Standard bots for stock monitoring are automated scripts or programs designed to watch market data (prices, volume, indicators, news) continuously and trigger alerts or even trades when certain pre-defined conditions are met.

These bots help traders by:

- Scanning many stocks simultaneously

- Raising real-time alerts when criteria are fulfilled

- Executing certain automated tasks (e.g. sending notifications or triggering orders)

- Freeing traders from manually observing ticker screens all day

By combining monitoring bots with analysis tools and automation, you can stay informed and act quickly.

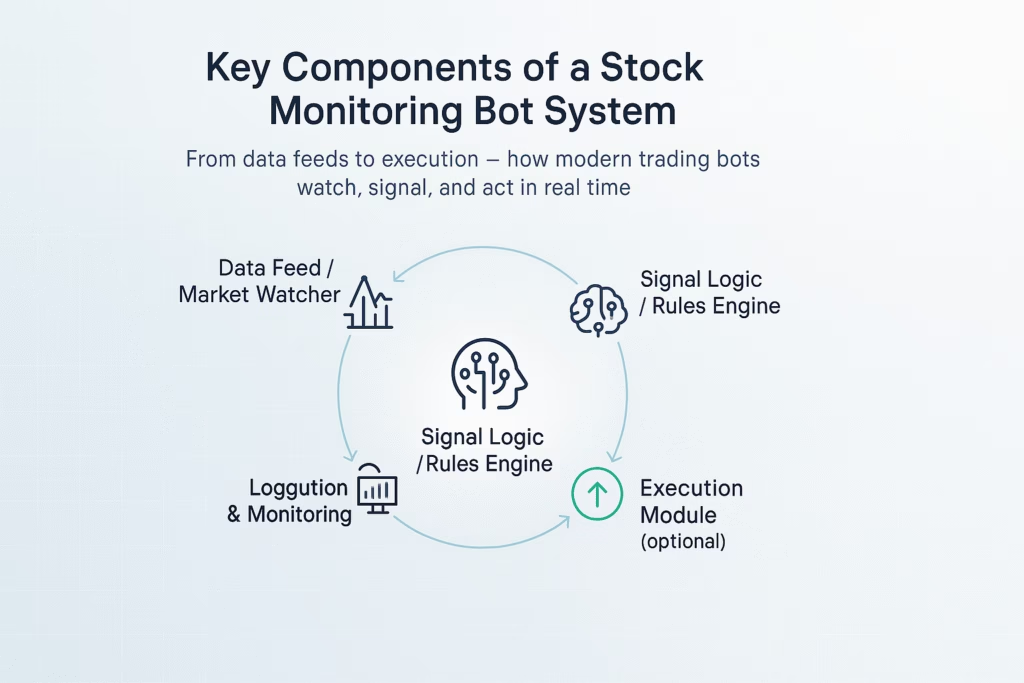

Key Components of a Stock Monitoring Bot System

To build or select a good monitoring bot system, these components matter:

| Component | Purpose | Typical Features |

|---|---|---|

| Data Feed / Market Watcher | Streaming real-time prices, volumes, order books | Fast APIs, low latency, multiple exchanges |

| Signal Logic / Rules Engine | Defines criteria (e.g. breakouts, volume spikes) | Technical indicators, threshold rules, pattern matching |

| Alert / Notification System | Notifies you when a signal fires | Email, SMS, mobile push, webhooks |

| Optional Execution Module | Automates trade placement when safe | Integrated broker APIs, safety checks |

| Logging & Monitoring | Track bot behavior, errors, performance | Logs, dashboards, health checks |

Popular Tools & Platforms for Stock Monitoring & Automation

Here are some tools and platforms (or integrations) traders use for bot-based monitoring and partial automation:

- Capitalise.ai — Enables rule-based trade scenarios in plain English. Monitors market data to send real-time alerts and supports automation.

- MultiCharts — A trading software platform that supports automated scripts (PowerLanguage / EasyLanguage) and real-time scanners.

- PickMyTrade — Lets you build automated bots for stocks, crypto, options, etc., integrated with brokers and driven by signals from tools like TradingView.

- Trade Ideas / TrendSpider / TradingView — Often used for alerts, scanning, and signal generation (some with semi-automation).

- QuantConnect / FinRL / Agentic systems — More advanced frameworks using quant models, RL or multi-agent systems to monitor, predict, and act.

These tools range from beginner-friendly scanners & alert systems to full algorithmic environments.

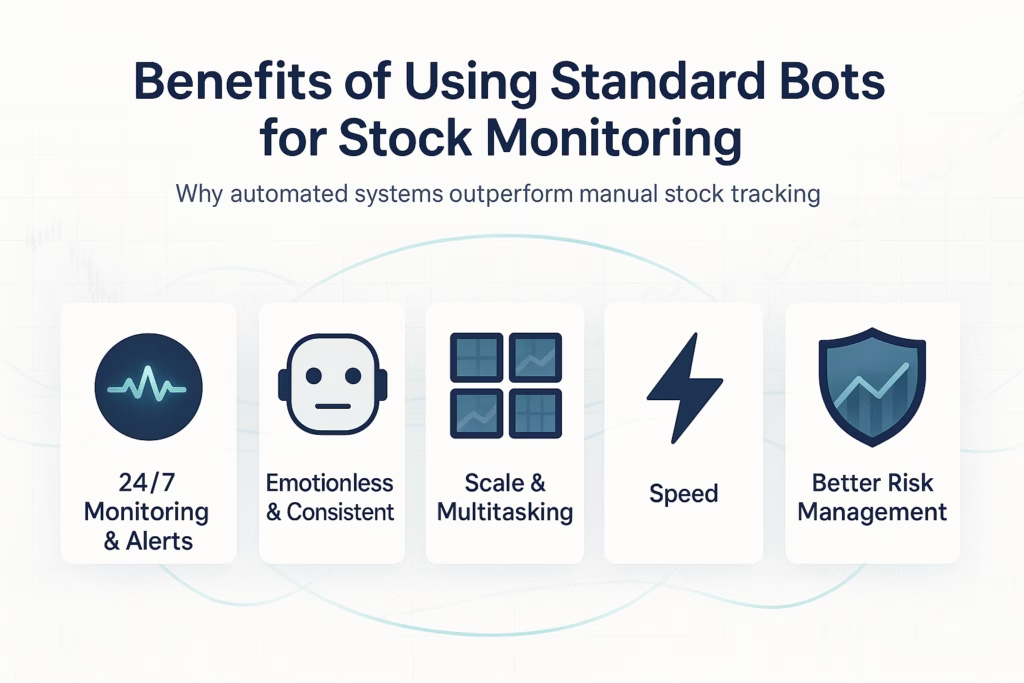

Benefits of Using Standard Bots for Stock Monitoring

- 24/7 Monitoring & Alerts — bots don’t sleep, so you won’t miss opportunities

- Emotionless & Consistent — alerts are based on rules, not fear or greed

- Scale & Multitasking — monitor dozens or hundreds of stocks simultaneously

- Speed — bots detect patterns and trigger alerts faster than humans

- Better Risk Management — you can set alerts for stop-loss breaches, volatility surges, etc.

Click Here To Start Stock Trading Automation For Free

Challenges & Risks to Be Aware Of

- False Signals & Noise — sudden spikes or anomalies can trigger alerts you don’t want

- Latency & Data Delay — small delays can reduce alert usefulness

- Overfitting / Rigid Rules — rules may work historically but break in new market regimes

- Execution Risk — if bots also place orders, errors or connectivity failures can cause costly mistakes

- Maintenance Overhead — you’ll need to tweak rules, monitor performance, and fix bugs

