Automated futures trading systems grounded in algorithmic trading use software to execute futures trades based on rules and market signals, without human intervention. These systems analyze price data, indicators, or even ML models, and place orders instantly.

This method is especially powerful in futures markets, where speed, precision, and discipline matter. In this article, you’ll discover how algorithmic systems work, their benefits and challenges, top platforms, and how PickMyTrade can streamline your execution.

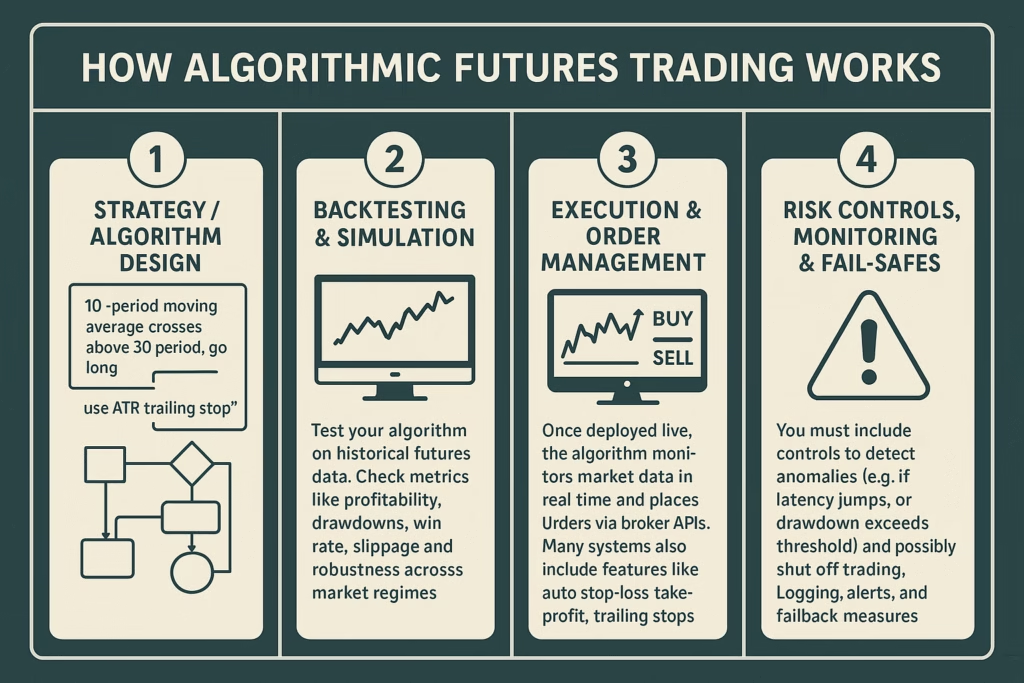

How Algorithmic Futures Trading Works

1. Strategy / Algorithm Design

You begin with a set of rules—e.g. “if 10-period moving average crosses above 30-period, go long,” or “use ATR trailing stop,” or more advanced ML models predicting volatility. Some recent research even uses transformer-based models for futures markets.

2. Backtesting & Simulation

Test your algorithm on historical futures data (e.g. E-mini, micro futures). Check metrics like profitability, drawdowns, win rate, slippage and robustness across market regimes.

3. Execution & Order Management

Once deployed live, the algorithm monitors market data in real time and places orders via broker APIs. Many systems also include features like auto stop-loss, take-profit, trailing stops, scaling in/out.

4. Risk Controls, Monitoring & Fail-Safes

You must include controls to detect anomalies (e.g. if latency jumps, or drawdown exceeds threshold) and possibly shut off trading. Logging, alerts, and fallback measures are critical.

