TradingView Alerts Mastery: The Ultimate 2025 Guide to Custom Alert Setup

Setting up smart alerts in TradingView can significantly improve trade execution, ensuring that traders receive timely notifications when key market conditions are met. Whether monitoring price levels, indicators, or custom strategies, alerts provide a structured approach to executing trades efficiently.

This guide outlines the process for setting up various alert types in TradingView, from basic price alerts to advanced Pine Script strategy notifications.

Why TradingView Alerts Matter

TradingView is a leading cloud-based charting platform that provides powerful tools for technical analysis and trade automation. One of its most valuable features is custom alerts, which notify traders when specific conditions are met.

Key Benefits:

- Improved Timing: React promptly to market movements.

- Reduced Screen Time: Avoid constant chart monitoring.

- Strategy Alignment: Ensure alerts complement trading plans.

Types of Alerts in TradingView

TradingView offers multiple alert options to suit different trading strategies:

1. Price Alerts

Triggered when an asset reaches a specific price level.

Example: Notification when Tesla stock drops below $200.

2. Indicator Alerts

Based on technical indicators such as RSI, MACD, or moving averages.

Example: Alert when RSI falls below 30, indicating an oversold condition.

3. Strategy Alerts

Triggered by signals from a custom TradingView strategy coded in Pine Script.

Example: Alert when an automated trading strategy generates a buy signal.

4. Drawing Tool Alerts

Linked to trend lines, channels, or other charting tools.

Example: Notification when the price touches a manually drawn support level.

How to Set Up Custom Alerts in TradingView

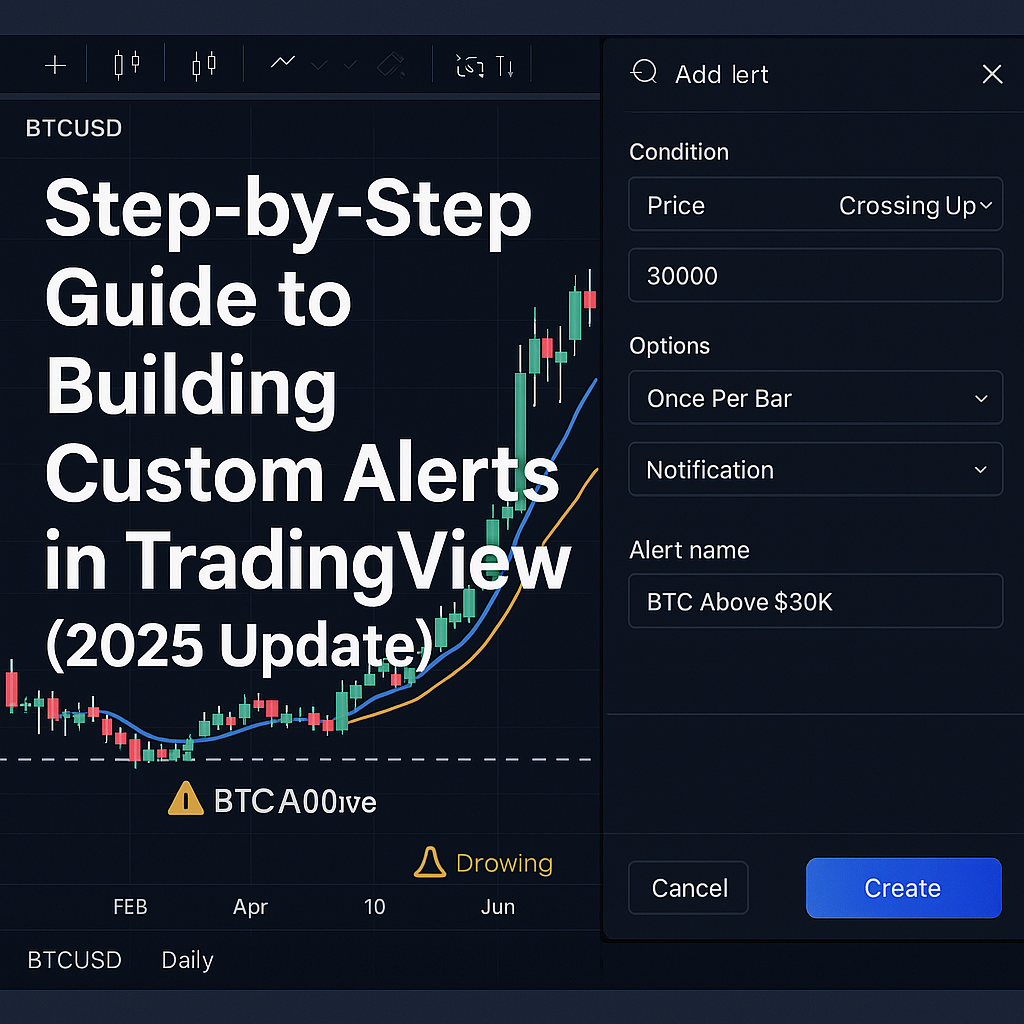

1. Creating a Price Alert: Bitcoin Crosses $30,000

- Open the BTC/USD chart in TradingView.

- Click the alarm clock icon or right-click the chart.

- Select “Add Alert” from the dropdown.

- Under “Condition,” choose “Price” and select “Crossing Up.”

- Enter 30,000 in the value box.

- In “Options,” select “Once Per Bar.”

- Choose notification preferences (email, SMS, or pop-up alert).

- Name the alert “BTC Above $30K.”

- Click “Create.”

2. Setting an Indicator Alert: 50-Day MA Crosses 200-Day MA

- Open the S&P 500 chart and apply the 50-day and 200-day moving averages.

- Right-click the chart or click the alarm clock icon, then select “Add Alert.”

- In the “Condition” field, select 50-day MA > Crossing Up.

- Choose 200-day MA as the second condition.

- Set notification methods.

- Name the alert “S&P 500 Golden Cross.”

- Click “Create.”

3. Strategy Alert: Custom Pine Script Signal

- Apply a custom strategy script to the chart.

- Open the Strategy Tester tab and select “Add Alert.”

- Choose “Any Alert() Function Call” or specify a condition.

- Configure notification settings.

- Name the alert (e.g., “My Strategy Buy Signal”).

- Click “Create.”

4. Drawing Tool Alert: Price Hits a Trend Line

- Select the trend line on the chart.

- Right-click and choose “Add Alert.”

- Set condition to “Price Touches Line.”

- Choose notification methods.

- Name the alert “EUR/USD Trend Line Hit.”

- Click “Create.”

What to Expect from TradingView in 2025 (Speculative)

- AI-Powered Alerts: AI-based suggestions for optimized alert setups.

- Multi-Condition Alerts: Combine conditions like price + RSI.

- App Integrations: Notifications via Telegram, WhatsApp, or Discord.

- API-Linked Execution: Broker-integrated alerts for direct trade automation.

Check TradingView’s official blog for the latest confirmed features.

Managing Alerts Efficiently

- Use the Alerts Manager to track and review active alerts.

- Modify or delete outdated alerts as needed.

- Organize by asset or strategy.

- Set expiration dates for temporary setups.

- Review alerts weekly for relevance.

Optimizing Alerts for Smarter Trading

- Be Selective: Avoid overloading your system with minor alerts.

- Diversify Notifications: Use both SMS and email depending on urgency.

- Backtest Alerts: Validate setup through paper trading before going live.

- Stick to Strategy: Ensure alerts align with your trading plan.

Conclusion

TradingView’s alert system offers precision and structure for both discretionary and automated traders. With correct implementation, these alerts become a powerful tool to monitor market movements, respond promptly, and enhance your trading discipline. Start with the basics, optimize over time, and integrate with your overall strategy for best results.