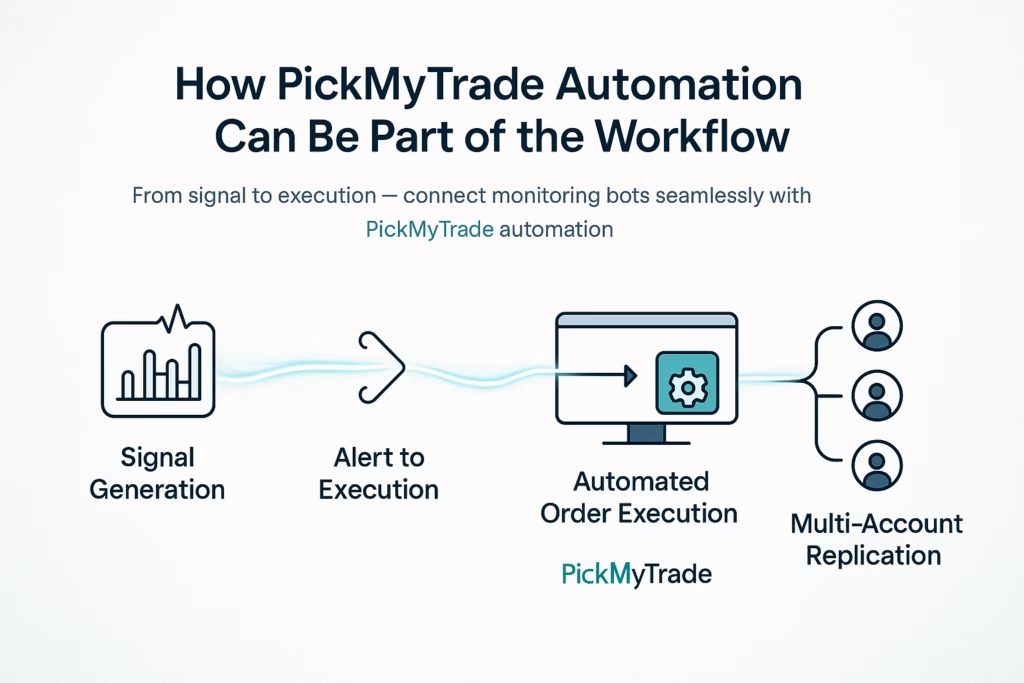

How PickMyTrade Automation Can Be Part of the Workflow

You can combine monitoring bots with PickMyTrade automation to bridge the gap between signals and execution:

- Signal generation – Use bots or scanners (e.g. in TradingView, Capitalise, Trade Ideas) to detect patterns.

- Alert to execution – When the bot triggers an alert, send it to PickMyTrade as a webhook or signal.

- Automated order execution – PickMyTrade handles sending orders with predefined stop-loss and take-profit to your futures or stock brokerage.

- Multi-account replication – The same signal can be executed across multiple accounts, keeping your strategy consistent.

This creates a layered system: real-time monitoring + rule-based alerts + safe order execution.

Best Practices for Bot-Based Monitoring & Automation

- Always start with alerts only (not full automation), to validate signals.

- Use multiple confirmatory filters (e.g. volume threshold + price action) to avoid false triggers.

- Implement kill-switch or manual override capabilities.

- Log every alert and trade decision for review.

- Periodically re-optimize or update rules as market conditions evolve.

- Keep latency low: use good data feeds and colocated servers if possible.

Disclaimer: This article is for informational and educational purposes only. It should not be considered financial, investment, or trading advice. Trading stocks, futures, and other financial instruments involves risk and may not be suitable for all investors. Always conduct your own research or consult with a licensed financial advisor before making trading decisions.

FAQs: Standard Bots & Stock Monitoring

Q1: Do bots replace human traders?

A: No, they assist. Bots are tools to monitor and signal. Judgment and oversight remain essential.

Q2: Can a monitoring bot place trades directly?

A: Yes, with proper broker API integration. But it’s safer to test alerts first before full automation.

Q3: Are monitoring bots legal?

A: Yes, in most markets. But make sure your broker allows automated strategies and follow exchange/Broker API rules.

Q4: Which tool is best for beginners?

A: Tools like Capitalise.ai (rule-based in plain language) or scanners in TradingView are beginner-friendly.

Q5: How many stocks can a bot monitor at once?

A: Depends on data feeds & computing power. Many bots monitor hundreds of tickers if infrastructure supports it.

Q6: How does PickMyTrade help with bot systems?

A: It can receive signals and convert them into live trades (with stop-loss/take-profit) across accounts, making the transition from alert to execution smoother.

Also Checkout: AMD Stock: Overview & Why It’s Making Headlines in 2025