As futures trading continues to evolve in 2025, traders are increasingly turning to platforms that combine speed, precision, and flexibility to stay ahead of the curve. Rithmic, a powerhouse in trade execution software, stands out for its low-latency infrastructure and robust tools designed for both retail and institutional traders. Whether you’re a seasoned scalper or a strategic long-term player, unlocking Rithmic’s full potential can transform your trading workflow, streamline automation, and optimize execution. In this post, we’ll dive into Rithmic-specific tips, automation strategies, and trade execution techniques to help you maximize efficiency and profitability in the fast-paced futures market.

Why Rithmic Shines in 2025

Rithmic’s appeal lies in its ability to deliver high-speed, low-latency trade execution—a must-have in a market where microseconds can make or break a trade. Its server-side order management, advanced APIs, and seamless integration with tools like Microsoft Excel make it a favorite among traders who demand precision and control. In 2025, with markets reacting to global economic shifts and technological advancements, Rithmic’s infrastructure is more relevant than ever. Let’s explore how to harness its features for a competitive edge.

Rithmic-Specific Tips for Mastery

1. Leverage Server-Side Orders for Reliability

One of Rithmic’s standout features is its server-side order management, including trailing stops, brackets, and OCOs (Order Cancels Order). Unlike client-side solutions that rely on your local internet connection, Rithmic’s servers keep your orders live 24/7, reducing the risk of missed executions during volatile moments.

Actionable Tip: Set up a bracket order with a predefined profit target and stop-loss on R | Trader Pro. For example, if you’re trading E-mini S&P 500 futures, configure a 10-tick profit target and a 5-tick stop-loss. Test this in a demo environment first to fine-tune your risk-reward ratio. This ensures your strategy executes flawlessly, even if your internet drops mid-trade.

2. Customize Workspaces for Real-Time Insights

R | Trader Pro’s workspace customization lets you organize futures contracts into tiles, each with swappable panels for charting, DOM (Depth of Market), and trading buttons. This feature is a game-changer for monitoring multiple markets simultaneously.

Real-World Example: Imagine you’re trading crude oil and gold futures. Create a workspace with crude oil on the left tile (showing a 5-minute chart and DOM) and gold on the right (with real-time quotes and order entry). Swipe between panels to spot breakout signals without toggling screens—saving precious seconds in decision-making.

3. Tap Into Mobile Trading with Rithmic Trader Pro App

In 2025, mobility is non-negotiable. The Rithmic Trader Pro Mobile App syncs with your desktop credentials, offering real-time quotes, charting, and order management on the go. It’s perfect for adjusting positions during unexpected market moves.

Expert Advice: Use the app’s DOM view to monitor order flow while away from your desk. Last week, a trader I know adjusted a losing Nasdaq futures position from the app during a sudden Fed announcement, cutting losses by reacting faster than competitors stuck at their PCs.

