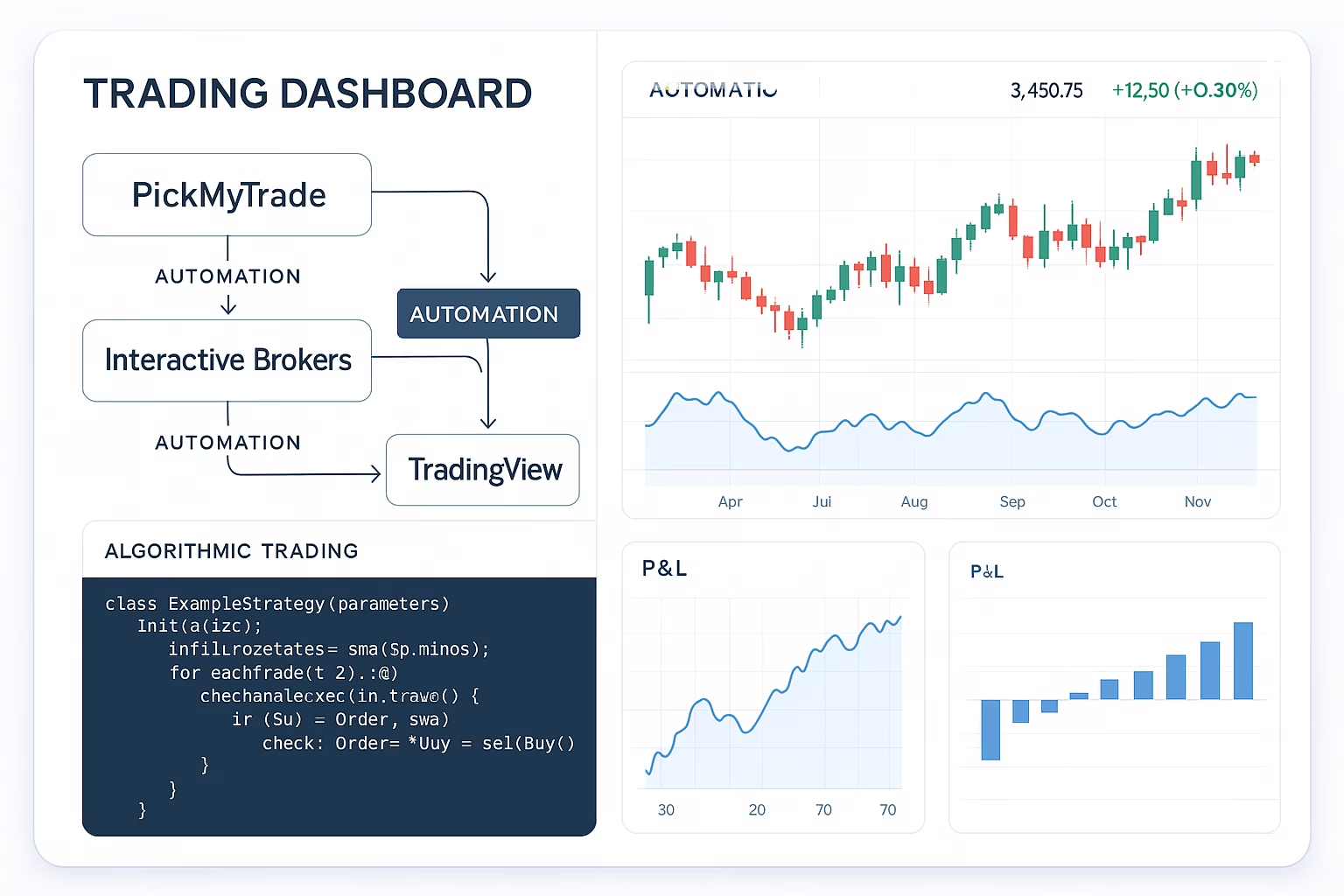

And if you want to take it one step further, you can automate your trades from TradingView using tools like PickMyTrade.io — perfect for keeping discipline in prop firm evaluations.

Also Checkout: Best Prop Firm Futures Strategy For You: RSI vs. Supertrend?