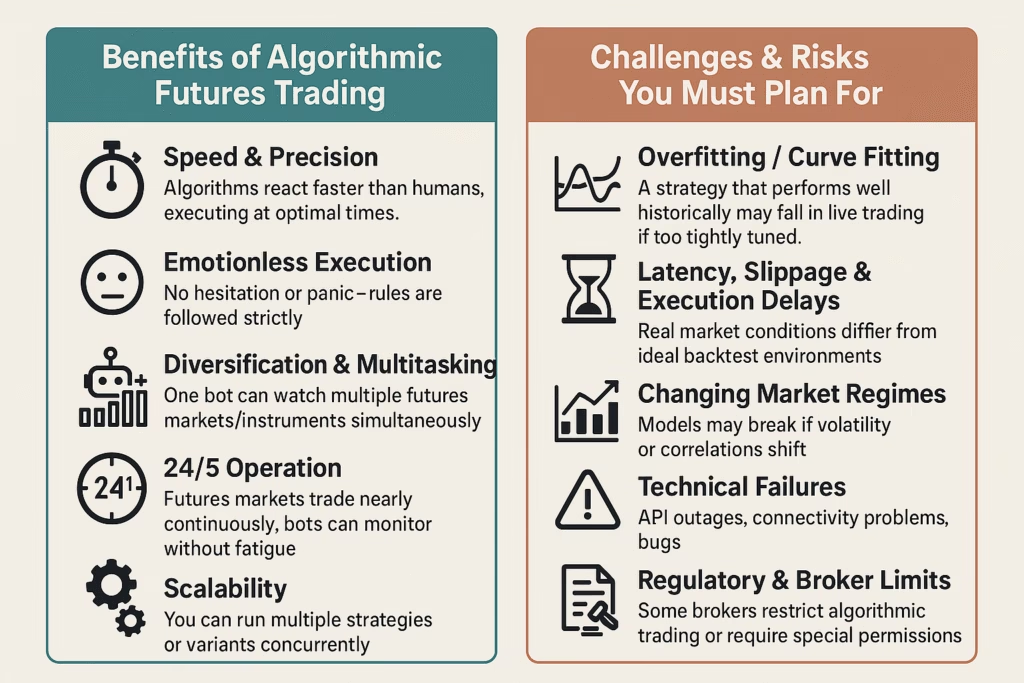

Benefits of Algorithmic Futures Trading

- Speed & Precision: Algorithms react faster than humans, executing at optimal times.

- Emotionless Execution: No hesitation or panic—rules are followed strictly.

- Diversification & Multitasking: One bot can watch multiple futures markets/instruments simultaneously.

- 24/5 Operation: Futures markets trade nearly continuously; bots can monitor without fatigue.

- Scalability: You can run multiple strategies or variants concurrently.

Challenges & Risks You Must Plan For

- Overfitting / Curve Fitting: A strategy that performs well historically may fail in live trading if too tightly tuned.

- Latency, Slippage & Execution Delays: Real market conditions differ from ideal backtest environments.

- Changing Market Regimes: Models may break if volatility or correlations shift.

- Technical Failures: API outages, connectivity problems, bugs.

- Regulatory & Broker Limits: Some brokers restrict algorithmic trading or require special permissions.

Top Platforms & Tools in 2025 for Algorithmic Futures Trading

Here are several notable platforms and tools you can use to build and deploy algorithmic futures systems:

| Platform / Tool | Strengths in Algorithmic & Futures Trading |

|---|---|

| NinjaTrader | Widely used for futures; strong support for strategy automation and third-party add-ons. |

| TradeStation | Good for multi-asset algo trading and offers APIs and scripting. |

| QuantConnect | Open-source cloud platform supporting equities, futures, options, crypto. |

| MetaTrader 5 (MT5) | Popular among retail algo traders, supports automated EAs and multi-asset. |

| TrendSpider / Algo platforms | Offer algorithmic tools, alerts, and automation layers. |

These tools let you build, test, and deploy strategies across futures markets with varying levels of complexity and support.

Click Here To Start TradeStation Trading Automation For Free

PickMyTrade acts as a bridge between your algorithmic signals (e.g. from TradingView) and real execution on futures brokers. Here’s how it strengthens your automated system:

How PickMyTrade Enhances Your Algorithmic Futures Trading Execution

- Automates strategy signals from TradingView to futures brokers (e.g., Tradovate, Rithmic, TradeStation, ProjectX etc) seamlessly.

- Automatically sets Take Profit (TP) and Stop Loss (SL) levels the moment your algorithm enters a position, improving risk control.

- Enables multi-account execution: a single algorithmic alert can be mirrored across multiple brokers/accounts.

- Supports continuous operation and unlimited trading across strategies and accounts.

In practice: your algorithm triggers a signal in TradingView → PickMyTrade receives the alert → the trade (with SL/TP) executes in your futures brokerage account with minimal delay.

Tips to Optimize Algorithmic Trading Strategies

- Use realistic slippage & commission models in your backtests.

- Walk-forward testing and out-of-sample validation to check robustness.

- Begin with small capital / micro futures before scaling.

- Monitor performance metrics and alerts continuously—don’t just “set and forget.”

- Maintain versioning & logging: keep track of your algorithm revisions and results.

- Diversify strategies (trend, mean reversion, breakout) to reduce correlated risk.

- Fail-safe switches: e.g. disable all trading if drawdown > X%, or if latency disruptions.

Regulatory & Market Trends to Watch

- The algorithmic trading market is expected to grow significantly—projected to reach ~USD 28 billion by 2030, with strong growth in retail participation.

- In India, SEBI is enforcing formal rules for retail algo trading: brokers must register strategies with exchanges, maintain audit trails, and support API-based systems.

- Kraken’s acquisition of NinjaTrader (a popular futures trading platform) signals industry convergence of crypto and traditional futures markets.

These changes underscore how algorithmic trading, especially in futures, is becoming more democratized—and more regulated.

Conclusion

Algorithmic trading transforms futures trading by injecting order, discipline, speed, and the ability to operate at scale. But it’s not plug-and-play—you need strong strategy design, risk management, and monitoring.

Tools like PickMyTrade make execution more efficient by turning strategy alerts directly into live trades, handling TP/SL, multi-account sync, and speed.

If you build reliable, well-tested algorithms and use robust execution systems, automation can give you an edge in futures markets.

Disclaimer: This article is for informational and educational purposes only. It should not be considered financial, investment, or trading advice. Trading stocks, futures, and other financial instruments involves risk and may not be suitable for all investors. Always conduct your own research or consult with a licensed financial advisor before making trading decisions.

Also Checkout: Trusted Prop Firms in 2025: Top Picks for Traders Seeking Funding