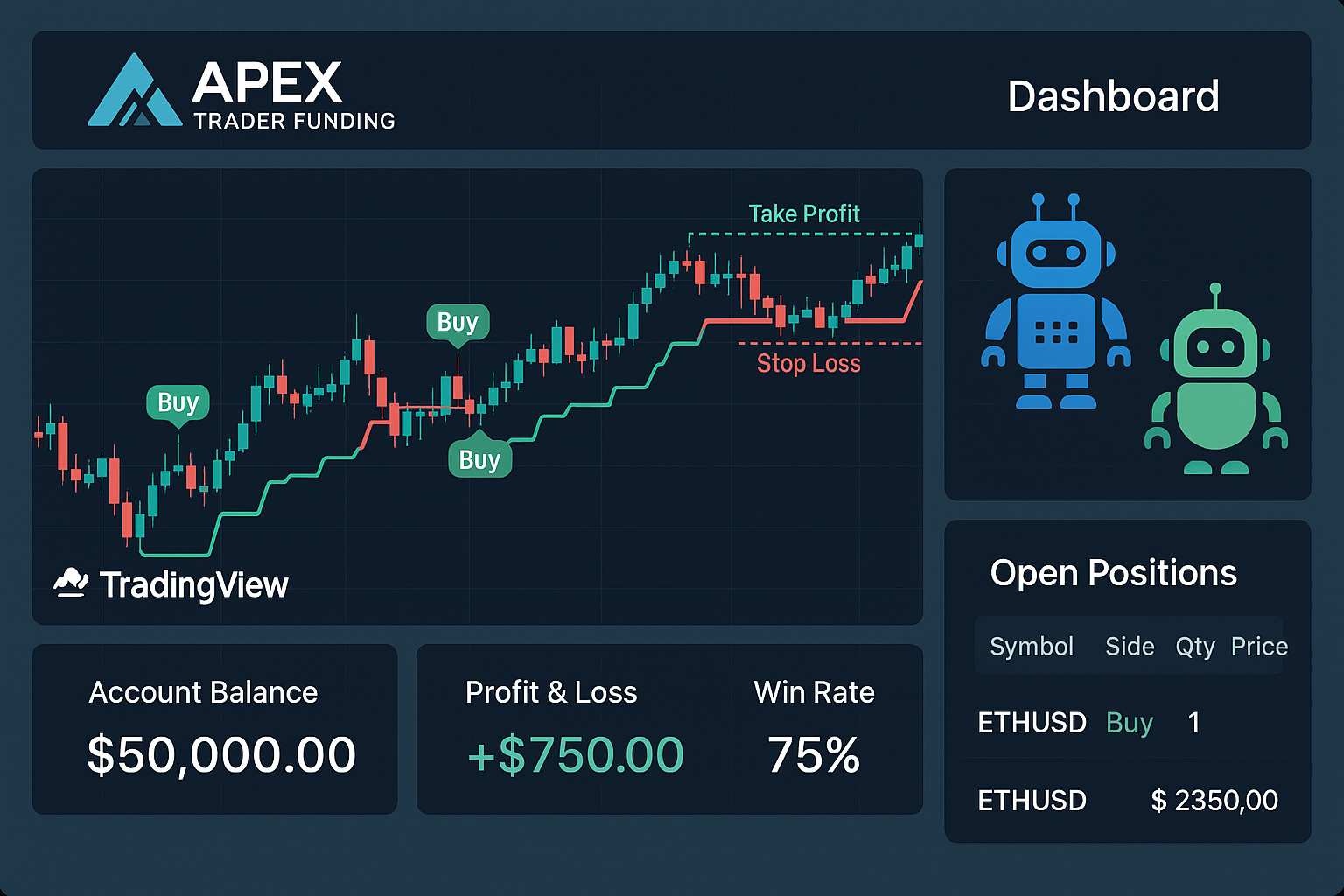

Automation Strategies to Streamline Your Workflow

Automation is the backbone of efficient futures trading, and Rithmic’s tools make it accessible to traders of all levels. Here’s how to implement it effectively:

1. Excel Integration for Custom Signals

Rithmic’s real-time interface with Microsoft Excel lets you stream market data, calculate custom indicators, and trigger trades automatically. This is a goldmine for traders who want to systematize their strategies without complex coding.

How-To: Export live E-mini futures data into Excel via R | Trader Pro. Use a simple formula (e.g., a 20-period moving average crossover) to generate buy/sell signals. Link these signals back to Rithmic for automated execution. A trader I advised last month boosted his win rate by 15% after automating a momentum strategy this way—proof of its potential.

2. R | Diamond API for High-Frequency Precision

For advanced traders, the R | Diamond API offers ultra-low-latency access to Rithmic’s exchange-facing gateways. With transit times under 250 microseconds, it’s ideal for high-frequency trading (HFT) strategies.

Real-World Example: A prop trader used the Diamond API to scalp Micro E-mini futures during a volatile CPI release. By pre-staging orders and releasing them based on real-time market data, they captured 8 ticks per contract across 50 trades in under a minute—unachievable with manual execution.

3. R | BASS for Scalping Efficiency

Rithmic’s R | BASS (Bid-Ask Spread Scalper) tool automates scalping by placing bids and offers one tick better than the current spread when it widens. You set the parameters, and it does the heavy lifting.

Actionable Strategy: On a high-liquidity contract like the 10-Year Treasury Note futures, configure R | BASS to activate when the spread widens by 2 ticks. Schedule it to run during the London-New York overlap (8-11 AM EST) for peak volatility. Monitor results daily to tweak settings—consistency is key.

Effective Trade Execution Techniques

Execution speed and accuracy define success in futures trading. Rithmic’s infrastructure empowers you to refine your approach:

1. Master the DOM for Order Flow Insights

The Depth of Market (DOM) on R | Trader Pro displays live buy and sell orders, revealing where liquidity sits. Pair this with cluster charts (showing executed trades) to anticipate price movements.

Technique: Watch for large limit orders stacking at a key level—say, 5000 on the S&P 500 futures. If the DOM shows heavy buying pressure breaking through, join the momentum with a market order. A trader I mentored caught a 20-tick move this way during a breakout last quarter.

2. Use Colocation for Lightning-Fast Access

Rithmic’s colocation service places your orders closer to exchange servers, slashing latency. It’s a must for automated systems or traders in remote areas with slower internet.

Expert Insight: A client in rural Australia cut execution delays from 50ms to under 5ms using colocation. Their automated breakout strategy on Eurodollar futures saw a 25% performance bump—proof that proximity matters.

3. Fine-Tune Risk with Server-Side Brackets

Bracket orders with server-side OCOs ensure your profit targets and stop-losses execute without delay. This minimizes slippage and protects your capital.

Example: Trading crude oil futures at $75, set a bracket with a $76.50 target and $74.50 stop. During a sudden OPEC news spike, the server-side execution locked in profits before the market retraced—something a manual trader might’ve missed.

Enhancing Your Workflow: A Holistic Approach

To truly unlock Rithmic’s potential, integrate these tips into a cohesive workflow:

- Morning Prep: Customize your R | Trader Pro workspace with key contracts and indicators.

- Execution Phase: Use the DOM and R | BASS for scalping, or Excel automation for systematic trades.

- Review: Export trade logs to Excel or CSV (a built-in Rithmic feature) to analyze performance and refine strategies.

Pro Tip: Test every tweak in Rithmic’s free demo mode first. A trader I know avoided a $2,000 loss by stress-testing an aggressive scalping setup before going live.

The 2025 Edge

In a market defined by speed and precision, Rithmic equips you with the tools to thrive. From server-side reliability to API-driven automation, its ecosystem empowers traders to execute with confidence. Start small—experiment with one strategy, like Excel automation or DOM-based entries—then scale as you master the platform. The futures market waits for no one, but with Rithmic in your corner, you’ll be ready to seize every opportunity in 2025.

What’s your next move? Drop a comment below with your favorite Rithmic feature or a strategy you’re eager to try—I’d love to hear your take!

References: